Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Long Call and Long Strangle (Buy Strangle) options trading strategies. Find similarities and differences between Long Call and Long Strangle (Buy Strangle) strategies. Find the best options trading strategy for your trading needs.

| Long Call | Long Strangle (Buy Strangle) | |

|---|---|---|

|

|

|

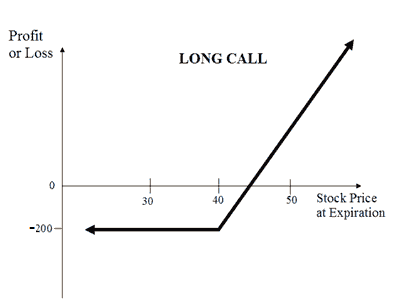

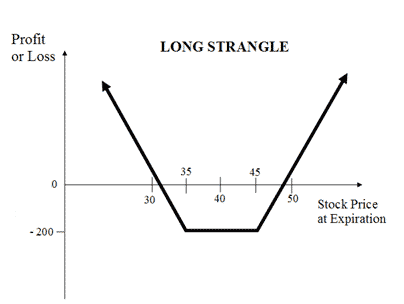

| About Strategy | A Long Call Option trading strategy is one of the basic strategies. In this strategy, a trader is Bullish in his market view and expects the market to rise in near future. The strategy involves taking a single position of buying a Call Option (either ITM, ATM or OTM). This strategy has limited risk (max loss is premium paid) and unlimited profit potential. When the trader goes long on call, the trader buys a Call Option and later sells it to earn profits if the price of the underlying asset goes up. When the trader buys a call, he pays the option premium in exchange for the right (but not the obligation) to buy share or index at a fixed price by a certain expiry date. This premium is the only amount at-the-risk for trader in case the mark... Read More | The Long Strangle (or Buy Strangle or Option Strangle) is a neutral strategy wherein Slightly OTM Put Options and Slightly OTM Call are bought simultaneously with same underlying asset and expiry date. This strategy can be used when the trader expects that the underlying stock will experience significant volatility in the near term. It is a limited risk and unlimited reward strategy. The maximum loss is the net premium paid while maximum profit is achieved when the underlying moves either significantly upwards or downwards at expiration. The usual Long Strangle Strategy looks like as below for NIFTY current index value at 10400 (NIFTY Spot Price): Options Strangle Orders OrdersNIFTY Strike Price Buy 1 Slightly OTM PutN... Read More |

| Market View | Bullish | Neutral |

| Strategy Level | Beginners | Beginners |

| Options Type | Call | Call + Put |

| Number of Positions | 1 | 2 |

| Risk Profile | Limited | Limited |

| Reward Profile | Unlimited | Unlimited |

| Breakeven Point | Strike Price + Premium | two break-even points |

| Long Call | Long Strangle (Buy Strangle) | |

|---|---|---|

| When to use? | A long call Option strategy works well when you expect the underlying instrument to move positively in the recent future. If you expect XYZ company to do well in near future then you can buy Call Options of the company. You will earn the profit if the price of the company shares closes above the Strike Price on the expiry date. However, if underlying shares don't do well and move downwards on expiry date you will incur losses (i.e. lose premium paid). |

A Long Strangle is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Market View | Bullish When you're expecting a rise in the price of the underlying and increase in volatility. |

Neutral When you are unsure of the direction of the underlying but expecting high volatility in it. |

| Action |

A long call strategy involves buying a call option only. So if you expect Reliance to do well in near future then you can buy Call Options of Reliance. You will earn a profit if the price of Reliance shares closes above the Strike price on the expiry date. However, if Reliance shares don't move up within the expiry date you will incur losses. |

Suppose Nifty is currently at 10400 and you expect the price to move sharply but are unsure about the direction. In such a scenario, you can execute long strangle strategy by buying Nifty at 10600 and at 10800. The net premium paid will be your maximum loss while the profit will depend on how high or low the index moves. |

| Breakeven Point | Strike Price + Premium The break-even point for Long Call strategy is the sum of the strike price and premium paid. Traders earn profits if the price of the underlying asset moves above the break-even point. Traders loose premium if the price of the underlying asset falls below the break-even point. |

two break-even points A Options Strangle strategy has two break-even points. Lower Breakeven Point = Strike Price of Put - Net Premium Upper Breakeven Point = Strike Price of Call + Net Premium |

| Long Call | Long Strangle (Buy Strangle) | |

|---|---|---|

| Risks | Limited The risk is limited to the premium paid for the call option irrespective of the price of the underlying on the expiration date.

|

Limited Max Loss = Net Premium Paid The maximum loss is limited to the net premium paid in the long strangle strategy. It occurs when the price of the underlying is trading between the strike price of Options. |

| Rewards | Unlimited There is no limit to maximum profit attainable in the long call option strategy. The trade gets profitable when price of the underlying is greater than strike price plus premium.

|

Unlimited Maximum profit is achieved when the underlying moves significantly up and down at expiration. Profit = Price of Underlying - Strike Price of Long Call - Net Premium Paid Or Profit = Strike Price of Long Put - Price of Underlying - Net Premium Paid |

| Maximum Profit Scenario | Underlying closes above the strike price on expiry. |

One Option exercised |

| Maximum Loss Scenario | Underlying closes below the strike price on expiry. |

Both Option not exercised |

| Long Call | Long Strangle (Buy Strangle) | |

|---|---|---|

| Advantages | Buying a Call Option instead of the underlying allows you to gain more profits by investing less and limiting your losses to minimum. |

|

| Disadvantage | Call options have a limited lifespan. So, in case the price of your underlying stock is not higher than the strike price before the expiry date, the call option will expire worthlessly and you will lose the premium paid. |

The strategy requires significant price movements in the underlying to gain profits. |

| Simillar Strategies | Protective Put, Covered Put/Married Put, Bull Call Spread | Long Straddle, Short Strangle |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|