Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

CFF Fluid Control IPO is a fixed price issue of Rs 85.80 crores. The issue is entirely a fresh issue of 52 lakh shares.

CFF Fluid Control IPO bidding started from May 30, 2023 and ended on June 2, 2023. The allotment for CFF Fluid Control IPO was finalized on Wednesday, June 7, 2023. The shares got listed on BSE SME on June 12, 2023.

CFF Fluid Control IPO price is ₹165 per share. The minimum lot size for an application is 800 Shares. The minimum amount of investment required by retail investors is ₹132,000. The minimum lot size investment for HNI is 2 lots (1,600 shares) amounting to ₹264,000.

Aryaman Financial Services Limited is the book running lead manager of the CFF Fluid Control IPO, while Cameo Corporate Services Limited is the registrar for the issue. The market maker for CFF Fluid Control IPO is Aryaman Capital Markets.

Refer to CFF Fluid Control IPO RHP for detailed information.

| IPO Date | May 30, 2023 to June 2, 2023 |

| Listing Date | June 12, 2023 |

| Face Value | ₹10 per share |

| Price | ₹165 per share |

| Lot Size | 800 Shares |

| Total Issue Size | 5,200,000 shares (aggregating up to ₹85.80 Cr) |

| Fresh Issue | 5,200,000 shares (aggregating up to ₹85.80 Cr) |

| Issue Type | Fixed Price Issue IPO |

| Listing At | BSE SME |

| Share holding pre issue | 14,274,100 |

| Share holding post issue | 19,474,100 |

| Market Maker portion | 260,800 shares Aryaman Capital Markets |

CFF Fluid Control IPO offers 4,939,200 shares. 2,339,200 (47.36%) to NII, 2,339,200 (47.36%) to RII.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | - |

| Market Maker Shares Offered | 260,800 (5.28%) |

| Other Shares Offered | 2,339,200 (47.36%) |

| Retail Shares Offered | 2,339,200 (47.36%) |

| Total Shares Offered | 4,939,200 (100%) |

CFF Fluid Control IPO opens on May 30, 2023, and closes on June 2, 2023.

| IPO Open Date | Tuesday, May 30, 2023 |

| IPO Close Date | Friday, June 2, 2023 |

| Basis of Allotment | Wednesday, June 7, 2023 |

| Initiation of Refunds | Thursday, June 8, 2023 |

| Credit of Shares to Demat | Friday, June 9, 2023 |

| Listing Date | Monday, June 12, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on June 2, 2023 |

Investors can bid for a minimum of 800 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 800 | ₹132,000 |

| Retail (Max) | 1 | 800 | ₹132,000 |

| HNI (Min) | 2 | 1,600 | ₹264,000 |

| Lot Size Calculator | |||

Sunil Menon and Gautam Makkar are the promoters of the company.

| Share Holding Pre Issue | 99.99% |

| Share Holding Post Issue | 73.30% |

Incorporated in 2012, CFF Fluid Control Limited is primarily engaged in the business of manufacturing and servicing of shipboard machinery. They manufacture critical component systems and test facilities for submarines and surface ships for The Indian Navy.

The entity also designs, manufacture, and service Mechanical equipment and systems for industries like Nuclear and Clean Energy.

The Company's promoters and group companies have been in the defense manufacturing space for more than 20 years.

CFF Fluid Control was incorporated with the purpose of having a dedicated new entity focused on meeting the growing requirements of the Indian Navy, Mazagaon Dockyard, and Shipbuilders Limited (MDL). This was to undertake the manufacturing and supplying of mechanical equipment for the "Scorpene" Submarine Program of India.

The company's facilities are situated at Khopoli. The facility is spread over 6,000 sq. mtrs. and has all the relevant state-of-the-art machinery and testing facilities. At the facility, the company design, manufacture, and service.

Servicing includes fluid control systems, distributor and air panels Weapons and Control Systems, Steering gear, Propulsion Systems, High-Pressure Air Systems, Hydraulics Systems, Breathing and Diving Air Systems, and Integrated Platform Management Systems for submarines and surface ships for the Indian Navy and its OEMs.

The facility is Indian Navy, MDL & Naval Group (France) approved and has ISO 9001:2015 certification for quality management systems.

| Period Ended | Total Assets | Total Revenue | Profit After Tax | Net Worth | Reserves and Surplus | Total Borrowing |

|---|---|---|---|---|---|---|

| 31-Mar-20 | 4,310.42 | 3,196.48 | 132.99 | 679.11 | 607.74 | 1,433.03 |

| 31-Mar-21 | 4,232.32 | 1,481.27 | 24.60 | 703.71 | 632.34 | 2,261.21 |

| 31-Mar-22 | 5,593.59 | 4,712.39 | 779.51 | 1,483.22 | 1,411.85 | 1,659.17 |

| 31-Dec-22 | 7,165.57 | 5,085.37 | 718.11 | 2,201.33 | 773.92 | 2,693.09 |

| Amount in ₹ Lakhs | ||||||

The market capitalization of CFF Fluid Control IPO is Rs 321.32 Cr.

| KPI | Values |

|---|---|

| ROE | 0.52% |

| ROCE | 0.31% |

| Debt/Equity | 1.22 |

| RoNW | 52.56% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 5.46 | |

| P/E (x) | 30.22 |

The Company proposes to utilize the Net Proceeds from Issue towards funding the following objects:

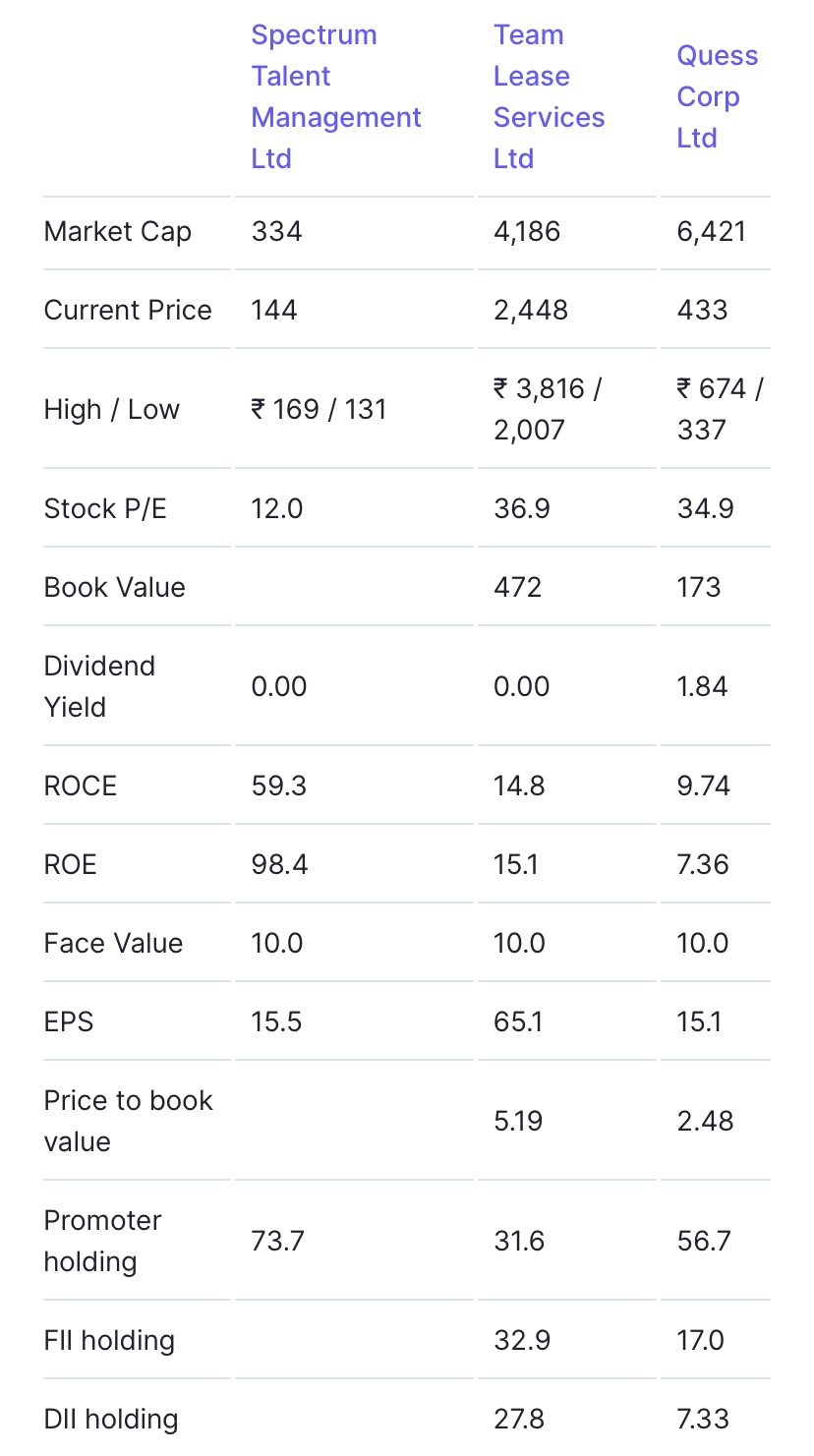

[Dilip Davda] The company is catering to the Defence sector and has posted an average financial performance so far. Its peers’ comparison appears to be an eyewash. Based on its annualized FY23 earnings, the issue is aggressively priced. It also mulls encasing the current fancy for the Defence segment and has priced its IPO greedily. There is no harm in skipping this pricey bet. Read detail review...

The CFF Fluid Control IPO is subscribed 2.21 times on June 2, 2023 7:02:00 PM. The public issue subscribed 1.67 times in the retail category, times in the QIB category, and 2.75 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| Other | 2.75 |

| Retail | 1.67 |

| Total | 2.21 |

Total Application : 1,906 (0.65 times)

| Listing Date | June 12, 2023 |

| BSE Script Code | 543920 |

| NSE Symbol | |

| ISIN | INE0NJ001013 |

| Final Issue Price | ₹165 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE SME |

|---|

| ₹165.00 |

| ₹175.00 |

| ₹175.00 |

| ₹183.75 |

| ₹183.75 |

CFF Fluid Control Limited

Plot No 01, Survey No 96,

Kumbhivli Madap Khopoli,

Khalapur, Raigarh-410203

Phone: +91-2246086806

Email: compliance@cffdefensys.com

Website: http://www.cffdefensys.com/

Cameo Corporate Services Limited

Phone: +91-44-28460390

Email: priya@cameoindia.com

Website: https://ipo.cameoindia.com/

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

CFF Fluid Control IPO is a SME IPO of 5,200,000 equity shares of the face value of ₹10 aggregating up to ₹85.80 Crores. The issue is priced at ₹165 per share. The minimum order quantity is 800 Shares.

The IPO opens on May 30, 2023, and closes on June 2, 2023.

Cameo Corporate Services Limited is the registrar for the IPO. The shares are proposed to be listed on BSE SME.

Zerodha customers can apply online in CFF Fluid Control IPO using UPI as a payment gateway. Zerodha customers can apply in CFF Fluid Control IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in CFF Fluid Control IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The CFF Fluid Control IPO opens on May 30, 2023 and closes on June 2, 2023.

CFF Fluid Control IPO lot size is 800 Shares, and the minimum amount required is ₹132,000.

You can apply in CFF Fluid Control IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for CFF Fluid Control IPO will be done on Wednesday, June 7, 2023, and the allotted shares will be credited to your demat account by Friday, June 9, 2023. Check the CFF Fluid Control IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

CFF Fluid Control bags order worth Rs 25 cr from Defence Ministry