Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, April 18, 2018 | Modified on Wednesday, June 5, 2019

| Strategy Level | Beginners |

| Instruments Traded | Call + Underlying |

| Number of Positions | 2 |

| Market View | Bullish |

| Risk Profile | Limited |

| Reward Profile | Unlimited |

| Breakeven Point | Underlying Price + Put Premium |

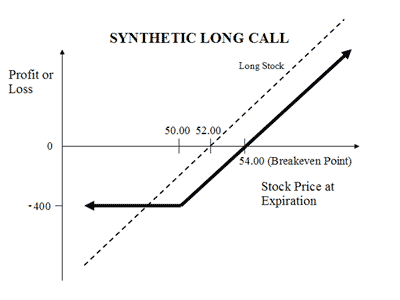

A Synthetic Call strategy is used by traders who are currently holding the underlying asset and are Bullish on it for the long term. But he is also worried about the downside risks in near future. This strategy offers unlimited reward potential with limited risk.

The strategy is used by buying PUT OPTION of the underlying you are holding for long. If the price of the underlying rises then you make profits on holdings. If it falls then your loss will be limited to the premium paid for PUT OPTION.

A Synthetic Call option strategy is when a trader is Bullish on long term holdings but is also concerned with the associated downside risk.

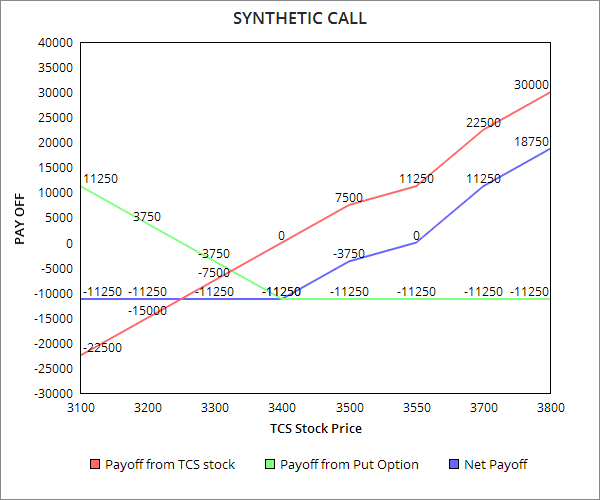

Suppose you are bullish about TCS currently trading at Rs 3,400. But you are also concerned with losses in case TCS stock price move downwards. In such a scenario, synthetic call strategy can be executed by buying TCS stock at current market price. To protect against fall in the price of TCS, you buy a Put option with a strike price Rs 3300 at a premium of Rs 150.

| Current Market Price of TCS Stock | Rs 3,400 |

| Put Option Strike Price | Rs 3,300 |

| Option Lot Size | 75 |

| Premium Paid | Rs 150 |

| Break Even Point (Purchase Price of Underlying + Premium Paid) | 3,550 |

| TCS Stock Price on Expiry (Rs ) | Payoff from TCS Stock | Payoff from Put Option (BEP-CP) BEP = 3,250 MAX LOSS=11,250 | Net Payoff(Rs ) |

|---|---|---|---|

| 3100 | -22500 | 11250 | -11250 |

| 3200 | -15000 | 3750 | -11250 |

| 3300 | -7500 | -3750 | -11250 |

| 3400 | 0 | -11250 | -11250 |

| 3500 | 7500 | -11250 | -3750 |

| 3550 | 11250 | -11250 | 0 |

| 3700 | 22500 | -11250 | 11250 |

| 3800 | 30000 | -11250 | 18750 |

Scenario 1: If the stock prices rise, you will make unlimited profits as the stock price you hold goes up. You will lose the premium paid to buy the put option.

Scenario 2: If the stock prices fall, then the loss is covered by the Put Option. The loss incurred in stocks you hold will be compensated by rising profits from Put Options.

As shown in below chart, the net position remains profitable to the investor.

The strategy is used by buying PUT OPTION of the underlying you're holding for long. If the price of the underlying rises then you make profits on holdings. If it falls then your loss will be limited to the premium paid for PUT OPTION.

Underlying Price + Put Premium

Maximum loss happens when price of the underlying moves above strike price of Put.

Max Loss = Premium Paid

Maximum profit is realized when price of underlying moves above purchase price of underlying plus premium paid for Put Option.

Profit = (Current Price of Underlying - Purchase Price of Underlying) - Premium Paid

Underlying goes up

Underlying goes down and option exercised

Provides protection to your long term holdings.

You can incur losses if underlying goes down and the option is exercised.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|