Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Protective Call (Synthetic Long Put) and Covered Put (Married Put) options trading strategies. Find similarities and differences between Protective Call (Synthetic Long Put) and Covered Put (Married Put) strategies. Find the best options trading strategy for your trading needs.

| Protective Call (Synthetic Long Put) | Covered Put (Married Put) | |

|---|---|---|

|

|

|

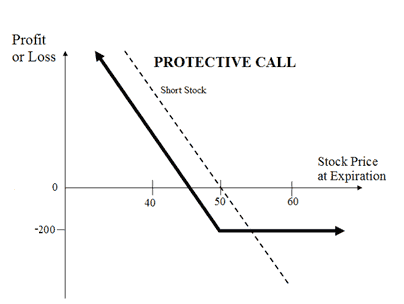

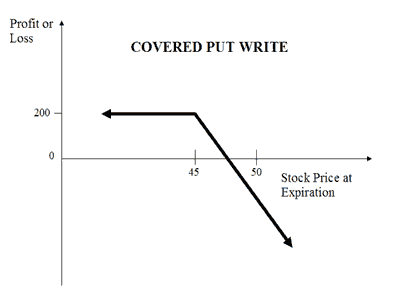

| About Strategy | The Protective Call strategy is a hedging strategy. In this strategy, a trader shorts position in the underlying asset (sell shares or sell futures) and buys an ATM Call Option to cover against the rise in the price of the underlying. This strategy is opposite of the Synthetic Call strategy. It is used when the trader is bearish on the underlying asset and would like to protect 'rise in the price' of the underlying asset. The risk is limited in the strategy while the rewards are unlimited. How to use a Protective Call trading strategy? The usual Protective Call Strategy looks like as below for State Bank of India (SBI) Shares which are currently traded at Rs 275 (SBI Spot Price): Protective Call Orders - SBI Stock Orde... Read More | The Covered Put is a neutral to bearish market view and expects the price of the underlying to remain range bound or go down. In this strategy, while shorting shares (or futures), you also sell a Put Option (ATM or slight OTM) to cover for any unexpected rise in the price of the shares. This strategy is also known as Married Put strategy or writing covered put strategy. The risk is unlimited while the reward is limited in this strategy. How to use a Protective Call trading strategy? The usual Covered Put looks like as below for State Bank of India (SBI) Shares which are currently traded at Rs 275 (SBI Spot Price): Covered Put Orders - SBI Stock OrdersSBI Strike Price Sell Underlying SharesSell 100 SBI Shares ... Read More |

| Market View | Bearish | Bearish |

| Strategy Level | Beginners | Advance |

| Options Type | Call + Underlying | Put + Underlying |

| Number of Positions | 2 | 2 |

| Risk Profile | Limited | Unlimited |

| Reward Profile | Unlimited | Limited |

| Breakeven Point | Underlying Price - Call Premium | Futures Price + Premium Received |

| Protective Call (Synthetic Long Put) | Covered Put (Married Put) | |

|---|---|---|

| When to use? | The Protective Call option strategy is used when you are bearish in market view and want to short shares to benefit from it. The strategy minimizes your risk in the event of prime movements going against your expectations. |

The Covered Put works well when the market is moderately Bearish |

| Market View | Bearish When you are bearish on the underlying but want to protect the upside. |

Bearish When you are expecting a moderate drop in the price and volatility of the underlying. |

| Action |

|

Sell Underlying Sell OTM Put Option Suppose SBI is trading at 300. You believe that the price will remain range bound or mildly drop. The covered put allows you to benefit from this market view. In this strategy, you sell the underlying and also sell a Put Option of the underlying and receive the premium. You will benefit from drop in prices of SBI, the Put Option will minimize your risks. If there is no change in price then you keep the premium received as profit. |

| Breakeven Point | Underlying Price - Call Premium When the price of the underlying is equal to the total of the sale price of the underlying and premium paid. |

Futures Price + Premium Received The break-even point is achieved when the price of the underlying is equal to the total of the sale price of underlying and premium received. |

| Protective Call (Synthetic Long Put) | Covered Put (Married Put) | |

|---|---|---|

| Risks | Limited The maximum loss is limited to the premium paid for buying the Call option. It occurs when the price of the underlying is less than the strike price of Call Option. Maximum Loss = Call Strike Price - Sale Price of Underlying + Premium Paid |

Unlimited The Maximum Loss is Unlimited as the price of the underlying can theoretically go up to any extent. Loss = Price of Underlying - Sale Price of Underlying - Premium Received |

| Rewards | Unlimited The maximum profit is unlimited in this strategy. The profit is dependent on the sale price of the underlying. Profit = Sale Price of Underlying - Price of Underlying - Premium Paid |

Limited The maximum profit is limited to the premiums received. The profit happens when the price of the underlying moves above strike price of Short Put. |

| Maximum Profit Scenario | Underlying goes down and Option not exercised |

Underlying goes down and Options exercised |

| Maximum Loss Scenario | Underlying goes down and Option exercised |

Underlying goes up and Options exercised |

| Protective Call (Synthetic Long Put) | Covered Put (Married Put) | |

|---|---|---|

| Advantages | Minimizes the risk when entering into a short position while keeping the profit potential limited. |

Its an income generation strategy in a neutral or Bearish market. Also allows you to benefit from fall in prices, range bound movements or mild increase. |

| Disadvantage | Premium paid for Call Option may eat into your profits. |

The risks can be huge if the prices increases steeply. |

| Simillar Strategies | Long Put | Bear Put Spread, Bear Call Spread |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|