Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Trading Platform Zerodha Pi and Kotak KEAT Pro X. Find similarities and differences between Zerodha Pi and Kotak KEAT Pro X Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Zerodha Pi and Kotak KEAT Pro X.

| Zerodha Pi | Kotak KEAT Pro X | |

|---|---|---|

|

|

|

| About Trading Platform | Zerodha's PI is a free, installable trading platform developed in-house. The platform features advanced charting, algos, strategies, and backtesting. |

KEAT Pro X is a free, downloadable online trading software that helps traders trade in BSE, NSE and NSE currency markets. It is a high-speed trading tool that helps traders buy and sell securities, manage their portfolio, and monitor the market. |

| Platform Owner

|

Zerodha | Kotak Securities Limited |

| Trading Segments Offered

|

Stocks, Commodity, Currency, Derivatives |

Equity, Derivatives, Currency, MFs, IPOs, Bonds |

| Products Offered

|

Q, Quant |

KEAT Pro X, Website Trading, Xtralite, FastLane, StockTrader |

| Order Type Offered

|

Limit, Market, StopLoss, StopLoss-Market, Bracket, Cover, After Market Orders |

Stop Loss, Limit, Market, GTC, Smart, Bracket |

| Supported Exchanges

|

BSE, NSE, MCX |

NSE, BSE |

| Brokers using this platform

|

||

| Order Management System (OMS)

|

Omnesys OMS |

|

| Risk Management System (RMA)

|

Omnesys RMS |

|

| Trading Platform Enquiry | Open Instant Account with Zerodha Pi | Open Instant Account with Kotak KEAT Pro X |

| Zerodha Pi | Kotak KEAT Pro X | |

|---|---|---|

| Product Highlights

|

Zerodha's Pi offers many unique features to make trading fast and accurate. Some of the major highlights of the platform are-

|

KEAT Pro X is used by over 13 lakh customers and more than 5 lakh trades are conducted using it. The installable trading platform facilitates trading in equities, derivatives, currency derivatives etc., in NSE and BSE. Some of the key highlights of the software are-

|

| Key Features

|

Zerodha's Pi offers a range of features suitable for beginner to advanced traders. Some of the major features are-

|

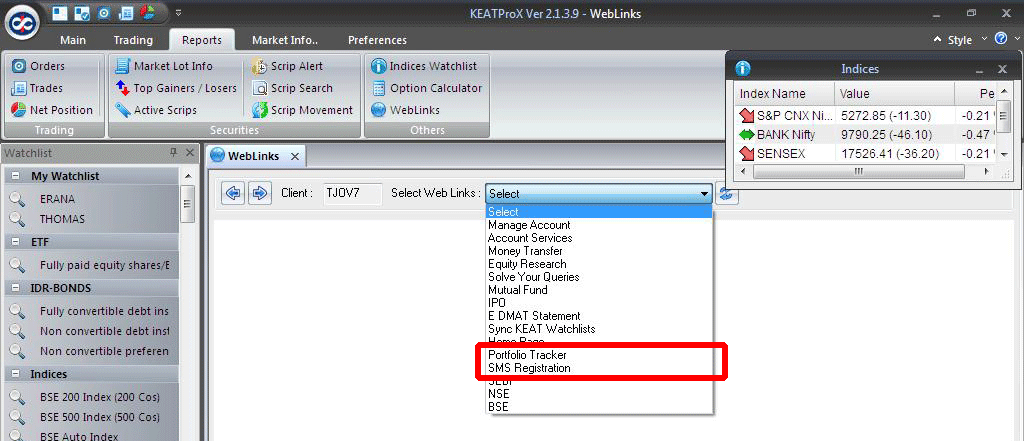

Source: Kotak KEAT Pro X offers a wide range of features to help traders trade with speed and ease. Some of the key features of the trading tool are-

|

| Advantages |

|

|

| Disadvantages |

|

The trading terminal doesn't supports commodity trading |

| Account Opening Enquiry | Open Instant Account with Zerodha Pi | Open Instant Account with Kotak KEAT Pro X |

| Zerodha Pi | Kotak KEAT Pro X | |

|---|---|---|

| Installable Trading Terminal

|

||

| Trading Website

|

||

| Mobile Trading App

|

||

| API Access

|

||

| Offered by Multiple Brokers

|

||

| Equity Trading

|

||

| Currency F&O Trading

|

||

| Commodity Trading

|

||

| Online IPO Application

|

||

| Online Mutual Funds

|

||

| Integrated Backoffice

|

||

| Open Account | Open Instant Account with Zerodha Pi | Open Instant Account with Kotak KEAT Pro X |

| Zerodha Pi | Kotak KEAT Pro X | |

|---|---|---|

| Chart Types Supported

|

10 | 5 |

| Chart Indicator

|

80 | 30 |

| Place Orders from Chart

|

||

| Account Opening | Open Instant Account with Zerodha Pi | Open Instant Account with Kotak KEAT Pro X |

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|