Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Basilic Fly Studio IPO is a book built issue of Rs 66.35 crores. The issue is a combination of fresh issue of 62.4 lakh shares aggregating to Rs 60.53 crores and offer for sale of 6 lakh shares aggregating to Rs 5.82 crores.

Basilic Fly Studio IPO bidding started from September 1, 2023 and ended on September 5, 2023. The allotment for Basilic Fly Studio IPO was finalized on Monday, September 11, 2023. The shares got listed on NSE SME on September 11, 2023.

Basilic Fly Studio IPO price band is set at ₹92 to ₹97 per share. The minimum lot size for an application is 1200 Shares. The minimum amount of investment required by retail investors is ₹116,400. The minimum lot size investment for HNI is 2 lots (2,400 shares) amounting to ₹232,800.

GYR Capital Advisors Private Limited is the book running lead manager of the Basilic Fly Studio IPO, while Purva Sharegistry India Pvt Ltd is the registrar for the issue. The market maker for Basilic Fly Studio IPO is Share India Securities.

Refer to Basilic Fly Studio IPO RHP for detailed information.

| IPO Date | September 1, 2023 to September 5, 2023 |

| Listing Date | September 11, 2023 |

| Face Value | ₹10 per share |

| Price Band | ₹92 to ₹97 per share |

| Lot Size | 1200 Shares |

| Total Issue Size | 6,840,000 shares (aggregating up to ₹66.35 Cr) |

| Fresh Issue | 6,240,000 shares (aggregating up to ₹60.53 Cr) |

| Offer for Sale | 600,000 shares of ₹10 (aggregating up to ₹5.82 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 17,000,000 |

| Share holding post issue | 23,240,000 |

| Market Maker portion | 1,026,000 shares Share India Securities |

Basilic Fly Studio IPO offers 6,840,000 shares. 1,162,800 (17.00%) to QIB, 872,400 (12.75%) to NII, 2,035,200 (29.75%) to RII 1,743,600 (25.49%) to Anchor investors.

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 1,743,600 (25.49%) |

| Market Maker Shares Offered | 1,026,000 (15.00%) |

| QIB Shares Offered | 1,162,800 (17.00%) |

| NII (HNI) Shares Offered | 872,400 (12.75%) |

| Retail Shares Offered | 2,035,200 (29.75%) |

| Total Shares Offered | 6,840,000 (100%) |

Basilic Fly Studio IPO raises Rs 16.91 crore from anchor investors. Basilic Fly Studio IPO Anchor bid date is August 31, 2023. Basilic Fly Studio IPO Anchor Investors list

| Bid Date | August 31, 2023 |

| Shares Offered | 1,743,600 |

| Anchor Portion Size (In Cr.) | 16.91 |

| Anchor lock-in period end date for 50% shares (30 Days) | October 11, 2023 |

| Anchor lock-in period end date for remaining shares (90 Days) | December 10, 2023 |

Basilic Fly Studio IPO opens on September 1, 2023, and closes on September 5, 2023.

| IPO Open Date | Friday, September 1, 2023 |

| IPO Close Date | Tuesday, September 5, 2023 |

| Basis of Allotment | Monday, September 11, 2023 |

| Initiation of Refunds | Tuesday, September 12, 2023 |

| Credit of Shares to Demat | Wednesday, September 13, 2023 |

| Listing Date | Thursday, September 14, 2023 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 5, 2023 |

Investors can bid for a minimum of 1200 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1200 | ₹116,400 |

| Retail (Max) | 1 | 1200 | ₹116,400 |

| HNI (Min) | 2 | 2,400 | ₹232,800 |

| Lot Size Calculator | |||

Mr. Balakrishnan and Ms. Yogalakshmi S are promoters of the company.

| Share Holding Pre Issue | 85.42% |

| Share Holding Post Issue |

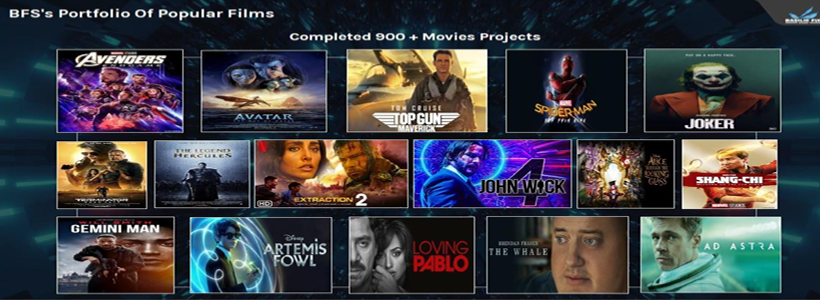

Incorporated in 2016, Basilic Fly Studio Limited is a visual effects (VFX) studio headquartered in Chennai, India with subsidiaries operating in Canada and the UK.

Basilic Fly Studio provides VFX solutions for movies, TV, net series, and commercials. BFS' service list includes

The company has over 500 skilled individuals and has offices in Pune, London, and Vancouver.

Basilic Fly Studio recorded Rs. 7,895.15 lacs in Total Revenue in fiscal 2022-23.

| Period Ended | 31 Mar 2022 | 31 Mar 2023 |

| Assets | 1,571.08 | 5,315.33 |

| Revenue | 2,528.78 | 7,895.15 |

| Profit After Tax | 90.10 | 2,774.02 |

| Net Worth | 394.16 | 3,166.98 |

| Reserves and Surplus | 274.17 | 1,466.98 |

| Total Borrowing | 413.23 | 427.08 |

The market capitalization of Basilic Fly Studio IPO is Rs 225.43 Cr.

| KPI | Values |

|---|---|

| ROE | 155.63% |

| ROCE | 104.73% |

| Debt/Equity | 0.14 |

| RoNW | 87.59% |

| Pre IPO | Post IPO | |

|---|---|---|

| EPS (Rs) | 16.32 | |

| P/E (x) | 8.08 |

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

[Dilip Davda] BFSL has mastered in VFX studios and has a global presence with a niche place. It has posted spectacular performance for FY23 reaping the benefits of timely expansion. The company is expanding further to enhance its global reach and is poised for bright prospects ahead. Investors may park funds for short to long-term rewards. Read detail review...

The Basilic Fly Studio IPO is subscribed 358.60 times on September 5, 2023 7:29:00 PM. The public issue subscribed 415.22 times in the retail category, 116.34 times in the QIB category, and 549.44 times in the NII category. Check Day by Day Subscription Details (Live Status)

| Category | Subscription (times) |

|---|---|

| QIB | 116.34 |

| NII | 549.44 |

| Retail | 415.22 |

| Total | 358.60 |

Total Application : 704,205 (415.22 times)

| Listing Date | September 11, 2023 |

| BSE Script Code | |

| NSE Symbol | BASILIC |

| ISIN | INE0OCC01013 |

| Final Issue Price | ₹97 per share |

| Price Details |

|---|

| Final Issue Price |

| Open |

| Low |

| High |

| Last Trade |

| NSE SME |

|---|

| ₹97.00 |

| ₹271.00 |

| ₹270.00 |

| ₹284.55 |

| ₹284.55 |

Basilic Fly Studio Limited

Tower A, KRC Commerzone,

Mount Poonamallee Road

Porur, Chennai - 600116

Phone: + 91 94164 22201

Email: cs@basilicfly.com

Website: http://www.basilicflystudio.com/

Purva Sharegistry India Pvt Ltd

Phone: +91-022-23018261/ 23016761

Email: support@purvashare.com

Website: https://www.purvashare.com/investor-service/ipo-query

SME Company Owners

We could help you get listed on the stock market.

Check our SME IPO Guide

Basilic Fly Studio IPO is a SME IPO of 6,840,000 equity shares of the face value of ₹10 aggregating up to ₹66.35 Crores. The issue is priced at ₹92 to ₹97 per share. The minimum order quantity is 1200 Shares.

The IPO opens on September 1, 2023, and closes on September 5, 2023.

Purva Sharegistry India Pvt Ltd is the registrar for the IPO. The shares are proposed to be listed on NSE SME.

Zerodha customers can apply online in Basilic Fly Studio IPO using UPI as a payment gateway. Zerodha customers can apply in Basilic Fly Studio IPO by login into Zerodha Console (back office) and submitting an IPO application form.

Steps to apply in Basilic Fly Studio IPO through Zerodha

Visit Zerodha IPO Application Process Review for more detail.

The Basilic Fly Studio IPO opens on September 1, 2023 and closes on September 5, 2023.

Basilic Fly Studio IPO lot size is 1200 Shares, and the minimum amount required is ₹116,400.

You can apply in Basilic Fly Studio IPO online using either UPI or ASBA as payment method. ASBA IPO application is available in the net banking of your bank account. UPI IPO application is offered by brokers who don't offer banking services. Read more detail about apply IPO online through Zerodha, Upstox, 5Paisa, Nuvama, ICICI Bank, HDFC Bank and SBI Bank.

The finalization of Basis of Allotment for Basilic Fly Studio IPO will be done on Monday, September 11, 2023, and the allotted shares will be credited to your demat account by Wednesday, September 13, 2023. Check the Basilic Fly Studio IPO allotment status.

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|