Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, April 19, 2018 | Modified on Sunday, May 10, 2020

| Strategy Level | Advance |

| Instruments Traded | Call + Put |

| Number of Positions | 4 |

| Market View | Neutral |

| Risk Profile | None |

| Reward Profile | Limited |

| Breakeven Point |

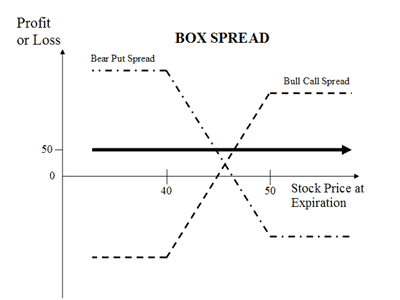

Box Spread (also known as Long Box) is an arbitrage strategy. It involves buying a Bull Call Spread (1 ITM and I OTM Call) together with the corresponding Bear Put Spread (1 ITM and 1 OTM Put), with both spreads having the same strike prices and expiration dates.

The strategy is called Box Spread as it is combination of 2 spreads (4 trades) and the profit/loss calculated together as 1 trade. Note that the total cost of the box remain same irrespective to the price movement of underlying security in any direction. The expiration value of the box spread is actually the difference between the strike prices of the options involved.

The Long Box strategy is opposite to Short Box strategy. It is used when the spreads are under-priced with respect to their combined expiration value.

The usual box spread look like as below for NIFTY current index value as 10550 (NIFTY Spot Price):

| Orders | NIFTY Strike Price | |

|---|---|---|

| Bull Call Spread | Buy 1 ITM Call | NIFTY18APR10400CE |

| Sell 1 OTM Call | NIFTY18APR10700CE | |

| Bear Put Spread | Buy 1 ITM Put | NIFTY18APR10700PE |

| Sell 1 OTM Put | NIFTY18APR10400PE |

Note:

As you see in the above table, this is a delta neutral strategy. The trader is buying and selling equivalent spreads. As long as the price paid for the box is significantly below the combined expiration value of the spreads, a riskless profit can be earned. We will discuss this in detail in an example below.

As the profit from the box spread is very small, the brokerage and taxes involved in this strategy can sometimes offset all of the gains. It's very important to consider the trading cost (brokerage, fee, taxes etc.) before trading in this strategy.

Being risks free arbitrage strategy, this strategy can earn better return than earnings in interest from fixed deposits. The earning from this strategy varies with the strike price chosen by the trader. i.e. Earning from strike price '10400, 10700' will be different from strike price combination of '9800,11000'.

The long box strategy should be used when the component spreads are underpriced in relation to their expiration values. In most cases, the trader has to hold the position till expiry to gain the benefits of the price difference.

Note: If the spreads are overprices, another strategy named Short Box can be used for a profit.

This strategy should be used by advanced traders as the gains are minimal. The brokerage payable when implementing this strategy can take away all the profits. This strategy should only be implemented when the fees paid are lower than the expected profit.

Let's take a simple example of a stock trading at Rs 45 (spot price) in June. The option contracts for this stock are available at the following premium:

Lot size: 100 shares in 1 lot

Buy a Bull Call Spread = Buy 'July 40 call' + Sell 'July 50 call'

Bull Call Spread Cost = (Rs 6*100) - (Rs 1*100) = Rs 500

Buy Bear Put Spread = Buy 'July 50 put' + Sell 'July 40 put'

Bear Put Spread Cost = (Rs 6*100) - (Rs 1.50*100) = Rs 450

The total cost of the box spread is: Rs 500 + Rs 450 = Rs 950

The expiration value of the box is computed to be: (Rs 50 - Rs 40) x 100 = Rs 1000

Since the box spread value is lower, the Long Box strategy can be used hear for risk free profits.

Profit: Rs 1000 - Rs 950 = Rs 50

Net Profit = Rs 50 - Brokerage - Taxes

In above example, since the total cost of the box spread is less than its expiration value, a risk-free arbitrage is possible with the long box strategy. Now let's discuss about the possible scenarios:

Scenario 1: Stock price remain unchanged at Rs 45

The July 40 put and the July 50 call expire worthless while both the July 40 call and the July 50 put expires in-the-money with Rs 500 intrinsic value each. So the total value of the box at expiration is: Rs 500 + Rs 500 = Rs 1000.

Scenario 2: Stock price reaches to Rs 50

Only the July 40 call expires in-the-money with Rs 1000 in intrinsic value. So the box is still worth Rs 1000 at expiration.

Scenario 3: Stock price falls to Rs 40

A similar situation as scenario 2 happens but this time it is the July 50 put that expires in-the-money with Rs 1000 in intrinsic value while all the other options expire worthless. Still, the box is worth Rs 1000.

In all the possible scenarios, the box worth remains at Rs 1000 on expiry resulting in profit of Rs 50.

Let's take an example of NIFTY Options which is traded in lot size of 75.

| Strike Price | Premium (Rs ) | Premium Paid (Rs ) (Premium * Lot Size of 75) | ||

| Bull Call Spread | Buy 1 ITM Call | 10400 | 187.70 | 14077.50 |

| Sell 1 OTM Call | 10700 | -14.00 | -1050.00 | |

| Bear Put Spread | Buy 1 ITM Put | 10700 | 145.55 | 10916.25 |

| Sell 1 OTM Put | 10400 | -24.95 | -1871.25 | |

| Total | 22072.50 |

| Bull Call Spread Cost | =(14077.50-1050.00) | 13027.50 |

| Bear Put Spread Cost | =(10916.25-1871.25) | 9045.00 |

| Total Box Spread Cost | 22072.50 | |

| Expiration value of the box | =(10700-10400)*75 | 22500 |

| Profit | =(22500-22072.50) | 427.5 |

| Brokerage + Taxes | =8 trades * Rs 20 + taxes | Rs 200 |

| Net Profit | Rs 227.5 (1.03%) |

Note the Net Profit changes when you buy options at different the strike price using the same strategy.

The market view for this strategy is neutral. The movement in underlying security doesn't affect the outcome (profit/loss). This arbitrage strategy is to earn small profits irrespective of the market movements in any direction.

Say for XYZ stock, the component spreads are underpriced in relation to their expiration values. The trader could execute Long Box strategy by buying 1 ITM Call and 1 ITM Put while selling 1 OTM Call and 1 OTM Put. There is no risk of loss while the profit potential would be the difference between two strike prices minus net premium.

The Box Spread Options Strategy is a relatively risk-free strategy. There is no risk in the overall position because the losses in one spread will be neutralized by the gains in the other spread.

The trades are also risk-free as they are executed on an exchange and therefore cleared and guaranteed by the exchange.

The small risks of this strategy include:

The reward in this strategy is the difference between the total cost of the box spread and its expiration value. Being an arbitrage strategy, the profits are very small.

It's an extremely low-risk options trading strategy.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|