Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Owais Metal and Mineral Processing IPO is a book built issue of Rs 42.69 crores. The issue is entirely a fresh issue of 49.07 lakh shares.

Owais Metal and Mineral Processing IPO bidding started from February 26, 2024 and ended on February 28, 2024. The allotment for Owais Metal and Mineral Processing IPO was finalized on Thursday, February 29, 2024. The shares got listed on NSE SME on March 4, 2024.

Owais Metal and Mineral Processing IPO price band is set at ₹83 to ₹87 per share. The minimum lot size for an application is 1600 Shares. The minimum amount of investment required by retail investors is ₹139,200. The minimum lot size investment for HNI is 2 lots (3,200 shares) amounting to ₹278,400.

Gretex Corporate Services Limited is the book running lead manager of the Owais Metal and Mineral Processing IPO, while Bigshare Services Pvt Ltd is the registrar for the issue. The market maker for Owais Metal and Mineral Processing IPO is Gretex Share Broking.

Refer to Owais Metal and Mineral Processing IPO RHP for detailed information.

| IPO Date | February 26, 2024 to February 28, 2024 |

| Listing Date | March 4, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹83 to ₹87 per share |

| Lot Size | 1600 Shares |

| Total Issue Size | 4,907,200 shares (aggregating up to ₹42.69 Cr) |

| Fresh Issue | 4,907,200 shares (aggregating up to ₹42.69 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 13,275,198 |

| Share holding post issue | 18,182,398 |

| Market Maker portion | 344,000 shares Gretex Share Broking |

Owais Metal and Mineral Processing IPO offers 4,907,200 shares. 912,000 (18.58%) to QIB, 684,800 (13.96%) to NII, 1,598,400 (32.57%) to RII and 1,368,000 (27.88%) to Anchor investors.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 1,368,000 (27.88%) |

| Market Maker Shares Offered | 344,000 (7.01%) |

| QIB Shares Offered | 912,000 (18.58%) |

| NII (HNI) Shares Offered | 684,800 (13.96%) |

| Retail Shares Offered | 1,598,400 (32.57%) |

| Total Shares Offered | 4,907,200 (100%) |

Owais Metal and Mineral Processing IPO raises Rs 11.90 crore from anchor investors. Owais Metal and Mineral Processing IPO Anchor bid date is February 23, 2024. Owais Metal and Mineral Processing IPO Anchor Investors list

| Bid Date | February 23, 2024 |

| Shares Offered | 1,368,000 |

| Anchor Portion Size (In Cr.) | 11.90 |

| Anchor lock-in period end date for 50% shares (30 Days) | March 30, 2024 |

| Anchor lock-in period end date for remaining shares (90 Days) | May 29, 2024 |

Owais Metal and Mineral Processing IPO opens on February 26, 2024, and closes on February 28, 2024.

| IPO Open Date | Monday, February 26, 2024 |

| IPO Close Date | Wednesday, February 28, 2024 |

| Basis of Allotment | Thursday, February 29, 2024 |

| Initiation of Refunds | Friday, March 1, 2024 |

| Credit of Shares to Demat | Friday, March 1, 2024 |

| Listing Date | Monday, March 4, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 28, 2024 |

Investors can bid for a minimum of 1600 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹139,200 |

| Retail (Max) | 1 | 1600 | ₹139,200 |

| HNI (Min) | 2 | 3,200 | ₹278,400 |

| Lot Size Calculator | |||

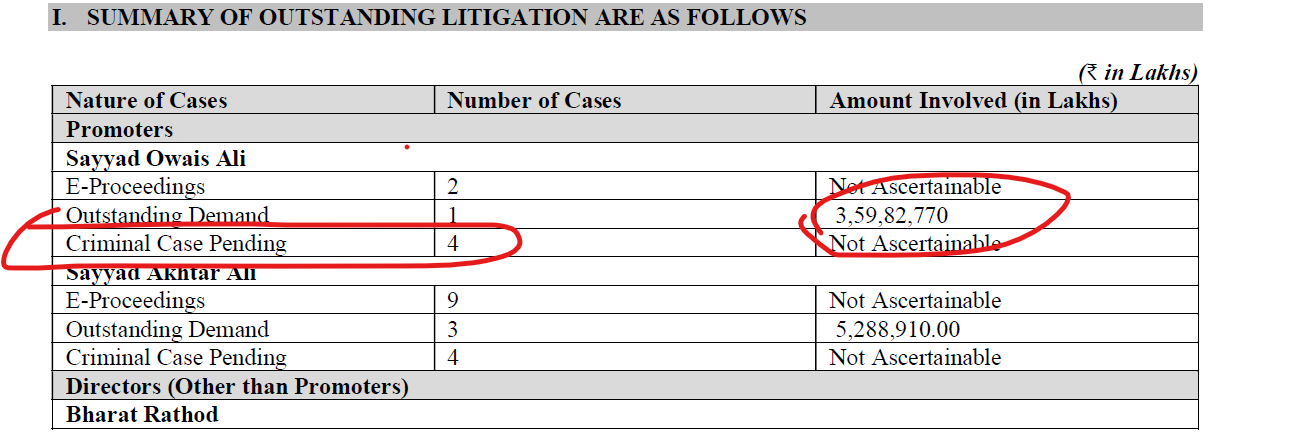

Mr. Saiyyed Owais Ali, Mr. Sayyad Akhtar Ali, and Mr. Saiyyed Murtuza Ali are the company promoters.

| Share Holding Pre Issue | 100.00% |

| Share Holding Post Issue | 73.01% |

Owais Metal and Mineral Processing Limited was established in 2022 and is engaged in the production and processing of metals and minerals. Prior to the incorporation of the company, the business of the company was carried on under the name of M/s Owais Ali Overseas, a sole proprietorship firm of the promoter Mr. Saiyyed Owais Ali.

The company is engaged in the manufacturing and processing of the following products

The company's manufacturing facility is located in Meghnagar, Madhya Pradesh. As of December 31, 2023, the company had 25 permanent employees.

| Period Ended | 31 Dec 2023 | 31 Mar 2023 |

| Assets | 5,164.23 | 379.62 |

| Revenue | 3,977.54 | |

| Profit After Tax | 765.47 | -12.72 |

| Net Worth | 2,122.77 | 57.28 |

| Reserves and Surplus | 795.25 | 44.28 |

| Total Borrowing | 1,350.59 | 321.29 |

| Amount in ₹ Lakhs | ||

The market capitalization of Owais Metal and Mineral Processing IPO is Rs 158.19 Cr.

| KPI | Values |

|---|---|

| ROE | -5.35% |

| Debt/Equity | 5.61 |

| RoNW | -22.22% |

| P/BV | 5.37 |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 4.08 | 2.98 |

| P/E (x) | 21.35 | 29.24 |

The company intends to utilize the Net Fresh Issue Proceeds for the following Objects:

[Dilip Davda] The company is in the manufacturing and processing of minerals and metals. It marked jump in its bottom lines from FY23 onwards that not only raise eyebrows but also concern over its sustainability going forward. Based on its FY24 annualized super earnings, the issue appears fully priced. There is no harm is skipping this “High Risk/Low Return” bet. Read detail review...

The Owais Metal and Mineral Processing IPO is subscribed 221.18 times on February 28, 2024 6:21:00 PM. The public issue subscribed 248.50 times in the retail category, 92.06 times in the QIB category, and 329.36 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 92.06 |

| NII | 329.36 |

| Retail | 248.50 |

| Total | 221.18 |

Total Application : 248,255 (248.50 times)

| Listing Date | March 4, 2024 |

| BSE Script Code | |

| NSE Symbol | OWAIS |

| ISIN | INE0R8M01017 |

| Final Issue Price | ₹87 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| NSE SME |

|---|

| ₹87.00 |

| ₹250.00 |

| ₹241.00 |

| ₹262.50 |

| ₹262.50 |

Owais Metal and Mineral Processing Limited

C/o Sayyad Akhtar Ali Vahid Nagar,

Old Baipass Road NA

Ratlam - 457001

Phone: +91-9300096498

Email: info@ommpl.com

Website: http://www.ommpl.com/

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: https://ipo.bigshareonline.com/ipo_status.html

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Owais Metal and Mineral Processing IPO is a SME IPO of 4,907,200 equity shares of the face value of ₹10 aggregating up to ₹42.69 Crores. The issue is priced at ₹83 to ₹87 per share. The minimum order quantity is 1600 Shares.

The IPO opens on February 26, 2024, and closes on February 28, 2024.

Bigshare Services Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on NSE SME.

Zerodha customers can apply online in Owais Metal and Mineral Processing IPO using UPI as a payment gateway. Zerodha customers can apply in Owais Metal and Mineral Processing IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Owais Metal and Mineral Processing IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Owais Metal and Mineral Processing IPO opens on February 26, 2024 and closes on February 28, 2024.

Owais Metal and Mineral Processing IPO lot size is 1600 Shares, and the minimum amount required is ₹139,200.

You can apply in Owais Metal and Mineral Processing IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Owais Metal and Mineral Processing IPO will be done on Thursday, February 29, 2024, and the allotted shares will be credited to your demat account by Friday, March 1, 2024. Check the Owais Metal and Mineral Processing IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|