Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

5.27% 34,741 Clients

Bajaj Financial Account Opening Enquiry

Rs 0 Account Opening Charges + Flat Rs 10 Per Trade Brokerage (with Rs 2500 yearly subscription charges) + Rs 0 Demat AMC Open Demat Account Now!.

Bajaj Financial is a safe and reliable stockbroker in India. It has a strong parent company, quality services, and variable brokerage rates as per customer requirements. Bajaj Financial follows all the regulatory guidelines. But, when it comes to margin funding, you have to make decisions wisely.

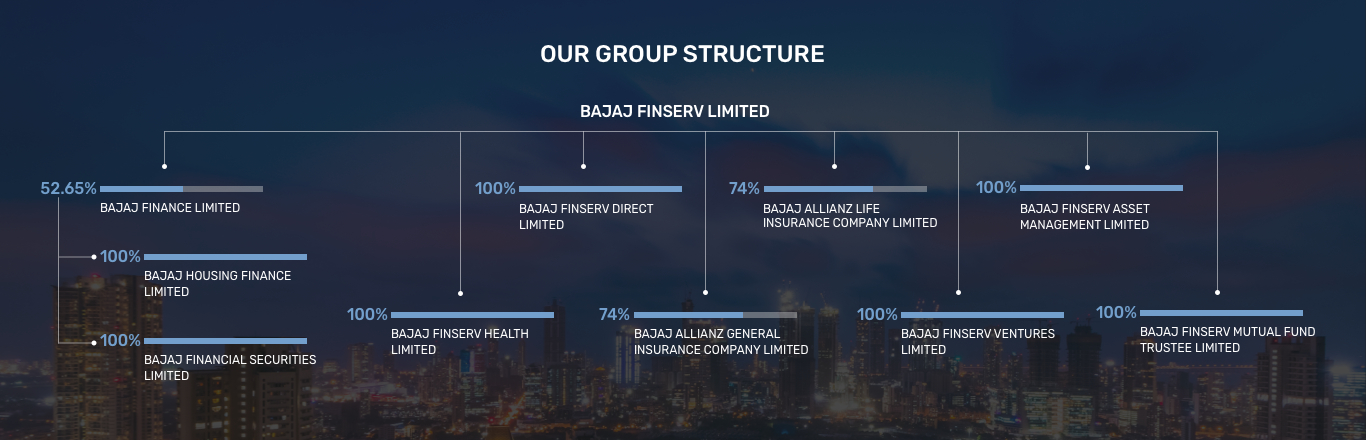

Bajaj Financial is a safe and reliable stockbroker with a strong parent company and excellent track record. Bajaj Financial Securities Limited (BFSL) is a 100% subsidiary of Bajaj Financial Limited - one of the largest financial service providers under Bajaj Group.

BFSL is regulated by the Securities and Exchange Board of India (SEBI). It is a registered broker with BSE, and NSE. It is a depository participant (DP) with both CDSL and NSDL.

As of March 2022, no major complaints have been reported against Bajaj Financial by regulators. That means it is following all the regulations prescribed by authorities.

Bajaj Financial Limited is a non-banking financial service provider under the Bajaj Group. The company is focused on lending, asset management, wealth management and insurance.

Bajaj Financial offers technologically advanced trading software for the stock market investors. The mobile app and website are equipped with critical tools and information required for trading and investments.

Till April 2022, the complaints to active client ratio across different exchanges were low. It favors the reliability of customers towards Bajaj Financial.

Bajaj Financial is a SEBI authorized broker and depository participant. It is a member of NSE and BSE stock exchanges. It offers depository services through its membership with CDSL and NSDL.

Bajaj Financial offers a margin funding facility to the clients. Margin Funding is a risky proportion as you earn profit only when the earned amount is higher than the margin. You also have to pay margin interest per day whether you generate profit or loss.

Bajaj Financial is member of NSE, BSE, CDSL and NSDL.

Bajaj Financial membership details:

Bajaj Financial is a safe and reliable stockbroker in India. It has a strong parent company, quality services, and variable brokerage rates as per customer requirements. Bajaj Financial follows all the regulatory guidelines. But, when it comes to margin funding, you have to make decisions wisely.

Must Read:

This is a limited-time offer. Simply leave your contact information with us and Bajaj Financial representatives will contact you.

Bajaj Financial Account Opening Enquiry

Rs 0 Account Opening Charges + Flat Rs 10 Per Trade Brokerage (with Rs 2500 yearly subscription charges) + Rs 0 Demat AMC Open Demat Account Now!.

Information on this page was last updated on Wednesday, June 19, 2024

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|