Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, April 18, 2018 | Modified on Wednesday, June 5, 2019

| Strategy Level | Advance |

| Instruments Traded | Call + Put + Underlying |

| Number of Positions | 3 |

| Market View | Bullish |

| Risk Profile | Limited |

| Reward Profile | Limited |

| Breakeven Point | Price of Features - Call Premium + Put Premium |

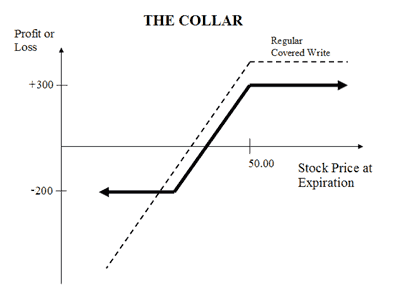

A Collar is similar to Covered Call but involves another position of buying a Put Option to cover the fall in the price of the underlying. It involves buying an ATM Put Option & selling an OTM Call Option of the underlying asset. It is a low risk strategy since the Put Option minimizes the downside risk. However, the rewards are also limited and is perfect for conservatively Bullish market view.

Suppose you are holding shares of SBI currently trading at Rs 250. You can deploy a collar strategy by selling a Call Option of strike price Rs 300 while at the same time purchasing a Rs 200 strike price Put option. If the price rises to Rs 300, your benefit from increase in value of your holdings and you will lose net premiums. If the price falls to Rs 200, you will lose value of your holdings but will benefit from exercising the Put option.

The Collar strategy is perfect if you're Bullish for the underlying you're holding but are concerned with risk and want to protect your losses.

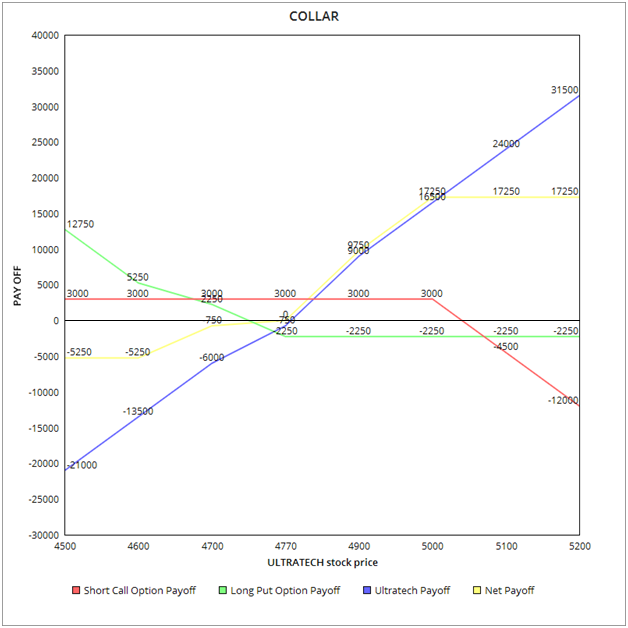

Suppose you are holding ULTRATECH cements, currently trading at Rs 4780, or plan to buy it expecting a rise in its price in the near future. You also want to protect yourself from losses in case the stock moves downwards. In such a scenario, you can use the Collar strategy by selling a Call at Rs 5000 for a premium of Rs 40 and simultaneously buying a Put at Rs 4700 for a premium of Rs 30.

| Current Trading Price of ULTRATECH | Rs 4780 |

| Option Lot Size | 75 |

| Call Option Strike Price | Rs 5000 |

| Premium Received | Rs 40 |

| Put Option Strike Price | Rs 4700 |

| Premium Paid | Rs 30 |

| Net Premium | Rs 10 |

| Break Even Point (Price of Underlying - Call Premium + Put Premium) | Rs 4770 |

Scenario 1: Price of ULTRATECH rises to Rs 5100

You can sell the stock or your holding will gain higher on paper value at Rs 5000. If sold, your profit will be Rs 220 (Rs 5000 – Rs 4780). When the net premium received of Rs 10 is factored in, your profit increases to Rs 230. The Put option will be worthless on expiry. Call option will be exercised and you have to pay Rs 100.

So net profit for you will be: Rs 220 + Rs 10- Rs 100 = Rs 130

Scenario 2: Price of ULTRATECH falls to Rs 4600

Your holdings will lose value on paper by Rs 180. You can exercise the Put option and earn Rs 100. The Call Option will be worthless on expiry. When the net premium received of Rs 10 is factored in, your loss will be: - Rs 180 + Rs 100 + Rs 12 = Rs 68

| Closing Price of Ultratech | Short Call Option Payoff | Long Put Option Payoff | Ultratech Payoff | Net Payoff |

|---|---|---|---|---|

| 4500 | 3000 | 12750 | -21000 | -5250 |

| 4600 | 3000 | 5250 | -13500 | -5250 |

| 4700 | 3000 | 2250 | -6000 | -750 |

| 4770 | 3000 | -2250 | -750 | 0 |

| 4900 | 3000 | -2250 | 9000 | 9750 |

| 5000 | 3000 | -2250 | 16500 | 17250 |

| 5100 | -4500 | -2250 | 24000 | 17250 |

| 5200 | -12000 | -2250 | 31500 | 17250 |

When you are of the view that the price of the underlying will move up but also want to protect the downside.

Price of Features - Call Premium + Put Premium

You will incur maximum losses when price of the underlying is less than the strike price of the Put Option.

Max Loss = Purchase Price of Underlying - Strike Price of Long Put - Net Premium Received

You will incur maximum profit when price of underlying is greater than the strike price of call option.

Max Profit = Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received

Underlying goes up and Call option exercised

Underlying goes down and Put option exercised

It protects the losses on underlying asset.

The profit is limited

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|