Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Signatureglobal India IPO is a book built issue of Rs 730.00 crores. The issue is a combination of fresh issue of 1.57 crore shares aggregating to Rs 603.00 crores and offer for sale of 0.33 crore shares aggregating to Rs 127.00 crores.

Signatureglobal India IPO bidding started from September 20, 2023 and ended on September 22, 2023. The allotment for Signatureglobal India IPO was finalized on Wednesday, September 27, 2023. The shares got listed on BSE, NSE on September 27, 2023.

Signatureglobal India IPO price band is set at ₹366 to ₹385 per share. The minimum lot size for an application is 38 Shares. The minimum amount of investment required by retail investors is ₹14,630. The minimum lot size investment for sNII is 14 lots (532 shares), amounting to ₹204,820, and for bNII, it is 69 lots (2,622 shares), amounting to ₹1,009,470.

ICICI Securities Limited, Axis Capital Limited and Kotak Mahindra Capital Company Limited are the book running lead managers of the Signatureglobal India IPO, while Link Intime India Private Ltd is the registrar for the issue.

Refer to Signatureglobal India IPO RHP for detailed information.

| IPO Date | September 20, 2023 to September 22, 2023 |

| Listing Date | September 27, 2023 |

| Face Value | ₹1 per share |

| Price Band | ₹366 to ₹385 per share |

| Lot Size | 38 Shares |

| Total Issue Size | 18,961,039 shares (aggregating up to ₹730.00 Cr) |

| Fresh Issue | 15,662,338 shares (aggregating up to ₹603.00 Cr) |

| Offer for Sale | 3,298,701 shares of ₹1 (aggregating up to ₹127.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 113,758,800 |

| Share holding post issue | 129,421,138 |

Signatureglobal India IPO offers 18,961,039 shares. 5,948,079 (31.37%) to QIB, 2,844,156 (15.00%) to NII, 1,896,104 (10.00%) to RII 8,272,700 (43.63%) to Anchor investors. 49,897 RIIs will receive minimum 38 shares and 1,782 (sNII) and 3,564 (bNII) will receive minimum 532 shares. (in case of oversubscription)

| Investor Category | Shares Offered | Maximum Allottees |

|---|---|---|

| Anchor Investor Shares Offered | 8,272,700 (43.63%) | NA |

| QIB Shares Offered | 5,948,079 (31.37%) | NA |

| NII (HNI) Shares Offered | 2,844,156 (15.00%) | |

| bNII > ₹10L | 1,896,103 (10.00%) | 3,564 |

| sNII < ₹10L | 948,052 (5.00%) | 1,782 |

| Retail Shares Offered | 1,896,104 (10.00%) | 49,897 |

| Total Shares Offered | 18,961,039 (100%) |

Signatureglobal India IPO raises Rs 318.50 crore from anchor investors. Signatureglobal India IPO Anchor bid date is September 18, 2023. Signatureglobal India IPO Anchor Investors list

| Bid Date | September 18, 2023 |

| Shares Offered | 8,272,700 |

| Anchor Portion Size (In Cr.) | 318.50 |

| Anchor lock-in period end date for 50% shares (30 Days) | October 27, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | December 26, 2023 |

Signatureglobal India IPO opens on September 20, 2023, and closes on September 22, 2023.

| IPO Open Date | Wednesday, September 20, 2023 |

| IPO Close Date | Friday, September 22, 2023 |

| Basis of Allotment | Wednesday, September 27, 2023 |

| Initiation of Refunds | Friday, September 29, 2023 |

| Credit of Shares to Demat | Tuesday, October 3, 2023 |

| Listing Date | Wednesday, September 27, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 22, 2023 |

Investors can bid for a minimum of 38 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 38 | ₹14,630 |

| Retail (Max) | 13 | 494 | ₹190,190 |

| S-HNI (Min) | 14 | 532 | ₹204,820 |

| S-HNI (Max) | 68 | 2,584 | ₹994,840 |

| B-HNI (Min) | 69 | 2,622 | ₹1,009,470 |

| Lot Size Calculator | |||

Pradeep Kumar Aggarwal, Lalit Kumar Aggarwal, Ravi Aggarwal, Devender Aggarwal, Pradeep Kumar Aggarwal HUF, Lalit Kumar Aggarwal HUF, Ravi Aggarwal HUF, Devender Aggarwal HUF and Sarvpriya Securities Private Limited are the promoters of the Company.

| Share Holding Pre Issue | 78.36% |

| Share Holding Post Issue | 69.63% |

Incorporated in 2000, Signatureglobal (India) Limited is a real estate development company. The company operates in the National Capital Region of Delhi ("Delhi NCR") focussed on offering affordable and mid-segment housing in terms of units supplied.

Signatureglobal (India) started its operations with its Solera project on 6.13 acres of land in Gurugram, Haryana and today has grown tremendously. As of March 2023, the company had sold 27,965 residential and commercial units, all located within the Delhi NCR region. In terms of Sales Growth too, they have attained a CAGR of 42.46%, from Rs. 16,902.74 million in Fiscal 2021 to Rs. 34,305.84 million in Fiscal 2023.

Signatureglobal (India) Limited focuses on GoI and state government policies supporting affordable housing in order to assist customers in realizing their dream of having their own home. Policies like Affordable Housing Policy, 2013, the Affordable Plotted Housing Policy or the Deen Dayal Jan Awas Yojana ("DDJAY - APHP"), and so on.

The company aspires to offer "value homes" which are a combination of attractive designs and amenities. Another aspect that the company proactively seeks is to enhance the value of its projects and create a better living environment.

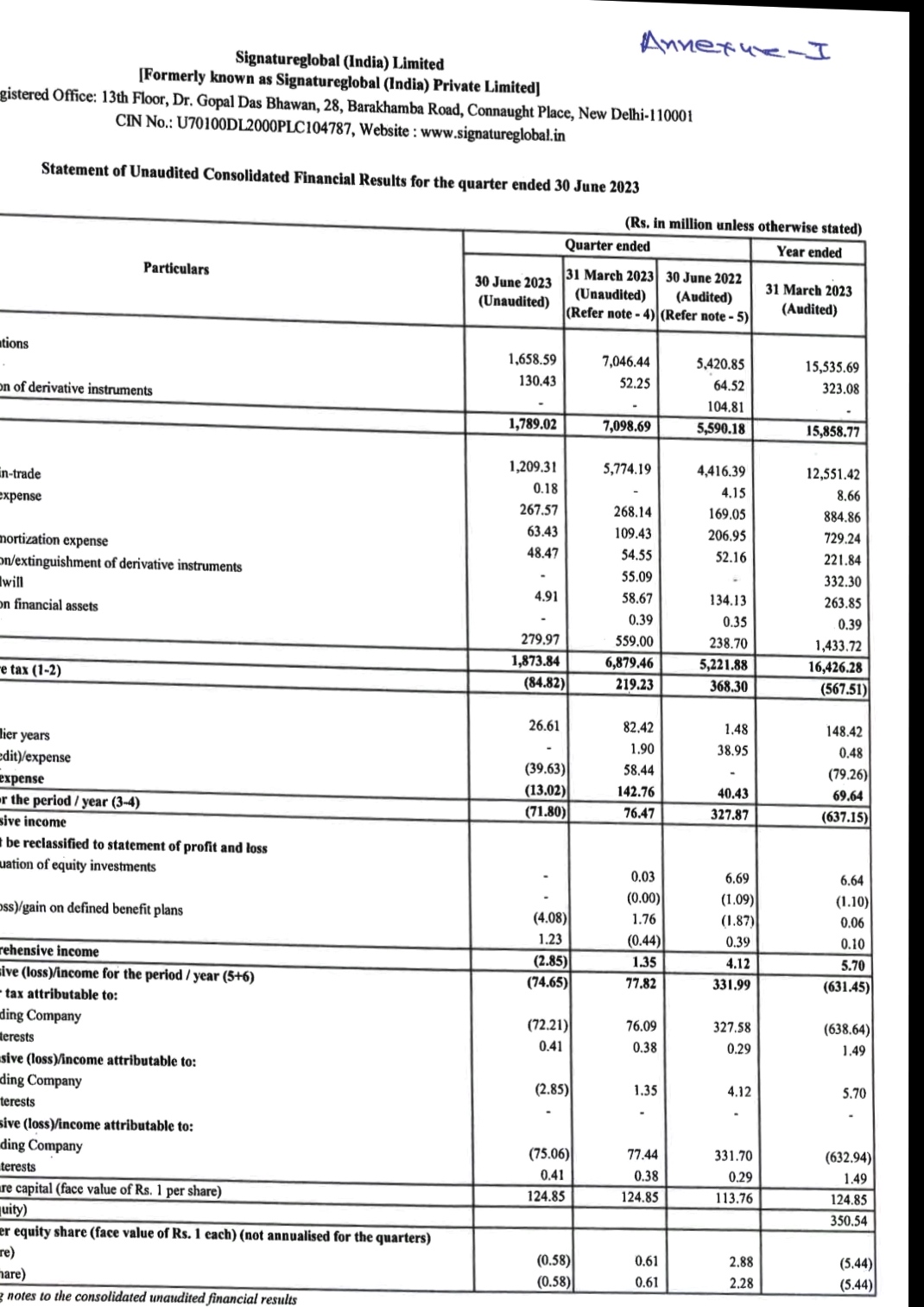

| Period Ended | 31 Mar 2020 | 31 Mar 2021 | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 2,930.52 | 3,762.37 | 4,430.85 | 5,999.13 |

| Revenue | 263.03 | 154.72 | 939.60 | 1,585.88 |

| Profit After Tax | -56.57 | -86.28 | -115.50 | -63.72 |

| Net Worth | -93.07 | -206.87 | -352.22 | 47.54 |

| Reserves and Surplus | -128.87 | -210.78 | -364.01 | 34.08 |

| Total Borrowing | 969.36 | 1,176.38 | 1,157.53 | 1,709.75 |

The market capitalization of Signatureglobal India IPO is Rs 5409.66 Cr.

| KPI | Values |

|---|---|

| ROE | -134.0% |

| ROCE | 1% |

| Debt/Equity | 34.1 |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | -5.44 |

The Company proposes to utilize the Net Proceeds towards the funding of the following objects:

[Dilip Davda] Though the company has lion market share in affordable housing in Delhi NCR region, its loss making journey so far makes the IPO exorbitantly priced with a negative P/E. The company has large projects on hand and with its sale realization, the company is likely to turn the table in the nearer term. But based on its performance so far, it’s a “High Risk/Low Return” bet. Hence only well-informed/cash surplus/risk seekers may park moderate funds for the long term rewards, others can skip it. Read detail review...

The Signatureglobal India IPO is subscribed 12.50 times on September 22, 2023 7:02:00 PM. The public issue subscribed 7.17 times in the retail category, 13.37 times in the QIB category, and 14.24 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 13.37 |

| NII | 14.24 |

| bNII (bids above ₹10L) | 16.60 |

| sNII (bids below ₹10L) | 9.53 |

| Retail | 7.17 |

| Total | 12.50 |

Total Application : 349,431 (7.00 times)

| Listing Date | September 27, 2023 |

| BSE Script Code | 543990 |

| NSE Symbol | SIGNATURE |

| ISIN | INE903U01023 |

| Final Issue Price | ₹385 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| BSE |

|---|

| ₹385.00 |

| ₹445.00 |

| ₹444.10 |

| ₹473.45 |

| ₹458.40 |

| NSE |

|---|

| ₹385.00 |

| ₹444.00 |

| ₹444.00 |

| ₹474.00 |

| ₹458.55 |

Signatureglobal (India) Limited

13th Floor, Dr. Gopal Das Bhawan,

28 Barakhamba Road, Connaught Place,

New Delhi 110 001

Phone: +91 11 4928 1700

Email: cs@signatureglobal.in

Website: http://www.signatureglobal.in/

Link Intime India Private Ltd

Phone: +91-22-4918 6270

Email: Signatureglobal.ipo@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

Signatureglobal India IPO is a main-board IPO of 18,961,039 equity shares of the face value of ₹1 aggregating up to ₹730.00 Crores. The issue is priced at ₹366 to ₹385 per share. The minimum order quantity is 38 Shares.

The IPO opens on September 20, 2023, and closes on September 22, 2023.

Link Intime India Private Ltd is the registrar for the IPO. The shares are proposed to be listed on BSE, NSE.

Zerodha customers can apply online in Signatureglobal India IPO using UPI as a payment gateway. Zerodha customers can apply in Signatureglobal India IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Signatureglobal India IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Signatureglobal India IPO opens on September 20, 2023 and closes on September 22, 2023.

Signatureglobal India IPO lot size is 38 Shares, and the minimum amount required is ₹14,630.

You can apply in Signatureglobal India IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Signatureglobal India IPO will be done on Wednesday, September 27, 2023, and the allotted shares will be credited to your demat account by Tuesday, October 3, 2023. Check the Signatureglobal India IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|