Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, December 10, 2019 by Chittorgarh.com Team | Modified on Wednesday, February 26, 2020

SBI Cards and Payment Services Ltd is a payment solution provider in India. Incorporated in 1998, SBI Card is a venture of State Bank of India (SBI). SBI Cards IPO opens on 2nd March 2020 and closes on 5th March 2020 (4th March for QIB bidders). .

As per the RHP document, SBI Employees can apply in SBI Cards IPO under the reserved category for Employees with certain terms and conditions. This article provides detail about how SBI current and a retired employee of SBI can benefit by applying in SBI Cards IPO under retail, employee and shareholders category of the IPO.

The rules for investing in SBI Cards IPO for SBI employees are as below:

Note-

Read more about SBI Cards IPO

Rs 500,000 is the Maximum limit to apply under the employee category of SBI Cards IPO. But the process allotment will be as below:

If applying in multiple categories, the maximum limit will be as below:

| Category | Maximum Limit |

|---|---|

|

Employee Category |

Maximum Rs 5 Lakhs |

|

Shareholders Category |

Maximum Rs 2 Lakhs |

|

General Category |

Any Amount* |

* Bid under Retail Individual Bidders Portion for upto Rs 200,000 OR in Non-Institutional Bidders Portion such that the Bid Amount exceeds Rs 200,000 but not exceeding the size of the Net Offer (excluding QIB portion).

If total demand in the employee category is less than or equal to 1,864,669 Equity Shares (total shares allocated to employees) at or above the Offer Price, the full allocation shall be made to the Eligible Employees.

In case of an under-subscription in the Employee Reservation Portion, the unsubscribed shares may be allocated on a proportionate basis to employees bidding in excess of Rs 200,000. However, the total allotment in under-subscription, as well as over-subscription, will not exceed Rs 500,000.

The Bid must be for a minimum of 19 Equity Shares and in multiples of 19 Equity Shares thereafter so as to ensure that the Bid Amount payable by the Eligible Employee does not exceed Rs 500,000 on a net basis. However, the initial allocation to an Eligible Employee in the Employee Reservation Portion shall not exceed Rs 200,000 (which will be less Employee Discount). Only in the event of an under-subscription in the Employee Reservation Portion post the initial allocation, such unsubscribed portion may be allocated on a proportionate basis to Eligible Employees Bidding in the Employee Reservation Portion, for a value in excess of Rs 200,000, subject to the total Allotment to an Eligible Employee not exceeding Rs 500,000 (which will be less Employee Discount). Eligible Employees under the Employee Reservation Portion may Bid at Cut-off Price.

Bids under Employee Reservation Portion by Eligible Employees shall be:

- Made only in the prescribed Bid cum Application Form or Revision Form (i.e. [.] colour form).

- The Bid must be for a minimum of 19 Equity Shares and in multiples of 19 Equity Shares thereafter so as to ensure that the Bid Amount payable by the Eligible Employee subject to a maximum Bid Amount of Rs 500,000 (which will be less Employee Discount) on a net basis. Eligible Employees under the Employee Reservation Portion may Bid at Cut-off Price.

- Eligible Employees should mention their employee number at the relevant place in the Bid cum Application Form.

- Only Eligible Employees would be eligible to apply in this Offer under the Employee Reservation Portion and the Bidder should be an Eligible Employee as defined above.

- Bids by Eligible Employees in the Employee Reservation Portion and in the Net Offer portion shall not be treated as multiple Bids. Further, bids by Eligible Employees in the Employee Reservation Portion and in the SBI Shareholders Reservation Portion (subject to Bid Amount being up to Rs 200,000), as SBI Shareholders, shall also not be treated as multiple Bids. Therefore, Eligible Employees bidding in the Employee Reservation Portion and the SBI Shareholders Reservation Portion (subject to the Bid Amount being up to Rs 200,000) can also Bid under the Net Offer and such Bids will not be treated as multiple Bids. Our Company reserves the right to reject, in its absolute discretion, all or any multiple Bids in any or all categories.

- Only those Bids, which are received at or above the Offer Price, net of Employee Discount, if any, would be considered for Allotment under this category.

- Eligible Employees can also Bid in the Net Offer to the Public and such Bids shall not be treated as multiple Bids.

- In case of joint bids, the First Bidder shall be an Eligible Employee.

- Eligible Employees shall not Bid through the UPI mechanism.

- If the aggregate demand in this category is less than or equal to 1,864,669 Equity Shares at or above the Offer Price, full allocation shall be made to the Eligible Employees to the extent of their demand.

In the event of under-subscription in the Employee Reservation Portion, the unsubscribed portion will be available for allocation and Allotment, proportionately to all Eligible Employees who have Bid in excess of Rs 200,000, subject to the maximum value of Allotment made to such Eligible Employee not exceeding Rs 500,000.

Under-subscription, if any, in any category including the Employee Reservation Portion and the SBI Shareholders Reservation Portion, except in the QIB Portion, would be allowed to be met with spill over from any other category or a combination of categories at the discretion of our Company in consultation with the BRLMs and the Designated Stock Exchange.

SBI Bank IPO offers a reservation of 1.35% shares for SBI staff. SBI Employees also get a discount of Rs 75 when applying in the employee reservation category. An employee of the state bank of India can apply up to Rs 5 Lakhs in the employee category.

This offers an excellent opportunity for SBI employees to make quick money from this IPO. The 10% discount and expected 40% up listing could result in total gains up to 50%.

In addition to the employee reservation category, SBI staff can also apply in:

The maximum amount SBI Employee can apply for in SBI Cards IPO under the Employee category is Rs 500,000.

However, the initial allotment to an employee is limited to Rs 200,000 only. The remaining Rs 300,000 will be considered in case of under-subscription. The unsubscribed portion will be allocated proportionately to all Eligible Employees applied between Rs 2L to Rs 5L.

Yes. The shares allocated under employee quota of SBI Cards IPO are treated in the same way as shares allotted in the retail category. You can sell them, transfer them or give them as a gift once the shares are credited in your demat account.

No, retired employees from SBI are not eligible to apply in employee quota of SBI Cards IPO. Only current employees of State Bank of India can apply under the employee category.

However, if you hold SBI shares till the cut-off date (18th Feb 2020) then you can apply in SBI shareholder's quota or apply in general in the retail category.

No, pensioners of SBI are not eligible to apply in employee quota in SBI Cards IPO. The employee category is reserved only for current employees.

However, if you hold SBI shares till the cut-off date (18th Feb 2020) then you can apply in SBI shareholders quota or apply in general in the retail category

Employees can bid in 3 categories using the same demat account and PAN number in SBI Cards IPO. This includes

If you apply in all 3 categories, you will be eligible to get the allotment in all 3 categories.

Note: Eligible Employees shall not Bid through the UPI mechanism.

* Considered as RII or NII based on the amount you apply. It is considered as Retail Individual Bidders Portion (RII) for upto Rs 200,000 OR in Non-Institutional Bidders Portion (NII) when the Bid Amount exceeds Rs 200,000

No. There are no restrictions or limitations on shares allotted under the Employee Reservation Category of SBI Cards IPO. These shares are treated the same as shares allotted in the general retail category. You can sell them on the same day of listing for listing day gains.

The offer price is the final price on which shares are allotted. As it is a book building issue, the issue will be available in the price band for bidding. The investors who bid in the employee category can bid at any price in the price band. After finalising the offer price, the bids which are received at or above the offer price would be eligible to get allotment.

The best way to bid at or above the offer price is to bid at the cap price of the price band.

SBI Card IPO has 1,864,669 Equity Share reserved for State Bank of India (SBI) employees. Approximate 1.35% of the total issue size is reserved for employees. Note the employee quote is applicable only for current employees. It excludes retired SBI employees.

Shares are distributed on a proportionate basis in SBI Card IPO employee category. Rs 5 lakhs is the maximum limit in the employee category.

No, Eligible Employees are not permitted to apply through the UPI mechanism in SBI Card IPO. The eligible employees cannot apply through brokers who don't offer a 3-in-1 account. This means you cannot apply in SBI Card IPO's employee category using your account with Zerodha, 5paisa, Edelweiss, Upstox, etc.

No, there is no locking period for shares allocated under the employee category. SBI current employees can apply for SBI Card IPO shares of up to Rs 5 Lakhs under employee reservation. They get Rs 75 discount too.

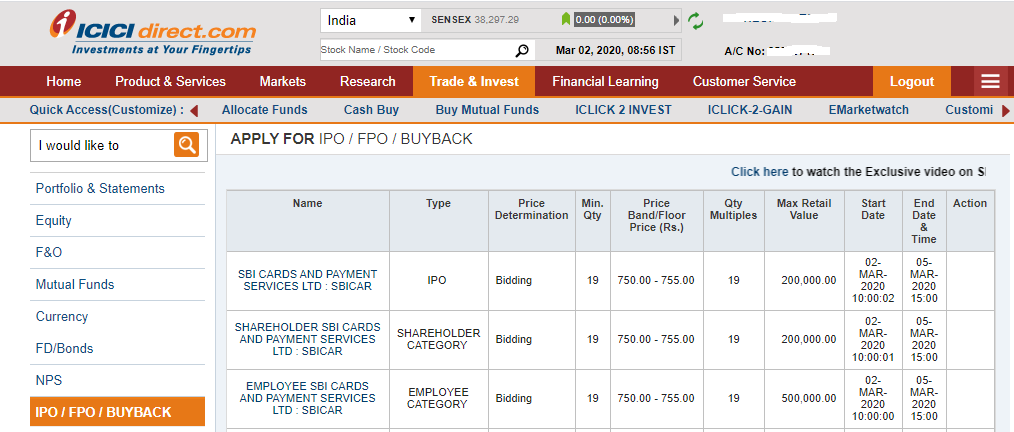

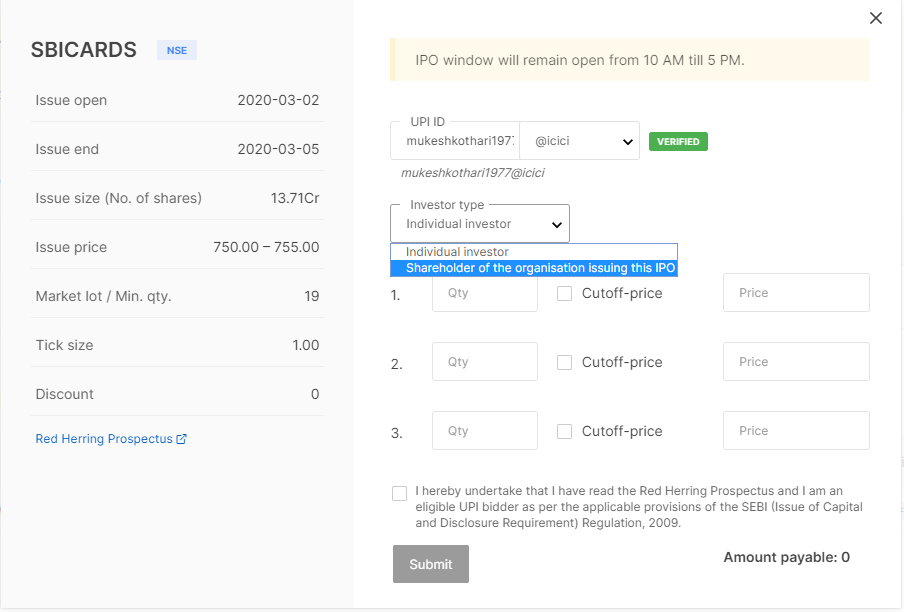

If you are applying in an IPO through the net-banking facility of SBI, ICICI or HDFC, you can find an option to apply an employee category as shown below.

The options to apply in the employee category is not available with discount brokers like Zerodha, 5paisa, Upstox, and Edelweiss.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|