Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, December 9, 2019 by Chittorgarh.com Team | Modified on Sunday, April 19, 2020

SBI Cards and Payment Services Limited, a subsidiary of SBI, is coming up with an IPO. The issue opens on 2nd March 2020 and closes on 5th March 2020 (4th March for QIB Bidders). There's a special category of investor reservation portion for SBI shareholders. As per the SBI Cards IPO RHP filed by the company, here are the rules for investing in SBI Cards IPO for SBI holders:

| Scenario | Maximum Eligible Bidding Limit | |

|---|---|---|

|

1 |

Applying only in Shareholders Category |

Above Rs 200,000 (Maximum bid up to the shareholder reservation portion) |

|

2 |

Applying Shareholders and Retail Category Both |

Rs 200,000 in Shareholders Any Amount in Retail* |

|

3 |

Applying in: Shareholders Category RII Category |

Rs 200,000 in Shareholders Any Amount in Retail* Rs 500,000 in Employee |

* Bid under Retail Individual Bidders Portion for upto Rs 200,000 OR in Non-Institutional Bidders Portion such that the Bid Amount exceeds Rs 200,000 but not exceeding the size of the Net Offer (excluding QIB portion)

Note: An eligible SBI shareholder bidding in SBI shareholder reservation portion (subject to bid amount not exceeding Rs 2,00,000 under SBI shareholder reservation portion) may also bid under net offer i.e. either in Retail Individual Bidders Portion for upto Rs 200,000 OR in Non-Institutional Bidders Portion such that the Bid Amount exceeds Rs 200,000 but not exceeding the size of the Net Offer (excluding QIB portion), subject to applicable limits.

An SBI Shareholders bidding in the SBI Shareholders Reservation Portion above Rs 200,000 cannot Bid in the Net Offer as such Bids will be treated as multiple Bids.

Read more about SBI Cards IPO

Bids under the SBI Shareholders Reservation Portion shall be subject to the following:

- Only SBI Shareholders (i.e. individuals and HUFs who are equity shareholders of SBI (excluding such other persons not eligible under applicable laws, rules, regulations and guidelines) as at the date of the Red Herring Prospectus i.e 18th Feb 2020) would be eligible to apply in this Offer under the SBI Shareholders Reservation Portion.

- The sole/ First Bidder shall be a SBI Shareholder.

- Only those Bids, which are received at or above the Offer Price, would be considered for allocation under this category.

- The Bids must be for a minimum of 19 Equity Shares and in multiples of 19 Equity Shares thereafter. Bids by SBI Shareholders in SBI Shareholders Reservation Portion (subject to Bid Amount being up to Rs 200,000) and in the Net Offer portion shall not be treated as multiple Bids. To clarify, an SBI Shareholders bidding in the SBI Shareholders Reservation Portion above Rs 200,000 cannot Bid in the Net Offer as such Bids will be treated as multiple Bids. Further, bids by SBI Shareholders in SBI Shareholders Reservation Portion (subject to Bid Amount being up to Rs 200,000) and in the Employee Reservation Portion (as Eligible Employees), shall not be treated as multiple Bids Therefore, SBI Shareholders bidding in the SBI Shareholders Reservation Portion (subject to the Bid Amount being up to Rs 200,000) and bidding in the Employee Reservation Portion (as Eligible Employees) can also Bid under the Net Offer and such Bids will not be treated as multiple Bids. Our Company reserves the right to reject, in its absolute discretion, all or any multiple Bids in any or all categories.

- If the aggregate demand in this category is less than or equal to 13,052,680 Equity Shares at or above the Offer Price, full allocation shall be made to the SBI Shareholders to the extent of their demand.

- Under-subscription, if any, in any category including the SBI Shareholders Reservation Portion and the Employee Reservation Portion, except in the QIB Portion, would be allowed to be met with spill over from any other category or a combination of categories at the discretion of our Company in consultation with the BRLMs and the Designated Stock Exchange.

- SBI Shareholders Bidding under the SBI Shareholders Reservation Portion (subject to the Bid Amount being up to Rs 200,000) are entitled to Bid at the Cut-off Price.

- SBI Shareholders Bidding under the SBI Shareholders Reservation Portion (subject to the Bid Amount being above Rs 200,000) are not entitled to Bid at the Cut-off Price.

If the aggregate demand in this category is greater than 13,052,680 Equity Shares at or above the Offer Price, the allocation shall be made on a proportionate basis.

The cut-off date is the date of RHP filing that is 18th Feb 2020. Any investor who holds 1 or more shares of SBI on 18th Feb 2020 will be eligible for applying under shareholders category of SBI Cards IPO.

The minimum one share of SBI is enough to be eligible to participate in the SBI Cards IPO under the shareholder's category.

Note

Yes, you can apply in both shareholder category (up to Rs 2L) and retail category (any amount*).

* Considered as RII or NII based on the amount you apply. It is considered as Retail Individual Bidders Portion (RII) for upto Rs 200,000 OR in Non-Institutional Bidders Portion (NII) when the Bid Amount exceeds Rs 200,000

Yes, you can apply in both retail and shareholders categories of SBI Cards IPO using the same demat account. Note that in this case, you are eligible for a maximum limit of Rs 200,000 in shareholders category. In case of retail, you could choose any amount but you will be qualified as RII or NII based on the amount you choose. Retail Individual Bidders Portion (RII) is for upto Rs 200,000 OR in Non-Institutional Bidders Portion (NII) when the Bid Amount exceeds Rs 200,000.

No, in SBI shareholder's quota, the person on whose name the IPO application is made needs to be an SBI shareholder. Other individuals cannot apply in shareholders category of SBI Cards IPO.

Traditionally, you could apply in 5 IPO applications (anyone's name) using one bank account with SBI. This is the same as Axis Bank and PNB bank.

We are not sure if SBI online banking will allow 5 retail + 5 shareholders applications from one bank account in SBI Cards IPO. We will keep posting updates as we receive from the bank.

No, the allotment will not be done based on the number of SBI shares owned by you in SBI Cards IPO. As long as you are an eligible shareholder of SBI, the chances of allotment are the same.

One share of SBI on a cut-off day (February 18, 2020) in your demat account is enough to be eligible for the SBI Cards IPO shareholders reservation category.

The cut-off date i.e. the date on which you should own the SBI shares is the date when the company will file the Red Herring-Prospectus (RHP).

SBI Card RHP was filed on February 18, 2020. This is the cut-off date for shareholders quota eligibility in SBI Cards IPO.

SBI Cards filed the DRHP (Draft Red Herring Prospectus) with SEBI on November 26, 2019. You can get the details here.

Note that in the case of SBI Cards IPO, the cut-off date for eligibility of shareholders quota is February 18, 2020, the date when RHP is filed.

Yes the PNB account holders should be able to apply in both shareholders and retail category of SBI Cards IPO.

But as per the information, there is a technical limitation in PNB Online IPO Application which only allows one application per PAN number. The bank has informed us that they are working to fix this issue. Hopefully, before the SBI Cards IPO opens, this should be fixed.

If you are applying in both shareholders and retail categories of SBI Cards IPO, the bid amount should not exceed Rs 200,000 in shareholders category.

If you are applying only on shareholders category, you can apply up to 13,052,680 Equity Shares.

For example, a shareholder can apply in following two ways:

| Category | Maximum Limit | |

|---|---|---|

|

1 |

Apply in both category |

Maximum Rs 2L in Shareholders + Any amount in Retail* |

|

2 |

Apply only in shareholders category |

Up to 13,052,680 Equity Shares |

* Considered as RII or NII based on the amount you apply. It is considered as Retail Individual Bidders Portion (RII) for upto Rs 200,000 OR in Non-Institutional Bidders Portion (NII) when the Bid Amount exceeds Rs 200,000

An individual can apply in the Shareholders category if he holds the SBI shares on February 18, 2020, the day of filing the SBI Cards IPO RHP (Ref Herring-Prospectus).

Yes, you can apply in both categories of SBI Cards IPO using the same demat account, savings account and PAN number.

If you are planning to apply in both categories, the maximum bid amount for the Retail and Shareholder category is up to Rs 200,000 in each category.

If you are only applying in the shareholder's category, you can apply up to 13,052,680 Equity Shares.

ICICI Direct website will show 2 entries in the IPO list, one for shareholders and another for regular application. It will be like applying in 2 IPO's.

The process is the same as it is with any other IPO you have applied in the past. You can use any bank's website (i.e. SBI, ICICI, HDFC, PNB, Axis, Kotak) to apply in SBI Card IPO online.

Note: SBI Cards IPO will be available to apply online only when it's open for public bidding. The date of the IPO will be announced by the company a week before it opens.

If you doing this first time follow these steps:

No. Only Individuals and HUFs who are the public equity shareholders of SBI (State Bank of India) or Promoter of SBI Cards, can apply in shareholder quota.

You have to at least 1 share of SBI in your demat account on February 18, 2020, to be eligible to apply under shareholders reservation category.

Yes, you can use the same ASBA account for applying in RII (Retail Individual Investors) and shareholders category in SBI Cards IPO.

If you planning to apply in both, the maximum bid amount for Shareholder Reservation categories is up to Rs 200,000.

If you applying only in the shareholder's category, you can apply for any amount (Max 13,052,680 shares).

Yes, you can sell the shares allocated under the shareholder's quota on the day of SBI Cards IPO Listing. There is no lock-in period.

No, there are no restrictions on SBI Cards IPO shares allocated under the shareholder's category. There is no lock-in period or any time frame to hold the shares before you can sell them. You could sell them on the listing day similar to shares allocated in the general retail category.

SBI Card IPO has 13,052,680 Equity Share reserved for State Bank of India (SBI) shareholders. Approximate 10% of the total issue size is reserved for shareholders. February 18, 2020 is the cut-off date for shareholders.

Minimum 1 share of State Bank of India (SBI) is required to be eligible for applying IPO application in the SBI Card IPO Shareholders category. The share should be in your demat account on February 18, 2020, the day of filing of SBI Card IPO Red Herring Document (RHP).

You have to apply through two separate applications, one for each category. You cannot apply both shareholders and retail category in the same application.

Shares are distributed on a proportionate basis in SBI Card IPO shareholders category. The minimum allotment will be 19 shares (1 lot).

There is no limit while applying in shareholders category by a retail investor as long as they are applying only in this category. The retail investors (shareholders) can apply as much as they want.

If a retail investor intent to apply in both retail and shareholders category, the limit is Rs 2 Lakhs in shareholders category. For retail, the investor will be considered as RII or NII based on the amount you apply. It is considered as Retail Individual Bidders Portion (RII) for upto Rs 200,000 OR in Non-Institutional Bidders Portion (NII) when the Bid Amount exceeds Rs 200,000.

Yes, the SBI Bank Account holders could apply in both shareholders and retail category of SBI Cards IPO through online IPO application using SBI Net Banking.

SBI Shareholders can apply in SBI card IPO through a reserved category for shareholders. Over 10% of SBI Card IPO shares worth of around Rs 1000 crore are reserved SBI Shareholders. The chances are getting IPO shares allocated in shareholders category are higher.

Retail investors who are also shareholders are eligible to apply in both retail as well as shareholders category. If applying in both, the max limit is Rs 2L in each category.

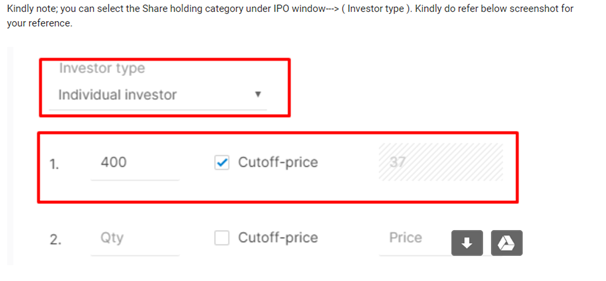

Here are the steps to apply under shareholder category through Zerodha Console:

SBI Card IPO doesn't have a separate reservation for retail investors (who apply for less than Rs 2 Lakh) in the shareholder's category.

No, shareholders don't get any discount in SBI Card IPO. The discount is only applicable to eligible employees of SBI applying in the Employee category.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

Just my money got deducted from my account