Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Bull Put Spread and Short Straddle (Sell Straddle or Naked Straddle) options trading strategies. Find similarities and differences between Bull Put Spread and Short Straddle (Sell Straddle or Naked Straddle) strategies. Find the best options trading strategy for your trading needs.

| Bull Put Spread | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

|

|

|

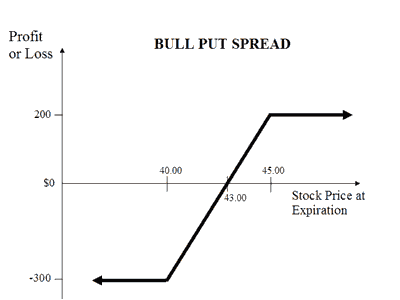

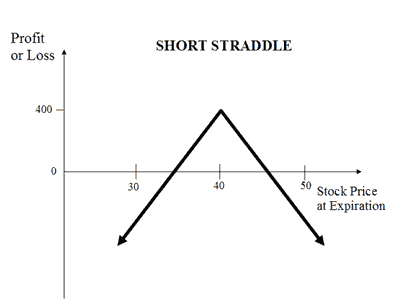

| About Strategy | A Bull Put Spread (or Bull Put Credit Spread) strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. The strategy involves buying a Put Option and selling a Put Option at different strike prices. The risk and reward for this strategy is limited. A Bull Put Strategy involves Buy OTM Put Option and Sell ITM Put Option. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at Rs 600 then you will buy an OTM Put Option at Rs 700 and a sell an ITM Put Option at Rs 550. You will make a profit when, at expiry, Reliance closes at Rs 700 level and incur losse... Read More | The Short Straddle (or Sell Straddle or naked Straddle) is a neutral options strategy. This strategy involves simultaneously selling a call and a put option of the same underlying asset, same strike price and same expire date. A Short Straddle strategy is used in case of little volatility market scenarios wherein you expect none or very little movement in the price of the underlying. Such scenarios arise when there is no major news expected until expire. This is a limited profit and unlimited loss strategy. The maximum profit earned when, on expire date, the underlying asset is trading at the strike price at which the options are sold. The maximum loss is unlimited and occurs when underlying asset price moves sharply in upward or down... Read More |

| Market View | Bullish | Neutral |

| Strategy Level | Advance | Advance |

| Options Type | Put | Call + Put |

| Number of Positions | 2 | 2 |

| Risk Profile | Limited | Unlimited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike price of short put - net premium paid | 2 Breakeven Points |

| Bull Put Spread | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| When to use? | This strategy works well when you're of the view that the price of a particular underlying will rise, move sideways, or marginally fall. |

This strategy is to be used when you expect a flat market in the coming days with very less movement in the prices of underlying asset. |

| Market View | Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. |

Neutral When trader don't expect much movement in its price in near future. |

| Action |

A Bull Put Strategy involves Buy OTM Put Option + Sell ITM Put Option. For example, If you are of the view that the price of Reliance Shares will moderately gain or drop its volatility in near future. If Reliance is currently trading at 600 then you will buy a OTM PUT OPTION at 700 and a sell a ITM PUT OPTION at 550. You will make a profit when at expiry Reliance closes at 700 level and incur losses if the prices fall down below the current price. |

|

| Breakeven Point | Strike price of short put - net premium paid |

2 Breakeven Points There are 2 break even points in this strategy. The upper break even is hit when the underlying price is equal to the total of strike price of short call and net premium paid. The lower break even is hit when the underlying price is equal to the difference between strike price of short Put and net premium paid. Break-even points: Lower Breakeven = Strike Price of Put - Net Premium Upper breakeven = Strike Price of Call+ Net Premium |

| Bull Put Spread | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| Risks | Limited Maximum loss occurs when the stock price moves below the lower strike price on expiration date. Max Loss = (Strike Price Put 1 - Strike Price of Put 2) - Net Premium Received Max Loss Occurs When Price of Underlying <= Strike Price of Long Put |

Unlimited There is a possibility of unlimited loss in the short straddle strategy. The loss occurs when the price of the underlying significantly moves upwards and downwards. Loss = Price of Underlying - Strike Price of Short Call - Net Premium Received Or Loss= Strike Price of Short Put - Price of Underlying - Net Premium Received |

| Rewards | Limited Maximum profit happens when the price of the underlying moves above the strike price of Short Put on expiration date. Max Profit = Net Premium Received |

Limited Maximum profit is limited to the net premium received. The profit is achieved when the price of the underlying is equal to either strike price of short Call or Put. |

| Maximum Profit Scenario | Both options unexercised |

Both Option not exercised |

| Maximum Loss Scenario | Both options exercised |

One Option exercised |

| Bull Put Spread | Short Straddle (Sell Straddle or Naked Straddle) | |

|---|---|---|

| Advantages | Allows you to benefit from time decay in profit situations. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying. |

It allows you to benefit from double time decay and earn profit in a less volatile scenario. |

| Disadvantage | Limited profit. Time decay may go against you in loss situations. |

Unlimited losses if the price of the underlying move significantly in either direction. |

| Simillar Strategies | Bull Call Spread, Bear Put Spread, Collar | Short Strangle, Long Straddle |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|