Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

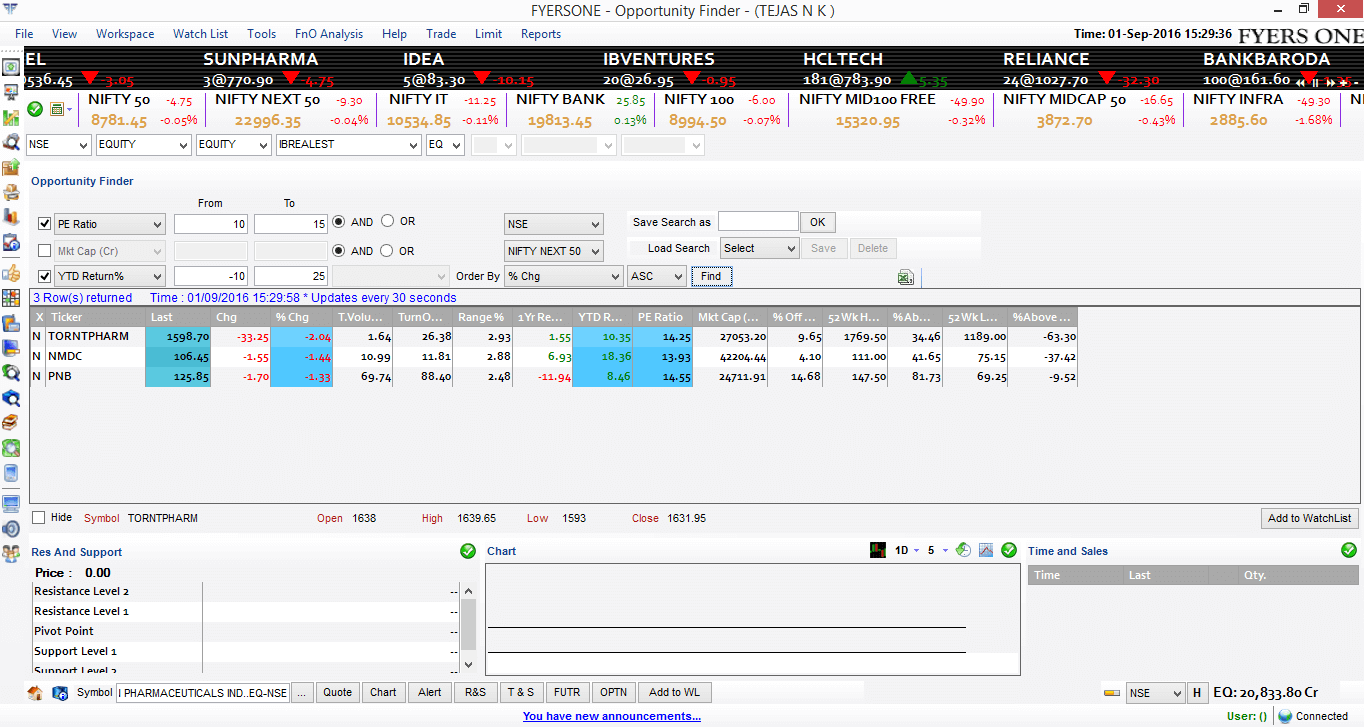

Compare Trading Platform Fyers One and HDFC ProTerminal. Find similarities and differences between Fyers One and HDFC ProTerminal Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Fyers One and HDFC ProTerminal.

| Fyers One | HDFC ProTerminal | |

|---|---|---|

|

|

|

| About Trading Platform | Fyers One is a trading platform launched in May 2016. The platform comes in 3 versions- an installable trading platform, a web trading platform, and a mobile app. |

HDFC Pro Terminal is a web-based trading platform developed for traders and analysts and offers a range of essential and advanced features for fast and reliable trading. The platform offers some unique features like sentiment analysis and predictive data analysis to help you accurately gauge the market sentiment and predict the market trends. |

| Platform Owner

|

Fyers securities | HDFC securities Ltd. |

| Trading Segments Offered

|

Equities, Currency, Commodities and Derivatives |

Equities, Currency, Derivatives, Mutual Funds and Bonds |

| Products Offered

|

Fyers One, Fyers Markets, Fyers Web |

Pro Terminal App |

| Order Type Offered

|

Limit, Market, StopLoss, Cover |

Limit, Market, StopLoss, StopLoss-Market |

| Supported Exchanges

|

NSE, BSE, MCX |

NSE, BSE |

| Brokers using this platform

|

||

| Order Management System (OMS)

|

Omnesys OMS |

|

| Risk Management System (RMA)

|

Omnesys RMS |

|

| Trading Platform Enquiry | Open Instant Account with Fyers One | |

| Fyers One | HDFC ProTerminal | |

|---|---|---|

| Product Highlights

|

Some of the major highlights of the Fyers One trading platform are-

|

HDFC Pro Terminal is an advanced trading platform built for faster trading and deep analysis of stocks. Some of the key highlights of the platform are-

|

| Key Features

|

Source: Fyers One Fyers One is a robust platform that offers a comprehensive set of features like-

|

Major features of the HDFC Pro Terminal platform are-

|

| Advantages |

|

|

| Disadvantages |

|

Subscription fee to access the platform. |

| Account Opening Enquiry | Open Instant Account with Fyers One |

| Fyers One | HDFC ProTerminal | |

|---|---|---|

| Installable Trading Terminal

|

||

| Trading Website

|

||

| Mobile Trading App

|

||

| API Access

|

||

| Offered by Multiple Brokers

|

||

| Equity Trading

|

||

| Currency F&O Trading

|

||

| Commodity Trading

|

||

| Online IPO Application

|

||

| Online Mutual Funds

|

||

| Integrated Backoffice

|

||

| Open Account | Open Instant Account with Fyers One |

| Fyers One | HDFC ProTerminal | |

|---|---|---|

| Chart Types Supported

|

4 | 8 |

| Chart Indicator

|

60 | |

| Place Orders from Chart

|

||

| Account Opening | Open Instant Account with Fyers One |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|