Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

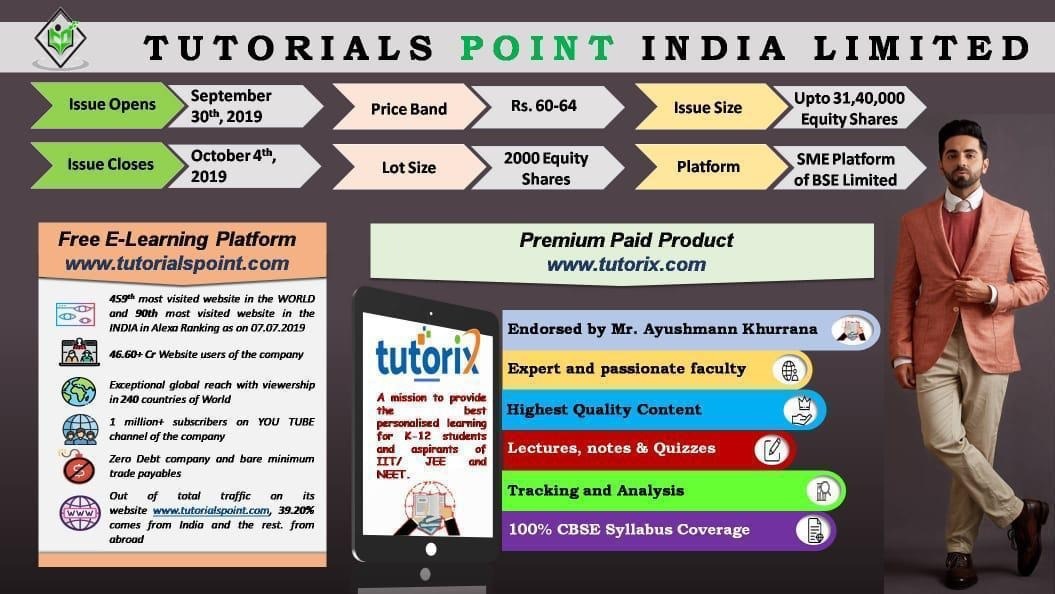

Tutorials Point IPO is a book built issue of Rs 20.10 crores.

Tutorials Point IPO bidding started from September 30, 2019 and ended on October 4, 2019. The allotment for Tutorials Point IPO was finalized on Thursday, October 10, 2019. Tutorials Point IPO will list on BSE SME with tentative listing date fixed as Tuesday, October 15, 2019.

Tutorials Point IPO price band is set at ₹60 to ₹64 per share. The minimum lot size for an application is 2000 Shares. The minimum amount of investment required by retail investors is ₹128,000.

Holani Consultants Private Limited is the book running lead manager of the Tutorials Point IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Tutorials Point IPO RHP for detailed information.

| IPO Date | September 30, 2019 to October 4, 2019 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹60 to ₹64 per share |

| Lot Size | 2000 Shares |

| Total Issue Size | 3,140,000 shares (aggregating up to ₹20.10 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE SME |

Tutorials Point IPO offers 3,140,000 shares. 1,570,000 (50.00%) to NII, 1,570,000 (50.00%) to RII.

| Investor Category | Shares Offered | |

|---|---|---|

| Anchor Investor Shares Offered | - | |

| Market Maker Shares Offered | - | - |

| NII (HNI) Shares Offered | 1,570,000 (50.00%) | |

| Retail Shares Offered | 1,570,000 (50.00%) | |

| Total Shares Offered | 3,140,000 (100%) |

Tutorials Point IPO opens on September 30, 2019, and closes on October 4, 2019.

| IPO Open Date | Monday, September 30, 2019 |

| IPO Close Date | Friday, October 4, 2019 |

| Basis of Allotment | Thursday, October 10, 2019 |

| Initiation of Refunds | Friday, October 11, 2019 |

| Credit of Shares to Demat | Monday, October 14, 2019 |

| Listing Date | Tuesday, October 15, 2019 |

| Cut-off time for UPI mandate confirmation | 5 PM on October 4, 2019 |

Investors can bid for a minimum of 2000 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 2000 | ₹128,000 |

| Retail (Max) | 1 | 2000 | ₹128,000 |

| Lot Size Calculator | |||

The promoters of the company are Mr. Mohammad Mohtashim and Mrs. Mahnaz Fatima.

| Share Holding Pre Issue | 99.99% |

| Share Holding Post Issue |

Google has presented an award to Tutorials Point Ltd for crossing 1 Million subscriber's milestone on its YouTube channel. The channel has a reach across 240 countries including republics and gulf. Total watch time of the YouTube videos has crossed 232 Million minutes.

| Particulars | For the year/period ended (in Rs. Lakhs) | |||

|---|---|---|---|---|

| � | 31-March-19 | 31-March-18 | 31-March-17 | |

| Total Assets | 1,386.56 | 963.79 | 583.47 | |

| Total Revenue | 1,035.29 | 1,025.06 | 1,037.07 | |

| Profit After Tax | 403.02 | 370.79 | 293.49 | |

The company proposes to utilize the net proceeds from the issue towards funding the following objects and to achieve the benefits of listing on the SME Platform of BSE Limited:

[Dilip Davda] With Digital India initiatives and major thrust for education is sure to lift the e-learning segment. Although the issue appears fully priced on the basis of current financial data, it is poised for bright prospects once Tutorix initiative goes on stream. Investors may consider investment for the long term. Read detail review...

The Tutorials Point IPO is subscribed 0.15 times on October 4, 2019 12:20:03 PM. The public issue subscribed 0.03 times in the retail category, times in the QIB category, and 0.28 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| NII | 0.28 |

| Retail | 0.03 |

| Total | 0.15 |

Date: 3rd Oct, 2019

The BSE SME IPO of Tutorials Point is withdrawn a day before its closing date because poor response from investors.

Tutorials Point (India) Ltd

4th Floor, Incor9 Building, Block B,

C-1 to C-5/1F, Kavuri Hills Madhapur,

Guttla Begumpet Village, Hyderabad -500081

Phone: +91 040-4854-3786

Email: raja.rao@tutorialspoint.com

Website: https://www.tutorialspoint.com/

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: tutorials.ipo@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Tutorials Point IPO is a SME IPO of 3,140,000 equity shares of the face value of ₹10 aggregating up to ₹20.10 Crores. The issue is priced at ₹60 to ₹64 per share. The minimum order quantity is 2000 Shares.

The IPO opens on September 30, 2019, and closes on October 4, 2019.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE SME.

The Tutorials Point IPO opens on September 30, 2019 and closes on October 4, 2019.

Tutorials Point IPO lot size is 2000 Shares, and the minimum amount required is ₹128,000.

You can apply in Tutorials Point IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Tutorials Point IPO will be done on Thursday, October 10, 2019, and the allotted shares will be credited to your demat account by Monday, October 14, 2019. Check the Tutorials Point IPO allotment status.

Thank you,

Admin @ Chittorgarh.com

ProStocks (Stock Broker) offers Unlimited Trades @ Rs 899 Per Month (or Rs 15 per trade) + Rs 0 Eq Delivery Brokerage + AMC Free Demat + Rs 0 Account Opening Fee. Team Chittorgarh.com guarantee you the best service. Open instant account

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|