Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

ROX Hi-Tech IPO is a book built issue of Rs 54.49 crores. The issue is a combination of fresh issue of 60.18 lakh shares aggregating to Rs 49.95 crores and offer for sale of 5.47 lakh shares aggregating to Rs 4.54 crores.

ROX Hi-Tech IPO bidding started from November 7, 2023 and ended on November 9, 2023. The allotment for ROX Hi-Tech IPO was finalized on Wednesday, November 15, 2023. The shares got listed on NSE SME on November 16, 2023.

ROX Hi-Tech IPO price band is set at ₹80 to ₹83 per share. The minimum lot size for an application is 1600 Shares. The minimum amount of investment required by retail investors is ₹132,800. The minimum lot size investment for HNI is 2 lots (3,200 shares) amounting to ₹265,600.

Swaraj shares and securities private limited is the book running lead manager of the ROX Hi-Tech IPO, while Purva Sharegistry India Pvt Ltd is the registrar for the issue. The market maker for ROX Hi-Tech IPO is Share India Securities.

Refer to ROX Hi-Tech IPO RHP for detailed information.

| IPO Date | November 7, 2023 to November 9, 2023 |

| Listing Date | November 16, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹80 to ₹83 per share |

| Lot Size | 1600 Shares |

| Total Issue Size | 6,564,800 shares (aggregating up to ₹54.49 Cr) |

| Fresh Issue | 6,017,600 shares (aggregating up to ₹49.95 Cr) |

| Offer for Sale | 547,200 shares of ₹10 (aggregating up to ₹4.54 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 16,818,750 |

| Share holding post issue | 22,836,350 |

| Market Maker portion | 848,000 shares Share India Securities |

ROX Hi-Tech IPO offers 6,569,600 shares. 1,051,200 (16.00%) to QIB, 896,000 (13.64%) to NII, 2,193,600 (33.39%) to RII and 1,580,800 (24.06%) to Anchor investors.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 1,580,800 (24.06%) |

| Market Maker Shares Offered | 848,000 (12.91%) |

| QIB Shares Offered | 1,051,200 (16.00%) |

| NII (HNI) Shares Offered | 896,000 (13.64%) |

| Retail Shares Offered | 2,193,600 (33.39%) |

| Total Shares Offered | 6,569,600 (100%) |

ROX Hi-Tech IPO raises Rs 13.12 crore from anchor investors. ROX Hi-Tech IPO Anchor bid date is November 6, 2023. ROX Hi-Tech IPO Anchor Investors list

| Bid Date | November 6, 2023 |

| Shares Offered | 1,580,800 |

| Anchor Portion Size (In Cr.) | 13.12 |

| Anchor lock-in period end date for 50% shares (30 Days) | December 15, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | February 13, 2024 |

ROX Hi-Tech IPO opens on November 7, 2023, and closes on November 9, 2023.

| IPO Open Date | Tuesday, November 7, 2023 |

| IPO Close Date | Thursday, November 9, 2023 |

| Basis of Allotment | Wednesday, November 15, 2023 |

| Initiation of Refunds | Thursday, November 16, 2023 |

| Credit of Shares to Demat | Thursday, November 16, 2023 |

| Listing Date | Thursday, November 16, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on November 9, 2023 |

Investors can bid for a minimum of 1600 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹132,800 |

| Retail (Max) | 1 | 1600 | ₹132,800 |

| HNI (Min) | 2 | 3,200 | ₹265,600 |

| Lot Size Calculator | |||

Jim Rakesh and Sukanya Rakesh are the promoters of the company.

| Share Holding Pre Issue | 83.29% |

| Share Holding Post Issue |

Incorporated in 2002, ROX Hi-Tech Limited is a customer-centric IT solutions provider. The company offers a comprehensive range of distributed IT solutions, including consulting, enterprise and end-user computing, managed print, and network services.

The company's offerings comprise:

ROX Hi-Tech has over 22 years of industry experience and has evolved from an IBM Business Partner into a prominent player in the IT segment.

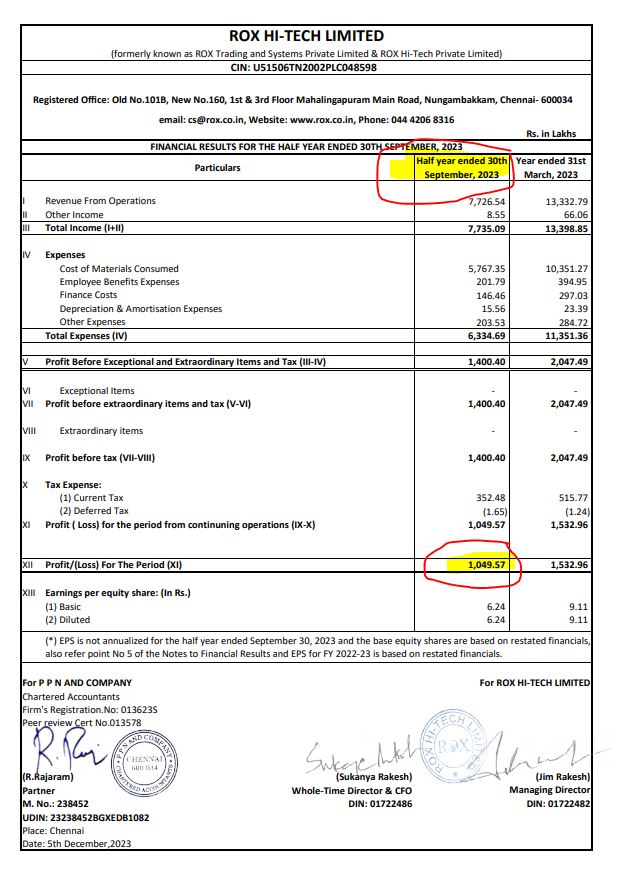

The company recorded a total revenue from operations of Rs. 13,372.79 Lacs, Rs. 10,286.22 Lacs, and Rs. 6.407.18 Lacs in fiscal 2023, 2022, and 2021 respectively.

ROX Hi-Tech Limited's revenue increased by 30.12% and profit after tax (PAT) rose by 913.13% between the financial year ending with March 31, 2023 and March 31, 2022.

| Period Ended | 31 Jul 2023 | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

| Assets | 8,010.87 | 6,103.26 | 3,866.72 | 3,887.58 |

| Revenue | 5,001.20 | 13,398.85 | 10,297.25 | 6,547.94 |

| Profit After Tax | 675.89 | 1,532.97 | 151.31 | 66.15 |

| Net Worth | 3,090.93 | 2,415.03 | 882.06 | 730.75 |

| Reserves and Surplus | 1,409.05 | 1,667.53 | 134.56 | 405.75 |

| Total Borrowing | 2,838.79 | 2,258.36 | 1,794.59 | 1,135.32 |

| Amount in ₹ Lakhs | ||||

The market capitalization of ROX Hi-Tech IPO is Rs 189.52 Cr.

| KPI | Values |

|---|---|

| ROE | 63.48% |

| ROCE | 50.17% |

| Debt/Equity | 0.94 |

| RoNW | 63.48% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 9.11 | |

| P/E (x) | 9.11 | 9.35 |

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

1. Funding for Capital Expenditure:

i. Setting up a Network Operations Centre (NOC) & Security Operations Centre (SOC) at Chennai;

ii. Setting up a Chennai Medical Automation Centre; and

iii. Setting up a Global Software Delivery Center in Noida.

2. Funding our working capital requirements, and

3. General Corporate Expenses.

[Dilip Davda] The company is in the business of customer centric IT solutions services. It has posted growth in its top lines for the reported periods, but boosted profits from FY23 onward raise concern. Considering its niche play as a preferred partner with renowned brands, higher equity post IPO leading to early migration, investors may park funds for the medium to long term rewards. Read detail review...

The ROX Hi-Tech IPO is subscribed 214.44 times on November 9, 2023 7:29:00 PM. The public issue subscribed 204.02 times in the retail category, 106.25 times in the QIB category, and 366.86 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 106.25 |

| NII | 366.86 |

| Retail | 204.02 |

| Total | 214.44 |

Total Application : 279,711 (204.02 times)

| Listing Date | November 16, 2023 |

| BSE Script Code | |

| NSE Symbol | ROXHITECH |

| ISIN | INE0PDJ01013 |

| Final Issue Price | ₹83 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| NSE SME |

|---|

| ₹83.00 |

| ₹135.00 |

| ₹135.00 |

| ₹141.75 |

| ₹141.75 |

ROX Hi-Tech Limited

Old No.101B, New No.160,

1st & 3rd Floor Mahalingapuram Main Road,

Nungambakkam, Chennai - 600034

Phone: + 91 44 4206 8316

Email: cs@rox.co.in

Website: https://www.rox.co.in/index.html

Purva Sharegistry India Pvt Ltd

Phone: +91-022-23018261/ 23016761

Email: support@purvashare.com

Website: https://www.purvashare.com/investor-service/ipo-query

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

ROX Hi-Tech IPO is a SME IPO of 6,564,800 equity shares of the face value of ₹10 aggregating up to ₹54.49 Crores. The issue is priced at ₹80 to ₹83 per share. The minimum order quantity is 1600 Shares.

The IPO opens on November 7, 2023, and closes on November 9, 2023.

Purva Sharegistry India Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on NSE SME.

Zerodha customers can apply online in ROX Hi-Tech IPO using UPI as a payment gateway. Zerodha customers can apply in ROX Hi-Tech IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in ROX Hi-Tech IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The ROX Hi-Tech IPO opens on November 7, 2023 and closes on November 9, 2023.

ROX Hi-Tech IPO lot size is 1600 Shares, and the minimum amount required is ₹132,800.

You can apply in ROX Hi-Tech IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for ROX Hi-Tech IPO will be done on Wednesday, November 15, 2023, and the allotted shares will be credited to your demat account by Thursday, November 16, 2023. Check the ROX Hi-Tech IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|