Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Bear Call Spread and Short Call Butterfly options trading strategies. Find similarities and differences between Bear Call Spread and Short Call Butterfly strategies. Find the best options trading strategy for your trading needs.

| Bear Call Spread | Short Call Butterfly | |

|---|---|---|

|

|

|

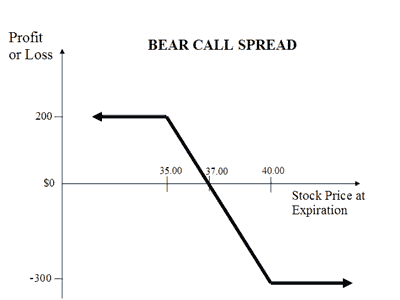

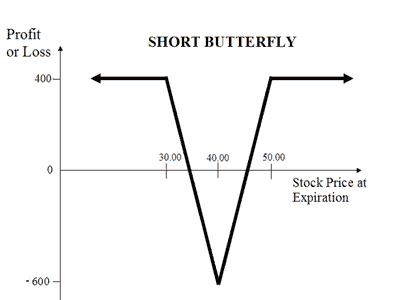

| About Strategy | A Bear Call Spread strategy involves buying a Call Option while simultaneously selling a Call Option of lower strike price on same underlying asset and expiry date. You receive a premium for selling a Call Option and pay a premium for buying a Call Option. So your cost of investment is much lower. The strategy is less risky with the reward limited to the difference in premium received and paid. This strategy is used when the trader believes that the price of underlying asset will go down moderately. This strategy is also known as the bear call credit spread as a net credit is received upon entering the trade. The risk and reward both are limited in the strategy. How to use the bear call spread options strategy? The bear call spr... Read More | Short Call Butterfly (or Short Butterfly) is a neutral strategy similar to Long Butterfly but bullish on the volatility. This strategy is a limited risk and limited profit strategy. This strategy consists of two long calls at a middle strike (or ATM) and one short call each at a lower and upper strike. All the options must have the same expiration date. Also, the upper and lower strikes (or wings) must both be equidistant from the middle strike (or body). In simple terms, it involves Sell 1 ITM Call, Buy 2 ATM Calls and Sell 1 OTM Call. The strike prices of all Options should be at equal distance from the current price as shown in the example below. The usual Short Butterfly strategy looks like as below for NIFTY current index value as 1... Read More |

| Market View | Bearish | Neutral |

| Strategy Level | Beginners | Advance |

| Options Type | Call | Call |

| Number of Positions | 2 | 4 |

| Risk Profile | Limited | Limited |

| Reward Profile | Limited | Limited |

| Breakeven Point | Strike Price of Short Call + Net Premium Received | 2 Break-even Points |

| Bear Call Spread | Short Call Butterfly | |

|---|---|---|

| When to use? | The bear call spread options strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of prime movements going against your expectations. |

This strategy is meant for special scenarios where you foresee a lot of volatility in the market due to election results, budget, policy change, annual result announcements etc. |

| Market View | Bearish When you are expecting the price of the underlying to moderately go down. |

Neutral When you are unsure about the direction in the movement in the price of the underlying but are expecting high volatility in it in the near future. |

| Action |

Let's assume you're Bearish on Nifty and are expecting mild drop in the price. You can deploy Bear Call strategy by selling a Call Option with lower strike and buying a Call Option with higher strike. You will receive a higher premium for selling a Call while pay lower premium for buying a Call. The net premium will be your profit. If the price of Nifty rises, your loss will be limited to difference between two strike prices minus net premium. |

|

| Breakeven Point | Strike Price of Short Call + Net Premium Received The break even point is achieved when the price of the underlying is equal to strike price of the short Call plus net premium received. |

2 Break-even Points There are 2 break even points in this strategy.

|

| Bear Call Spread | Short Call Butterfly | |

|---|---|---|

| Risks | Limited The maximum loss occurs when the price of the underlying moves above the strike price of long Call. Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received |

Limited The maximum risk is limited. Maximum Risk = Higher strike price- Lower Strike Price - Net Premium |

| Rewards | Limited The maximum profit the net premium received. It occurs when the price of the underlying is greater than strike price of short Call Option. Max Profit = Net Premium Received - Commissions Paid |

Limited The profit is limited to the net premium received. This happens when the price of the underlying is trading beyond the range of strike prices at expiration date. |

| Maximum Profit Scenario | Underlying goes down and both options not exercised |

All Options exercised or not exercised |

| Maximum Loss Scenario | Underlying goes up and both options exercised |

Only ITM Call exercised |

| Bear Call Spread | Short Call Butterfly | |

|---|---|---|

| Advantages | It allows you to profit in a flat market scenario when you're expecting the underlying to mildly drop, be range bound or marginally rise. |

This strategy requires no investment as net premium is positive and received. It allows you to benefit from high volatile market scenarios without the need to speculate on the direction of price movement. |

| Disadvantage | Limited profit potential. |

Profitability depends on significant movement in the price of the underlying. |

| Simillar Strategies | Bear Put Spread, Bull Call Spread | Long Straddle, Long Call Butterfly |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|