Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, April 18, 2018 | Modified on Wednesday, June 5, 2019

| Strategy Level | Advance |

| Instruments Traded | Put |

| Number of Positions | 2 |

| Market View | Bullish |

| Risk Profile | Limited |

| Reward Profile | Limited |

| Breakeven Point | Strike price of short put - net premium paid |

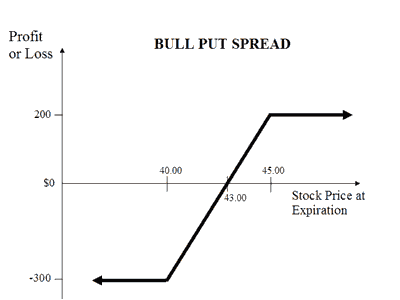

A Bull Put Spread (or Bull Put Credit Spread) strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. The strategy involves buying a Put Option and selling a Put Option at different strike prices. The risk and reward for this strategy is limited.

A Bull Put Strategy involves Buy OTM Put Option and Sell ITM Put Option. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at Rs 600 then you will buy an OTM Put Option at Rs 700 and a sell an ITM Put Option at Rs 550. You will make a profit when, at expiry, Reliance closes at Rs 700 level and incur losses if the prices fall down below the current price.

This strategy works well when you're of the view that the price of a particular underlying will rise, move sideways, or marginally fall.

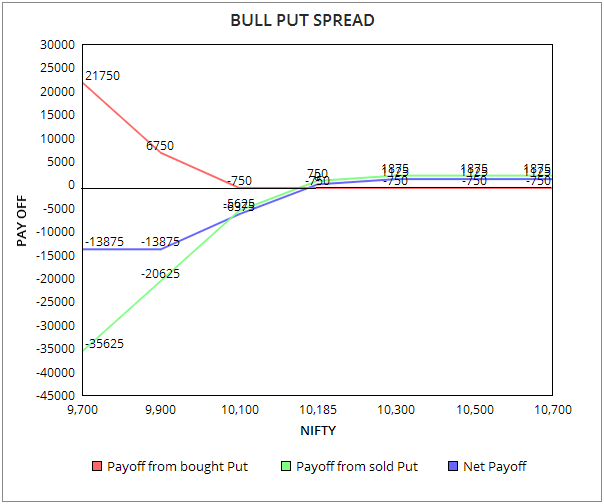

Suppose the Nifty is trading at Rs 10,400. This strategy is implemented by selling a Nifty Put option with a strike price of Rs 10,200 at a premium of Rs 25 and buying a OTM Nifty Put option with a strike price Rs 10,000 at a premium of Rs 10.

| Current Nifty | Rs 10,400 |

| Strike Price of Short Put Option | Rs 10,200 |

| Option Lot Size | 75 |

| Premium Received | Rs 25 |

| Strike Price of Buy Put Option | Rs 10,000 |

| Premium Paid | Rs 10 |

| Net Premium Received | Rs 15 |

| Break Even Point (Strike Price of short Put - Net Premium) | Rs 10,185 |

Bull Put Spread Strategy Pay-off Schedule

| Nifty on Expiry(CP) | Long Put Option PayOff=BEP-CP BEP=9990 MAX LOSS=750 | Short Put Option PayOff=CP-BEP BEP=10175 MAX PROFIT=1875 | Net Payoff(Rs ) |

|---|---|---|---|

| 9,700 | 21750 | -35625 | -13875 |

| 9,900 | 6750 | -20625 | -13875 |

| 10,100 | -750 | -5625 | -6375 |

| 10,185 | -750 | 750 | 0 |

| 10,300 | -750 | 1875 | 1125 |

| 10,500 | -750 | 1875 | 1125 |

| 10,700 | -750 | 1875 | 1125 |

A Bull Put Strategy involves Buy OTM Put Option + Sell ITM Put Option.

For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at 600 then you will buy a OTM PUT OPTION at 700 and a sell a ITM PUT OPTION at 550. You will make a profit when at expiry Reliance closes at 700 level and incur losses if the prices fall down below the current price.

Strike price of short put - net premium paid

Maximum loss occurs when the stock price moves below the lower strike price on expiration date.

Max Loss = (Strike Price Put 1 - Strike Price of Put 2) - Net Premium Received

Max Loss Occurs When Price of Underlying <= Strike Price of Long Put

Maximum profit happens when the price of the underlying moves above the strike price of Short Put on expiration date.

Max Profit = Net Premium Received

Both options unexercised

Both options exercised

Allows you to benefit from time decay in profit situations. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying.

Limited profit. Time decay may go against you in loss situations.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|