Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, May 17, 2021 by Chittorgarh.com Team

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

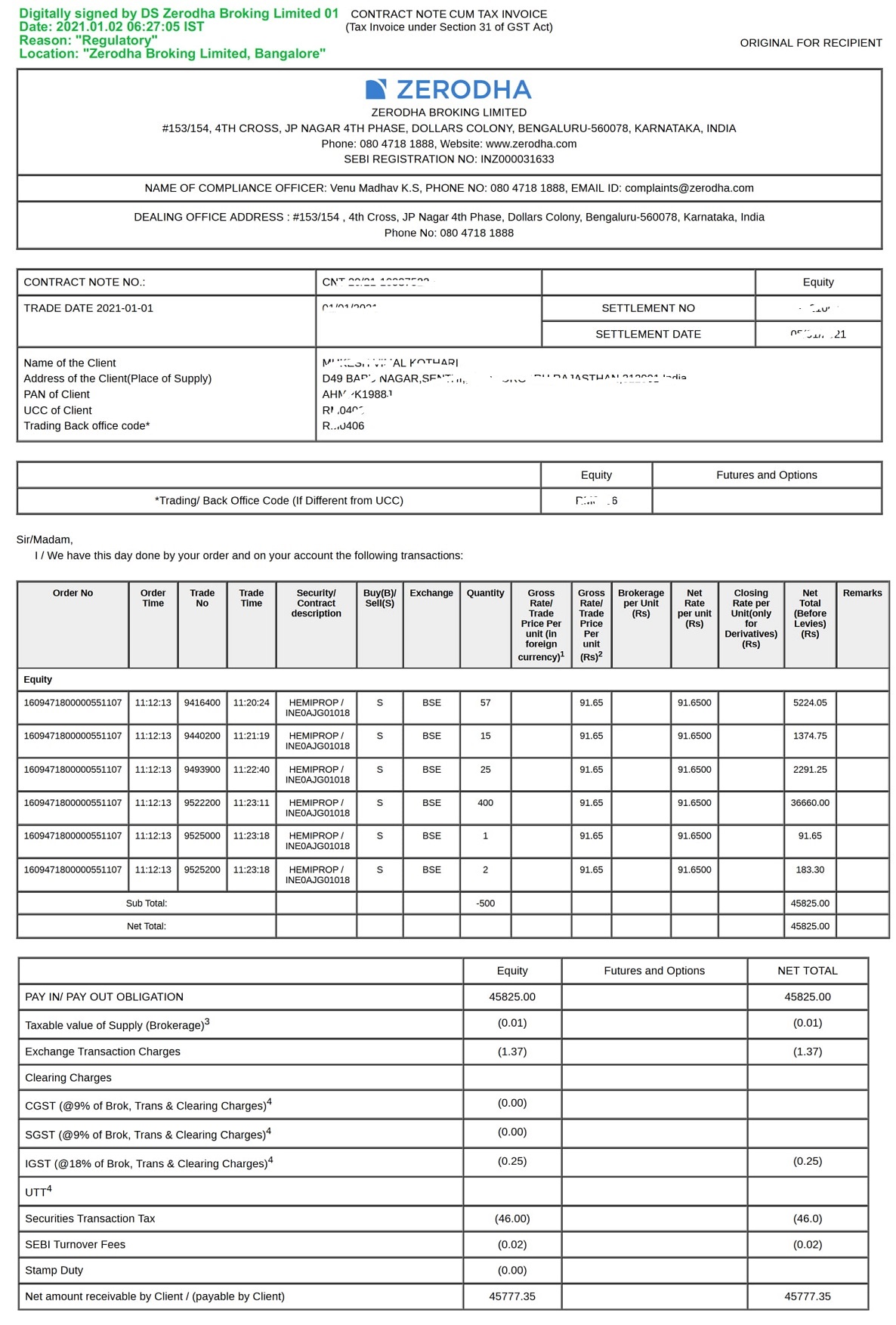

A contract note is a legal trade confirmation document issued by the stock broker for the trades executed on your behalf on the stock exchange.

Zerodha issues a combined contract note for all the trades executed across Equity, F&O, and Currency on NSE and BSE and a separate contract note for the Commodity segment every day. Zerodha sends an electronic contract note (ECN) in PDF format to their client's registered email address at around 7 PM.

The contract note of Zerodha contains all the required information as stipulated by SEBI and exchanges for a valid contract note.

A Zerodha contract note displays:

For Zerodha Contract Note interpretation, we need to understand the most important section of the contract note that contains the trade details.

The trade details in the Zerodha contract note are split into two parts. The first part contains the trade information that can help you verify your trades with exchange anytime. The second part contains the details of brokerage and other charges.

| Column Name | Description |

|---|---|

|

Order Number |

Displays the exchange order number |

|

Order time |

Displays the time when the order got placed with the exchange |

|

Trade Number |

Displays the exchange trade no. |

|

Trade Time |

Displays the time when the order got executed on the exchange |

|

Security/contract description |

Displays the name of the instrument traded |

|

Buy/sell |

Reflects the transaction type |

|

Quantity |

Reflects the quantity of stock executed |

|

Gross rate per unit |

Shows the trade price at which the order got executed |

|

Brokerage per unit |

Left blank as Zerodha displays brokerage charges separately |

|

Net rate per unit |

Same as the gross rate per unit as Zerodha shows brokerage separately |

|

Closing rate per unit (Applicable only for the derivative contracts) |

Displays the price at which the contract closed for the day. |

|

Net total before levies |

Total amount before brokerage and other taxes. |

The brokerage charges and other regulatory fees are segregated exchange-wise, segment-wise and shown separately below the trade details. The charges include brokerage, STT, GST, Stamp Duty, Exchange transaction taxes, and SEBI Turnover fees. It does not include DP charges, call & trade charges, and auto square-off charges that get charged over and above the displayed charges, whenever applicable.

| Column Name | Description |

|---|---|

|

PAYIN/PAYOUT OBLIGATION |

The total transaction amount before taxes and brokerage fee. |

|

Taxable value of Supply (Brokerage) |

The fee charged by broker for the services they offer. i.e. Zerodha brokerage charge is Rs 20 per trade for Intraday and F&O and Rs 0.01 for Equity delivery trade. |

|

Exchange Transaction Charges |

The fee is charged by an exchange (BSE, NSE, MCX) for using its platform. |

|

Clearing Charges |

The fee is charged by the clearing agent hired by the brokers to clear the trades. If the broker is also an authorised clearing agent for a particular segment, they don't charge this fee. |

|

CGST |

Central GST is charged at 9% if the state where you live in the same as the state of your broker's billing address. |

|

SGST |

State GST is charged at 9% if the state where you live in the same as the state of your broker's billing address. |

|

IGST |

Inter-State GST is charged at 18%. It is the GST tax levied if you live in a different state from the state of your broker's billing address. |

|

UTT |

Union Territory Tax if you live in a union territory. |

|

Security Transaction Tax |

The STT is a tax by the Government of India on Security transactions at stock exchanges. This is charged only on the sell side for intraday and F&O trades and on both sides for delivery trades in equity. There is no STT on Bonds, Currency and Mutual funds. |

|

Stamp Duty |

Stamp duty is a government tax in India on trading in stocks, currency derivatives and commodities. |

|

Net amount receivable by Client / (payable by Client) |

The net payable/receivable amount by the client. |

Note:

If the net amount is within brackets, it depicts that you need to pay Zerodha for stocks purchased or for the loss incurred on your trades.

Note: Zerodha charges with delayed payment charges if there is an insufficient balance in your Zerodha trading account for the above dues.

Zerodha does not levy any charges to issue the electronic contract note as it is a legal obligation of every broker. Zerodha sends the contract note PDF to your registered email address at around 7 PM on the trade execution day.

However, if you request a physical copy of a contract, Zerodha charges Rs. 20 per contract plus the courier charges.

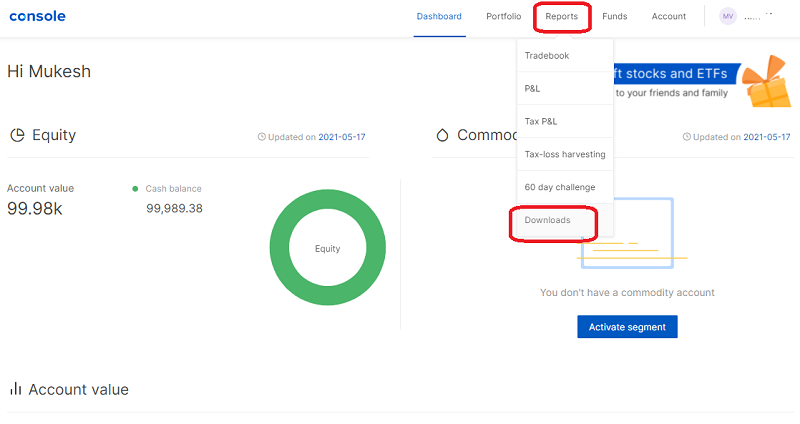

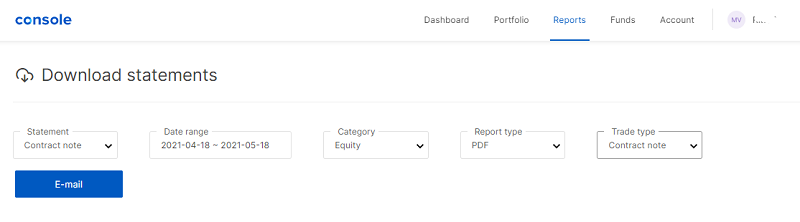

Zerodha also provides an option to their clients to download the contract note from Zerodha Console whenever required.

You can use this option to download any back-dated contract note (from April 2017 onwards) or in case you do not receive the contract note on your registered mail id due to technical issues.

Zerodha sends a mail to your registered address with the contract note details requested for download. The password to open the Zerodha contract note is your PAN number.

To summarize in a nutshell, below are the features of a Zerodha Contract note:

This is a limited time offer. Open an instant Zerodha account online and start trading today.

A contract note in Zerodha is a legal trade confirmatory note that contains the details of your trades executed on a particular exchange.

Zerodha issues a combined contract note for the trades executed across all segments on NSE and BSE on the registered mail id. The brokerage details are displayed separately in the Zerodha contract note along with other charges and taxes.

You can also download the contract notes from Zerodha Console.

Zerodha sends the contract note to the registered email id of clients generally by 7 PM on the trade execution day.

However, sometimes there can be a slight delay in the processing and issuance of contract notes if the transaction files get delayed from the exchange.

You can also download the contract note from Zerodha Console if you do not receive the contract notes due to some technical issues.

The contract notes in Zerodha are available in the back-office platform of Zerodha - Console.

Steps to download contract notes in Zerodha:

You will receive an email on your registered mail id with Zerodha (generally within 15 minutes) with the requested contract note details. The contract notes are password protected with your PAN number.

Zerodha's Contract Note password is the PAN number of the customer. The password is case-sensitive. Zerodha customers should use the PAN number to open the PDF Contract note sent via email.

As a part of the Zerodha account opening, you need to indicate the mode of contract note you wish to receive from Zerodha in the account opening form under the additional details.

For an Electronic Contract note (ECN), you need to provide a email address for its receipt.

If you opt to receive the contract notes in physical form, Zerodha charges Rs 20 per contract note plus the courier charges.

Zerodha also provides an option to download the old contract notes from Console - Zerodha's back-office platform.

Steps to get a Contract Note in Zerodha

You can check the contract notes in Zerodha on your registered mail id provided to Zerodha at the time of account opening for receipt of ECN. Zerodha sends password-protected PDF files on email as required by exchange regulations. The password to open the Zerodha contract note is your PAN number.

Alternatively, you can also download the contract notes from Zerodha Console for the required segment and date range. Zerodha has stored the contract notes in Console from April 2017 onwards. The contract notes are available for download under the Reports option.

The contract notes in Zerodha are available for download in Console, the back-office platform of Zerodha.

To see the contract note in Zerodha, you need to log in to Console and go to Reports>> Download. You can download the contract note for the required segment and period from April 2017 onwards. You will receive a mail from Zerodha with the details of the contract notes requested.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|