Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, May 14, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

Zerodha does not provide a facility to apply in the NCD NFO (new fund offer). You can apply in the NCD issues either through the ASBA supported banks or through the NCD issuing company's website using your Zerodha Demat account details.

While Zerodha does not offer to apply in NCD public issue, it allows you to buy listed NCDs through Zerodha Kite. The process of buying listed NCD is similar to buying a company share.

Note:

Zerodha doesn't provide an online NCD public issue application. You can apply in an NCD public issue through your bank's ASBA IPO application facility. If you use the Zerodha Demat Account Number while applying for NCD public issue, the allocated NCDs get deposited in the Zerodha demat account.

Steps to apply online in NCD IPO through ASBA supported bank

If you face any issues in applying online, you can also opt to apply offline in NCD by submitting the physical NCD application form.

Steps to apply offline in NCD IPO

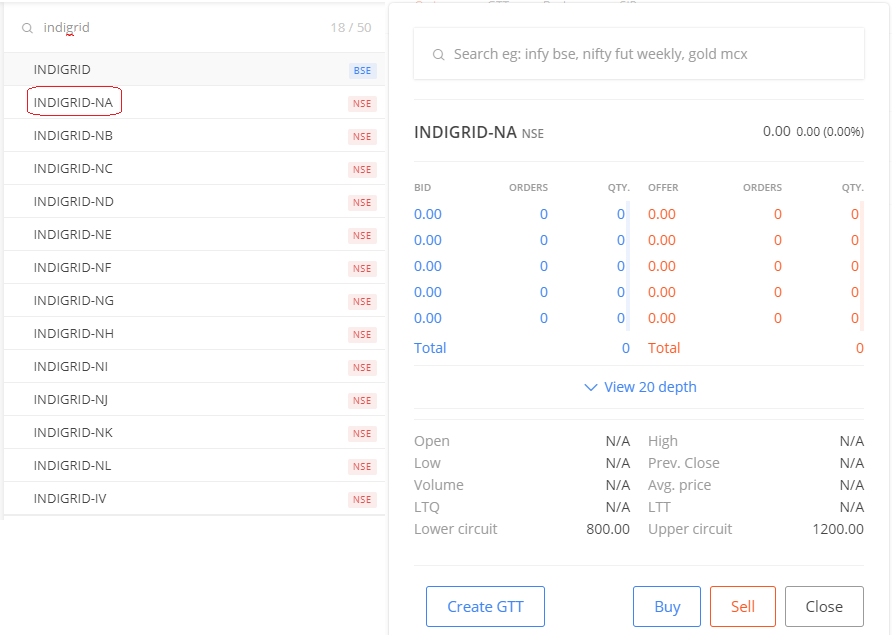

NCD's are debt instruments listed on BSE and NSE stock exchanges similar to listed companies. They are traded in the open market just like trading in equity stocks The NCD's liquidity for trading is usually very low as they are long-term investments. You can check for the NCD maturity details, coupon rate, and NCD type on the BSE website.

You can trade in NCDs using your Zerodha trading account. The trading and settlement for NCD happen just like in the case of Equity stocks. You get the credit of the NCD instrument (purchased on T day) in your Demat account on T+2.

Steps for NCD Trading in Zerodha

Zerodha offers brokerage-free NCD investment similar to the brokerage-free equity delivery (cash & carry) trades. Though NCD investment is free of brokerage, the customer still has to pay applicable taxes and demat.

NCD Intra-day trading brokerage is flat Rs 20 per executed order at Zerodha.

Zerodha offers its client an option to diversify their portfolio by offering to trade in listed NCD debt instruments through Zerodha Kite. The trading in NCD instruments is just like Equity stocks but with much lesser liquidity. You cannot withdraw the funds in NCD before its maturity but, you can exit from it by selling it once it gets listed on the exchange.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Zerodha doesn't allow NCD public issue applications. You could apply for NCD public issues using your bank's net banking under the IPO section. If you provide your Zerodha Demat Account Number while applying in the NCD issue, the allocated shares are deposited in your Zerodha Demat Account.

No, you cannot apply in NCD through the Zerodha trading platform or console. But you could use your Zerodha demat account while applying in NCDs public issue.

If you are a Zerodha customer, use the following ways to apply in NCD public issue.

Note:

You can use your Zerodha Demat account while applying for NCD IPO but, you cannot apply through Zerodha trading platforms as currently, Zerodha does not have this facility.

You can apply online or offline in NCD public issues through ASBA supported bank or through the NCD issuing company website.

To apply online, you need to log in to your ASBA supported net banking account. Look for the desired NCD IPO under the investment section. Submit the details and provide your Zerodha Demat account number.

To apply offline, you need to submit the physical application form available for download on the company website or exchange website. Fill the application form with the required details and submit the same to the nearest bidding collection centre.

Yes, you can buy listed NCD through Zerodha just as you do Equity stocks. Though Zerodha does not offer to apply in NCD, it allows you to trade and invest in NCD through the secondary market. You can buy or sell NCD through the Zerodha trading platform Kite using your Zerodha trading and Demat account.

Note: You cannot apply in NCD IPO (Public Issue) through Zerodha as NCD IPO application using UPI as the payment gateway is not allowed. You can apply in NCD online only using the ASBA mechanism provided by your bank's net banking.

You can buy in Zerodha through your Zerodha trading and Demat account. You can purchase or sell any NCD listed on the secondary market through Zerodha Kite.

Steps to buy/sell NCD in Zerodha:

There are no charges for using Zerodha Demat account while applying for NCD public issue through ASBA.

However, to trade and invest in NCD through Zerodha Kite, Zerodha charges a brokerage of Rs.20 or 0.03%, whichever is lower as in the case Equity Intraday and zero brokerage for delivery trades.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|