Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Mayank Cattle Food IPO is a fixed price issue of Rs 19.44 crores. The issue is entirely a fresh issue of 18 lakh shares.

Mayank Cattle Food IPO bidding started from January 29, 2024 and ended on January 31, 2024. The allotment for Mayank Cattle Food IPO was finalized on Thursday, February 1, 2024. The shares got listed on BSE SME on February 5, 2024.

Mayank Cattle Food IPO price is ₹108 per share. The minimum lot size for an application is 1200 Shares. The minimum amount of investment required by retail investors is ₹129,600. The minimum lot size investment for HNI is 2 lots (2,400 shares) amounting to ₹259,200.

Finshore Management Services Limited is the book running lead manager of the Mayank Cattle Food IPO, while Cameo Corporate Services Limited is the registrar for the issue. The market maker for Mayank Cattle Food IPO is Rikhav Securities.

Refer to Mayank Cattle Food IPO RHP for detailed information.

| IPO Date | January 29, 2024 to January 31, 2024 |

| Listing Date | February 5, 2024 |

| Face Value | ₹10 per share |

| Price | ₹108 per share |

| Lot Size | 1200 Shares |

| Total Issue Size | 1,800,000 shares (aggregating up to ₹19.44 Cr) |

| Fresh Issue | 1,800,000 shares (aggregating up to ₹19.44 Cr) |

| Issue Type | Fixed Price Issue IPO |

| Listing At | BSE SME |

| Share holding pre issue | 3,600,000 |

| Share holding post issue | 5,400,000 |

| Market Maker portion | 90,000 shares Rikhav Securities |

Mayank Cattle Food IPO offers 1,800,000 shares. 855,600 (47.53%) to NII, 854,400 (47.47%) to RII.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | - |

| Market Maker Shares Offered | 90,000 (5.00%) |

| Other Shares Offered | 855,600 (47.53%) |

| Retail Shares Offered | 854,400 (47.47%) |

| Total Shares Offered | 1,800,000 (100%) |

Mayank Cattle Food IPO opens on January 29, 2024, and closes on January 31, 2024.

| IPO Open Date | Monday, January 29, 2024 |

| IPO Close Date | Wednesday, January 31, 2024 |

| Basis of Allotment | Thursday, February 1, 2024 |

| Initiation of Refunds | Friday, February 2, 2024 |

| Credit of Shares to Demat | Friday, February 2, 2024 |

| Listing Date | Monday, February 5, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on January 31, 2024 |

Investors can bid for a minimum of 1200 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1200 | ₹129,600 |

| Retail (Max) | 1 | 1200 | ₹129,600 |

| HNI (Min) | 2 | 2,400 | ₹259,200 |

| Lot Size Calculator | |||

Mr. Bharatkumar Popatlal Vachhani and Mr. Ajay Popatlal Vachhani are the promoters of the company.

| Share Holding Pre Issue | 97.50% |

| Share Holding Post Issue | 65.00% |

Incorporated in 1998, Mayank Cattle Food Limited is an Oil company engaged in the business of manufacturing Cattle Food, Animal Food, Cattle Food Cake and Edible Oil.

The company operates a manufacturing facility equipped with the latest machinery and technology, situated in Rajkot, Gujarat. The facility covers an area of approximately 87,133 sq. ft.

The company currently has a production capacity of 22,896 MT per annum for Maize Oil and 45,792 MT per annum for Maize Cake. In the financial year 2023-24, the company expanded its installed capacity from 18,126 MT per annum to 22,896 MT per annum for Maize Oil and 36,252 MT per annum to 45,792 MT per annum for Maize Cake. Similarly, in the financial year 2021-22, the company expanded its installed capacity from 14,310 MT per annum to 18,126 MT per annum for Maize Oil and from 28,620 to 36,252 MT per annum for Maize Cake. These expansions aimed to increase the scale of operations and enhance the company's market presence.

Products are supplied to Gujarat, Delhi and Maharashtra by the company.

As of December 31, 2023, the company has 120 employees, out of which 104 are workers.

Mayank Cattle Food Limited's revenue decreased by -4.15% and profit after tax (PAT) rose by 64.45% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 31 Jul 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 5,122.44 | 4,893.64 | 4,163.85 | 3,433.62 |

| Revenue | 7,527.15 | 30,958.14 | 32,300.17 | 18,652.89 |

| Profit After Tax | 57.37 | 131.43 | 79.92 | 71.81 |

| Net Worth | 533.37 | 475.99 | 344.56 | 264.63 |

| Reserves and Surplus | 173.37 | 455.99 | 324.56 | 244.63 |

| Total Borrowing | 3,788.35 | 3,961.00 | 3,163.53 | 2,531.49 |

| Amount in ₹ Lakhs | ||||

The market capitalization of Mayank Cattle Food IPO is Rs 58.32 Cr.

| KPI | Values |

|---|---|

| ROE | 32% |

| ROCE | 11.27% |

| Debt/Equity | 9.13 |

| RoNW | 27.61% |

| P/BV | 0.45 |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 3.65 | 3.19 |

| P/E (x) | 29.58 | 33.89 |

The Objects of the Issue are:

[Dilip Davda] The company is operating in a highly competitive and fragmented segment. It has posted inconsistency in top and bottom lines for the reported periods. Based on FY24 annualized earnings, the issue appears aggressively priced. There is no harm in skipping this pricey issue. Read detail review...

The Mayank Cattle Food IPO is subscribed 8.83 times on January 31, 2024 7:02:00 PM. The public issue subscribed 11.77 times in the retail category, times in the QIB category, and 5.90 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| Other | 5.90 |

| Retail | 11.77 |

| Total | 8.83 |

Total Application : 9,728 (13.66 times)

| Listing Date | February 5, 2024 |

| BSE Script Code | 544106 |

| NSE Symbol | |

| ISIN | INE0R5Z01015 |

| Final Issue Price | ₹108 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE SME |

|---|

| ₹108.00 |

| ₹116.00 |

| ₹116.00 |

| ₹121.80 |

| ₹119.95 |

Mayank Cattle Food Limited

R. S. No. 162, Rajkot Jamnagar Highway

Near Khandheri Stadium, Vill. Naranka, Tal. Paddha

Rajkot, Gujarat, 360110,

Phone: +91 90333 33123

Email: cs@mayankcattlefood.com

Website: https://www.mayankcattlefood.com/

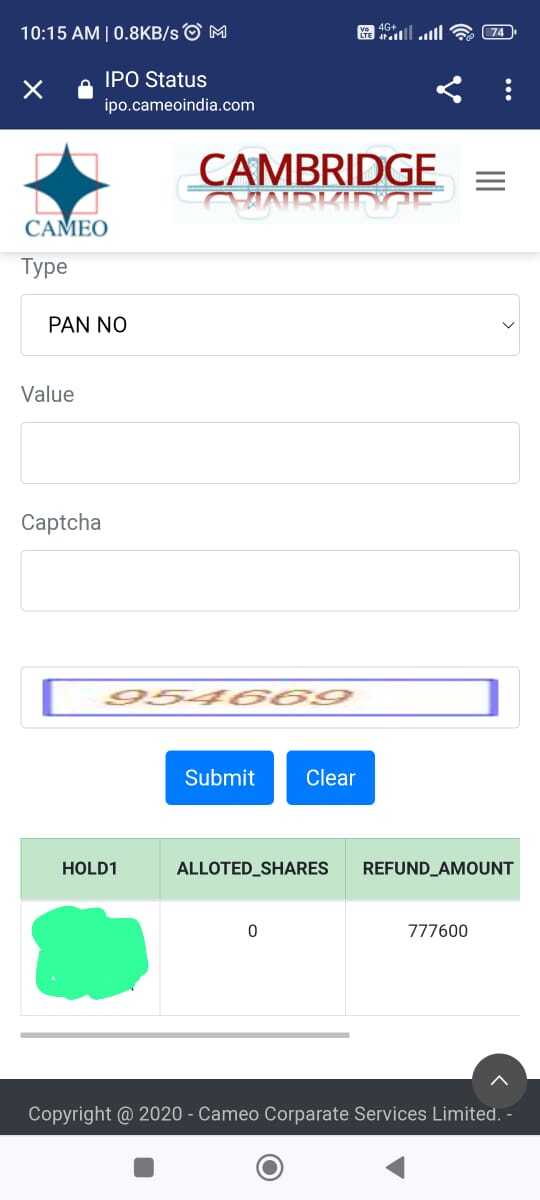

Cameo Corporate Services Limited

Phone: +91-44-28460390

Email: ipo@cameoindia.com

Website: https://ipo.cameoindia.com/

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Mayank Cattle Food IPO is a SME IPO of 1,800,000 equity shares of the face value of ₹10 aggregating up to ₹19.44 Crores. The issue is priced at ₹108 per share. The minimum order quantity is 1200 Shares.

The IPO opens on January 29, 2024, and closes on January 31, 2024.

Cameo Corporate Services Limited is the registrar for the IPO. The shares are proposed to be listed on BSE SME.

Zerodha customers can apply online in Mayank Cattle Food IPO using UPI as a payment gateway. Zerodha customers can apply in Mayank Cattle Food IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Mayank Cattle Food IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Mayank Cattle Food IPO opens on January 29, 2024 and closes on January 31, 2024.

Mayank Cattle Food IPO lot size is 1200 Shares, and the minimum amount required is ₹129,600.

You can apply in Mayank Cattle Food IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Mayank Cattle Food IPO will be done on Thursday, February 1, 2024, and the allotted shares will be credited to your demat account by Friday, February 2, 2024. Check the Mayank Cattle Food IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|