Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, April 19, 2018 | Modified on Monday, October 26, 2020

| Strategy Level | Advance |

| Instruments Traded | Call |

| Number of Positions | 4 |

| Market View | Volatile |

| Risk Profile | Limited |

| Reward Profile | Limited |

| Breakeven Point |

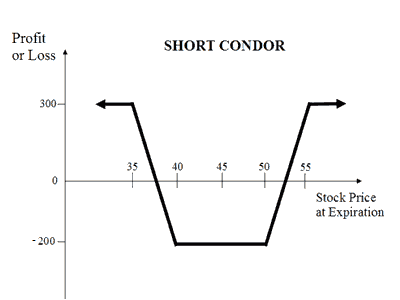

A Short Call Condor (or Short Condor) is a neutral strategy with a limited risk and a limited profit. The short condor strategy is suitable for a high volatile underlying.

The goal of this strategy is to profit from a stock price moving up or down beyond the highest or lowest strike prices of the position.

The strategy is similar to Short Call Butterfly strategy with the difference being in the strike prices selected.

Suppose Nifty is currently trading at 10,400. If the trader is expecting high volatility in the index due to specific events i.e. budget, results, and elections, he could choose the Short Condor strategy to profit in such a market scenario. The strategy could be constructed as below:

| Orders | Example NIFTY Strike Price |

|---|---|

| Buy 1 ITM Call | NIFTY18APR10200CE |

| Sell 1 ITM Call (Lower Strike) | NIFTY18APR10100CE |

| Buy 1 OTM Call | NIFTY18APR10500CE |

| Sell 1 OTM Call (Higher Strike) | NIFTY18APR10600CE |

In Short Condor, a Bear Call Spread and a Bull Call Spread combined into 1 strategy as shown in above example. The trader enters in this strategy by buying a lower strike ITM call, selling an even lower striking ITM call, buying a higher strike OTM call and selling another even higher striking OTM call.

The Net credit of the premium is the maximum possible profit in this strategy. The maximum loss is equal to the difference in strike prices of the 2 lower striking calls less the initial credit taken to enter the trade.

Note:

The Short Call Condor works well when you expect the price of the underlying to be very volatile. In other words, when the trader is anticipating massive price movements (in any direction) in the underlying during the lifetime of the options.

Let's take a simple example of an underlying stock trading at Rs 45 (spot price) in June. The option contracts for this stock are available at the following premium:

Lot size: 100 shares in 1 lot

Sell July 35 Call = Rs 11*100 = Rs 1100

Buy July 40 Call = Rs 7 * 100 = Rs 700

Buy July 50 Call = Rs 2 * 100 = Rs 200

Sell July 55 Call = Rs 1 * 100 = Rs 100

Net Credit of Premium = 1100-700+100-200 = Rs 300

Maximum Possible Profit = Net Credit of Premium = Rs 300

Scenario 1: Stock price goes down to Rs 35

At this price all options expires worthless. Thus the net profit is Rs 300 which was received at the time of buying the strategy.

Scenario 2: Stock price reaches to Rs 55

July 35 Call (Short) = (35-55)*100 = -Rs 2000

July 40 Call (Long) = (55-40)*100 = +Rs 1500

July 55 Call (Short) = Rs 0

July 50 Call (Long) = (55-50)*100 = +Rs 500

Net Position = -2000+1500+0+500= Rs 0

Initial Credit: Rs 300

Maximum Profit: Rs 300 paid as net credit of premium at the time of buying the strategy.

Scenario 3: Stock price remain at Rs 45

July 35 Call (Short) = (35-45)*100 = -Rs 1000

July 40 Call (Long) = (45-40)*100 = +Rs 500

Initial Credit: +Rs 300

Net Profit (Rs ) = -1000+500+300 = -200

In this example, the maximum loss is suffered if the underlying stock price at expiration is anywhere between Rs 40 and Rs 50. Price movement outside the range Rs 40 - Rs 50 in any direction makes this trade to result in profits.

| Spot Price | 8900 |

| Lot Size | 25 |

| Strike Price(Rs ) | Premium(Rs ) | Premium Paid(Rs ) | |

|---|---|---|---|

| Sell 1 ITM Call (Lower Strike) | 8700 | 580 | 14500 |

| Buy 1 ITM Call | 8800 | 520 | 13000 |

| Buy 1 OTM Call | 9000 | 420 | 10500 |

| Sell 1 OTM Call (Higher Strike) | 9100 | 380 | 9500 |

| Net Premium | (580-520-420+380) 20 | (20*25) 500 |

| Upper Breakeven(Rs ) | Strike Price of Highest Strike Short Call - Net Premium Paid (9100-20) | 9080 |

| Lower Breakeven(Rs ) | Strike Price of Lowest Strike Short Call + Net Premium Paid (8700+20) | 8720 |

| Maximum Possible Profit(Rs ) | Net Premium Paid | 500 |

| Net Payoff from position | |||||

|---|---|---|---|---|---|

| On Expiry Bank NIFTY closes at | 1 Short ITM Call (Lower Strike) (Rs ) | 1 Long ITM Call (Rs ) | 1 Long OTM Call (Rs ) | 1 Short OTM Call (Higher Strike) (Rs ) | Net Payoff (Rs ) |

| 8400 | 14500 | -13000 | -10500 | 9500 | 500 |

| 8600 | 14500 | -13000 | -10500 | 9500 | 500 |

| 8720 | 14000 | -13000 | -10500 | 9500 | 0 |

| 8800 | 12000 | -13000 | -10500 | 9500 | -2000 |

| 9000 | 7000 | -8000 | -10500 | 9500 | -2000 |

| 9080 | 5000 | -6000 | -8500 | 9500 | 0 |

| 9200 | 2000 | -3000 | -5500 | 7000 | 500 |

| 9400 | -3000 | 2000 | -500 | 2000 | 500 |

When you are unsure about the direction in the movement in the price of the underlying but are expecting high volatility in it in the near future.

Suppose Nifty is trading at 10,400. If you expect high volatility in the Nifty in the coming days then you can execute Short Call Condor by selling 1 ITM Nifty Call at 10,200, buying 1 ITM Call at 10,300, buying 1 OTM Call Option at 10, 500 and selling 1 OTM Nifty Call at 10, 600. Your maximum loss will be if Nifty closes in the range of 10,300 to 10,500 on expiry while maximum profit will be on either side of upper or lower strikes.

This is a limited risk strategy. The maximum risk in a short call condor strategy is calculated as below:

Max Loss = Strike Price of Lower Strike Long Call - Strike Price of Lower Strike Short Call - Net Premium Received + Commissions Paid

The max risk is when the price of the underlying remains in between strike price of 2 long calls.

The maximum profit in a short call condor strategy is realized when the price of the underlying is trading outside the range at time of expiration.<.p>

Max Profit = Strike Price of Lower Strike Short Call - Strike Price of Lower Strike Long Call - Net Premium Paid

All options exercised or not exercised

Both ITM Calls exercised

It allows you to profit from highly volatile underlying assets moving in any direction.

The maximum profit for the condor trade may be low in relation to other trading strategies but it has a comparatively wider profit zone.

Earn profit with little or no investment as you will have a credit of net premiums.

Strike prices selected may have an impact on the potential of profit.

Brokerage and taxes make a significant impact on the profits from this strategy. The cost of trading increases with the number of legs. This strategy has 4 legs and thus the brokerage cost is higher.

Reverse the trade by selling bought Options and buying back short Options.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|