Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Long Call and Bull Put Spread options trading strategies. Find similarities and differences between Long Call and Bull Put Spread strategies. Find the best options trading strategy for your trading needs.

| Long Call | Bull Put Spread | |

|---|---|---|

|

|

|

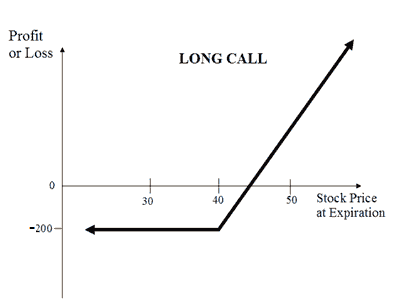

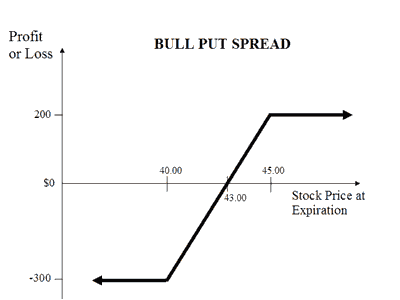

| About Strategy | A Long Call Option trading strategy is one of the basic strategies. In this strategy, a trader is Bullish in his market view and expects the market to rise in near future. The strategy involves taking a single position of buying a Call Option (either ITM, ATM or OTM). This strategy has limited risk (max loss is premium paid) and unlimited profit potential. When the trader goes long on call, the trader buys a Call Option and later sells it to earn profits if the price of the underlying asset goes up. When the trader buys a call, he pays the option premium in exchange for the right (but not the obligation) to buy share or index at a fixed price by a certain expiry date. This premium is the only amount at-the-risk for trader in case the mark... Read More | A Bull Put Spread (or Bull Put Credit Spread) strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. The strategy involves buying a Put Option and selling a Put Option at different strike prices. The risk and reward for this strategy is limited. A Bull Put Strategy involves Buy OTM Put Option and Sell ITM Put Option. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at Rs 600 then you will buy an OTM Put Option at Rs 700 and a sell an ITM Put Option at Rs 550. You will make a profit when, at expiry, Reliance closes at Rs 700 level and incur losse... Read More |

| Market View | Bullish | Bullish |

| Strategy Level | Beginners | Advance |

| Options Type | Call | Put |

| Number of Positions | 1 | 2 |

| Risk Profile | Limited | Limited |

| Reward Profile | Unlimited | Limited |

| Breakeven Point | Strike Price + Premium | Strike price of short put - net premium paid |

| Long Call | Bull Put Spread | |

|---|---|---|

| When to use? | A long call Option strategy works well when you expect the underlying instrument to move positively in the recent future. If you expect XYZ company to do well in near future then you can buy Call Options of the company. You will earn the profit if the price of the company shares closes above the Strike Price on the expiry date. However, if underlying shares don't do well and move downwards on expiry date you will incur losses (i.e. lose premium paid). |

This strategy works well when you're of the view that the price of a particular underlying will rise, move sideways, or marginally fall. |

| Market View | Bullish When you're expecting a rise in the price of the underlying and increase in volatility. |

Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. |

| Action |

A long call strategy involves buying a call option only. So if you expect Reliance to do well in near future then you can buy Call Options of Reliance. You will earn a profit if the price of Reliance shares closes above the Strike price on the expiry date. However, if Reliance shares don't move up within the expiry date you will incur losses. |

A Bull Put Strategy involves Buy OTM Put Option + Sell ITM Put Option. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at 600 then you will buy a OTM PUT OPTION at 700 and a sell a ITM PUT OPTION at 550. You will make a profit when at expiry Reliance closes at 700 level and incur losses if the prices fall down below the current price. |

| Breakeven Point | Strike Price + Premium The break-even point for Long Call strategy is the sum of the strike price and premium paid. Traders earn profits if the price of the underlying asset moves above the break-even point. Traders loose premium if the price of the underlying asset falls below the break-even point. |

Strike price of short put - net premium paid |

| Long Call | Bull Put Spread | |

|---|---|---|

| Risks | Limited The risk is limited to the premium paid for the call option irrespective of the price of the underlying on the expiration date.

|

Limited Maximum loss occurs when the stock price moves below the lower strike price on expiration date. Max Loss = (Strike Price Put 1 - Strike Price of Put 2) - Net Premium Received Max Loss Occurs When Price of Underlying <= Strike Price of Long Put |

| Rewards | Unlimited There is no limit to maximum profit attainable in the long call option strategy. The trade gets profitable when price of the underlying is greater than strike price plus premium.

|

Limited Maximum profit happens when the price of the underlying moves above the strike price of Short Put on expiration date. Max Profit = Net Premium Received |

| Maximum Profit Scenario | Underlying closes above the strike price on expiry. |

Both options unexercised |

| Maximum Loss Scenario | Underlying closes below the strike price on expiry. |

Both options exercised |

| Long Call | Bull Put Spread | |

|---|---|---|

| Advantages | Buying a Call Option instead of the underlying allows you to gain more profits by investing less and limiting your losses to minimum. |

Allows you to benefit from time decay in profit situations. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying. |

| Disadvantage | Call options have a limited lifespan. So, in case the price of your underlying stock is not higher than the strike price before the expiry date, the call option will expire worthlessly and you will lose the premium paid. |

Limited profit. Time decay may go against you in loss situations. |

| Simillar Strategies | Protective Put, Covered Put/Married Put, Bull Call Spread | Bull Call Spread, Bear Put Spread, Collar |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|