Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Srivari Spices and Foods IPO is a book built issue of Rs 9.00 crores. The issue is entirely a fresh issue of 21.42 lakh shares.

Srivari Spices and Foods IPO bidding started from August 7, 2023 and ended on August 9, 2023. The allotment for Srivari Spices and Foods IPO was finalized on Monday, August 14, 2023. The shares got listed on NSE SME on August 18, 2023.

Srivari Spices and Foods IPO price band is set at ₹40 to ₹42 per share. The minimum lot size for an application is 3000 Shares. The minimum amount of investment required by retail investors is ₹126,000. The minimum lot size investment for HNI is 2 lots (6,000 shares) amounting to ₹252,000.

GYR Capital Advisors Private Limited is the book running lead manager of the Srivari Spices and Foods IPO, while Bigshare Services Pvt Ltd is the registrar for the issue. The market maker for Srivari Spices and Foods IPO is Nikunj Stock Brokers.

Refer to Srivari Spices and Foods IPO RHP for detailed information.

| IPO Date | August 7, 2023 to August 9, 2023 |

| Listing Date | August 18, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹40 to ₹42 per share |

| Lot Size | 3000 Shares |

| Total Issue Size | 2,142,000 shares (aggregating up to ₹9.00 Cr) |

| Fresh Issue | 2,142,000 shares (aggregating up to ₹9.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 5,000,000 |

| Share holding post issue | 7,142,000 |

| Market Maker portion | 108,000 shares Nikunj Stock Brokers |

Srivari Spices and Foods IPO offers 2,142,000 shares. 408,000 (19.05%) to QIB, 306,000 (14.29%) to NII, 714,000 (33.33%) to RII 606,000 (28.29%) to Anchor investors.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 606,000 (28.29%) |

| Market Maker Shares Offered | 108,000 (5.04%) |

| QIB Shares Offered | 408,000 (19.05%) |

| NII (HNI) Shares Offered | 306,000 (14.29%) |

| Retail Shares Offered | 714,000 (33.33%) |

| Total Shares Offered | 2,142,000 (100%) |

Srivari Spices and Foods IPO raises Rs 2.55 crore from anchor investors. Srivari Spices and Foods IPO Anchor bid date is August 4, 2023. Srivari Spices and Foods IPO Anchor Investors list

| Bid Date | August 4, 2023 |

| Shares Offered | 606,000 |

| Anchor Portion Size (In Cr.) | 2.55 |

| Anchor lock-in period end date for 50% shares (30 Days) | September 13, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | November 12, 2023 |

Srivari Spices and Foods IPO opens on August 7, 2023, and closes on August 9, 2023.

| IPO Open Date | Monday, August 7, 2023 |

| IPO Close Date | Wednesday, August 9, 2023 |

| Basis of Allotment | Monday, August 14, 2023 |

| Initiation of Refunds | Wednesday, August 16, 2023 |

| Credit of Shares to Demat | Thursday, August 17, 2023 |

| Listing Date | Friday, August 18, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 9, 2023 |

Investors can bid for a minimum of 3000 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 3000 | ₹126,000 |

| Retail (Max) | 1 | 3000 | ₹126,000 |

| HNI (Min) | 2 | 6,000 | ₹252,000 |

| Lot Size Calculator | |||

Rathi Narayan Das and Neihaa Rathi are the Promoters of the Company.

| Share Holding Pre Issue | 99.90% |

| Share Holding Post Issue |

Incorporated in 2019, Srivari Spices and Foods Limited is engaged in the business of manufacturing spices and flour (chakki atta). The company also undertakes the process of marketing and selling its products. The company operates its operations primarily in and around Telangana and Andhra Pradesh.

The product categories of Srivari Spices and Foods are - Spices, Masala, and Atta. These include diverse spice products. The spices are delivered to over 3000 retail outlets and its whole wheat and sharbati atta to over 15000 outlets in Telangana and Andhra Pradesh.

Srivari Spices and Foods gathers its raw materials from various parts of the country and thereafter processes the same to create the final products. The entire procedure is executed with utmost care and without the use of artificial preservatives or chemicals. This way they create organic spices and flour, which carry the freshness and goodness of each ingredient.

The company engages in two business models to sell its end products:

In 2021, Srivari Spices was recognized as the "Best Emerging Spices Brand 2021" by Business Mint. The company has two manufacturing facilities. The first production facility was established in 2019 in Jalpally Village Ranga Reddy District, Telangana from where the company first started its primary operations. The second unit was set up in 2021 at Raikal Village, Farooqnagar Mandal, Ranga Reddy District, Telangana.

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 235.88 | 627.38 | 1,067.62 | 2,568.13 |

| Revenue | 19.05 | 1,139.90 | 1,764.21 | 3,582.01 |

| Profit After Tax | -10.69 | 35.26 | 72.84 | 312.61 |

| Net Worth | 177.54 | 426.91 | 499.75 | 910.02 |

| Reserves and Surplus | -10.69 | 24.57 | 97.41 | 410.02 |

| Total Borrowing | 277.39 | 1,283.51 |

The market capitalization of Srivari Spices and Foods IPO is Rs 30 Cr.

| KPI | Values |

|---|---|

| ROE | 44.35% |

| ROCE | 23.65% |

| Debt/Equity | 1.41 |

| RoNW | 24.79% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 4.45 | |

| P/E (x) | 9.59 |

The Company proposes to utilize the Net Proceeds towards funding the following objects:

[Dilip Davda] The company operates in a highly competitive and fragmented segment with many players around. The sudden boost in its bottom line for FY23 raises eyebrows and concern over the sustainability going forward. The management is confident of continuing the trends with more premium and high-margin products launch with consumer awareness for hygienic food cooking with Srivari Products. Based on FY23's performance, the IPO appears reasonably priced. The small post-IPO equity base may lead to longer gestation for migration to the mainboard. Investors may consider parking of funds with the medium to long-term perspectives. Read detail review...

The Srivari Spices and Foods IPO is subscribed 450.03 times on August 9, 2023 7:29:00 PM. The public issue subscribed 517.95 times in the retail category, 79.10 times in the QIB category, and 786.11 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 79.10 |

| NII | 786.11 |

| Retail | 517.95 |

| Total | 450.03 |

Total Application : 123,273 (517.95 times)

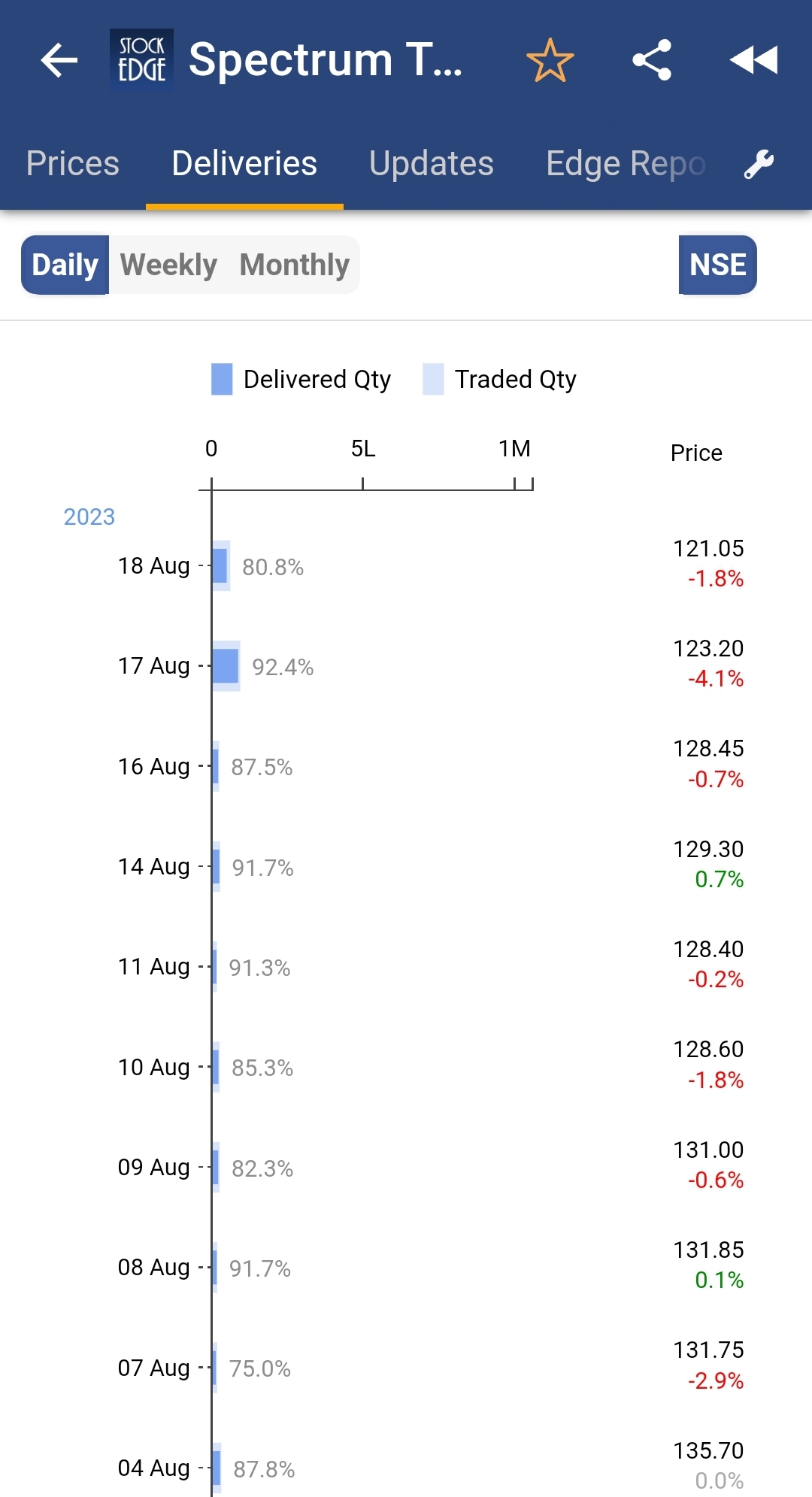

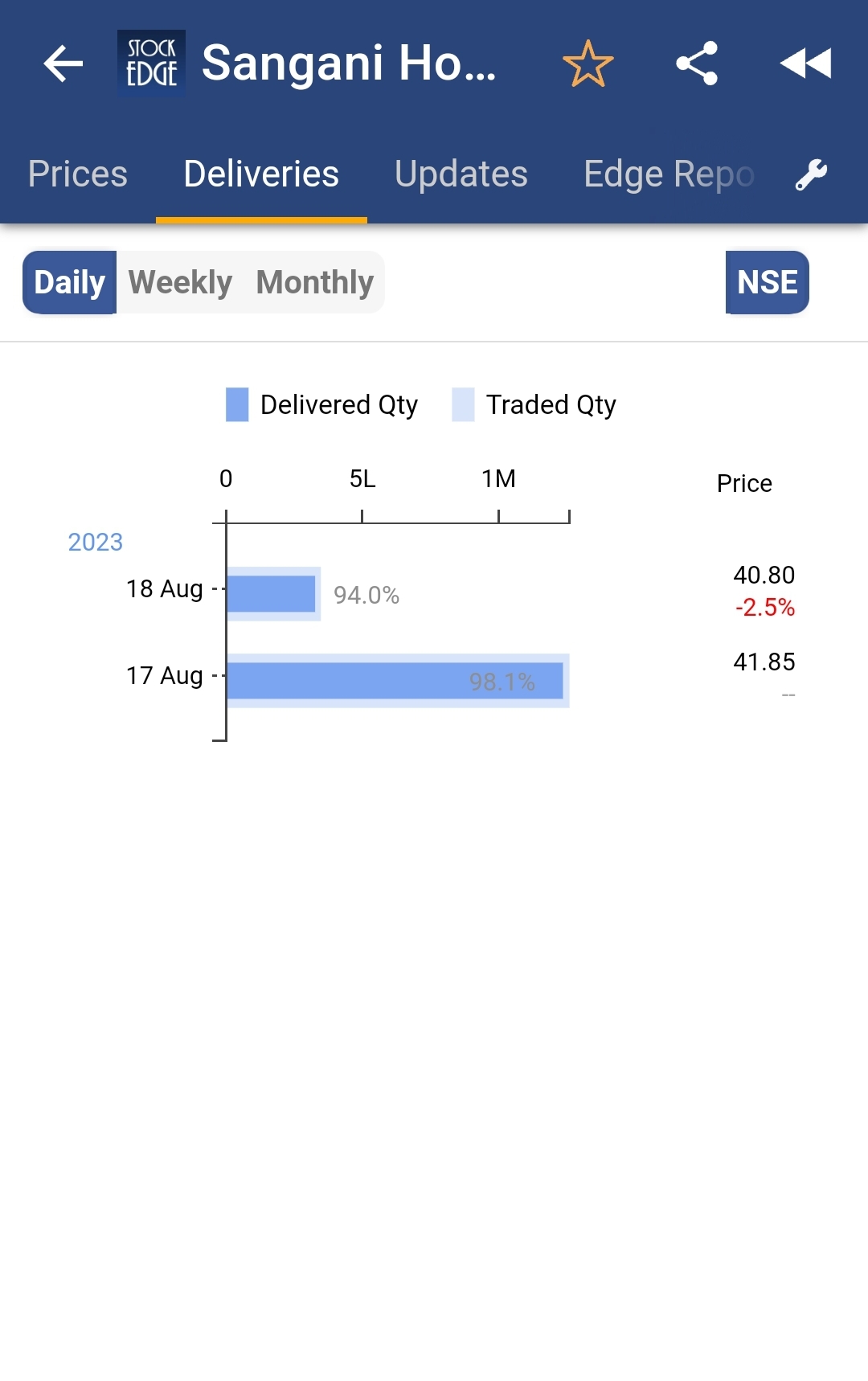

| Listing Date | August 18, 2023 |

| BSE Script Code | |

| NSE Symbol | SSFL |

| ISIN | INE0ON201012 |

| Final Issue Price | ₹42 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| NSE SME |

|---|

| ₹42.00 |

| ₹101.50 |

| ₹101.50 |

| ₹106.55 |

| ₹106.55 |

Srivari Spices and Foods Limited

Shed No. 5-105/4/A, SY No.234/A,

Sriram Industrial Area, Kattedan,

Jalpally, Hyderabad – 500 077

Phone: +91 737 588 8999

Email: compliance@srivarispices.com

Website: http://www.srivarispices.com/

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: https://ipo.bigshareonline.com/ipo_status.html

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Srivari Spices and Foods IPO is a SME IPO of 2,142,000 equity shares of the face value of ₹10 aggregating up to ₹9.00 Crores. The issue is priced at ₹40 to ₹42 per share. The minimum order quantity is 3000 Shares.

The IPO opens on August 7, 2023, and closes on August 9, 2023.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on NSE SME.

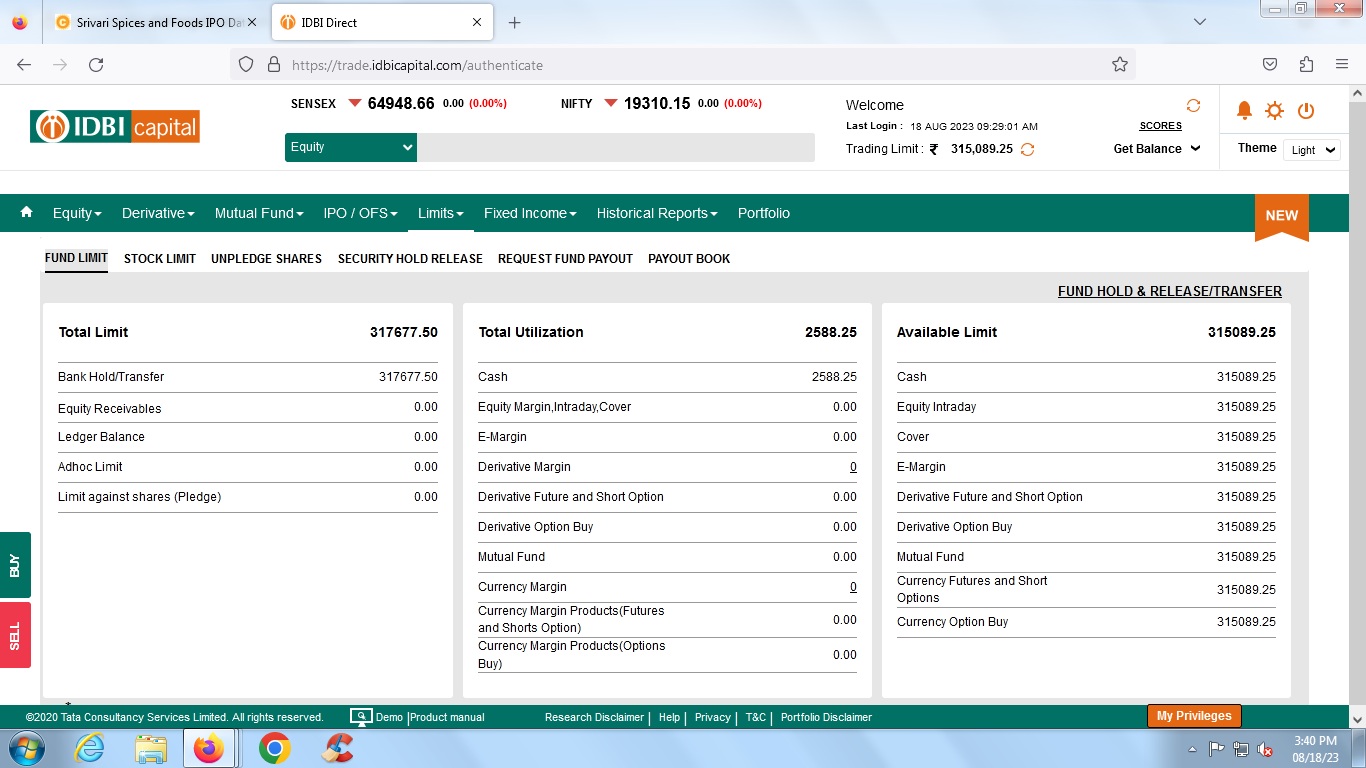

Zerodha customers can apply online in Srivari Spices and Foods IPO using UPI as a payment gateway. Zerodha customers can apply in Srivari Spices and Foods IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Srivari Spices and Foods IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Srivari Spices and Foods IPO opens on August 7, 2023 and closes on August 9, 2023.

Srivari Spices and Foods IPO lot size is 3000 Shares, and the minimum amount required is ₹126,000.

You can apply in Srivari Spices and Foods IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Srivari Spices and Foods IPO will be done on Monday, August 14, 2023, and the allotted shares will be credited to your demat account by Thursday, August 17, 2023. Check the Srivari Spices and Foods IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|