Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

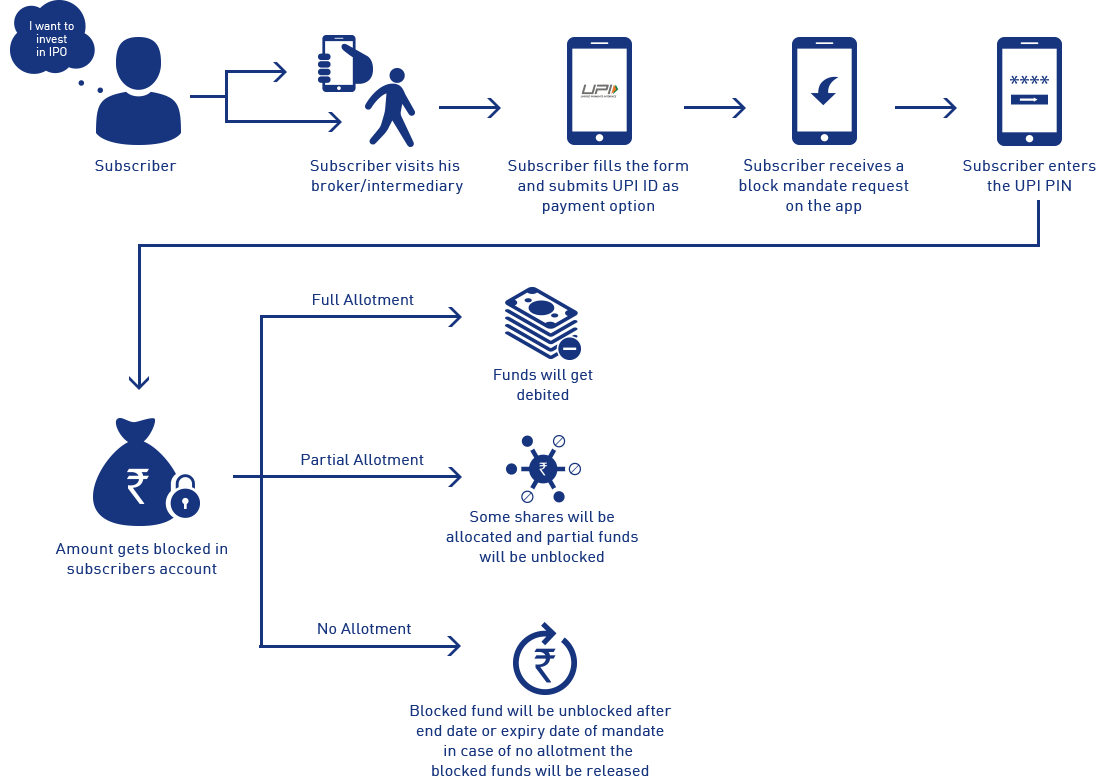

An investor can apply in an IPO using UPI as a payment option. The Unified Payment Interface (UPI) platform blocks the fund for IPO application after the customer approves the fund block mandate request.

UPI IPO Application is an alternative to the ASBA IPO Application wherein an investor uses UPI ID as a payment option while subscribing for IPO.

UPI is short of Unified Payment Interface. UPI is a platform build by the National Payments Corporation of India (NPCI) to simplify retail payments and settlement systems in India. It is an initiative by RBI and the Indian Banks Association (IBA).

The UPI IPO application allows you to apply in an IPO directly from your broker (i.e. Zerodha, Sharekhan or Angel). But it requires an additional step of approving the fund block mandate request in BHIM or net-banking mobile app. This additional step makes this process cumbersome. The overall process is not as fast as the ASBA IPO application due to an additional layer added.

Parties involve in UPI IPO Application

ASBA and UPI are two different ways through which funds are blocked when investors apply in IPO. The bank blocks the fund (lien mark on account) directly in the investor's bank account when using ASBA. When choosing UPI as a payment option, the customer has to take additional steps to approve the fund blocking mandate request using UPI mobile app.

| Facility | ASBA IPO Application | UPI IPO Application |

|---|---|---|

|

Fund Blocking Mechanism |

Directly by the bank |

Through UPI |

|

UPI ID |

Not-required |

Required |

|

Multiple IPO applications from one bank account |

Not possible. |

Not possible. |

|

Minor, HUF or Corporate IPO Application |

Yes |

Not possible as UPI ID cannot be set up for Minor, HUF or Corporate account. |

|

Facility offered by |

Only Banks |

All brokers and banks |

|

Time required for IPO Application |

Just a few seconds |

May take a few hours as the UPI mandate doesn't come instantly. |

|

Process Complexity |

Low |

High as in addition to the filling up IPO application, the UPI payment mandate has to be approved in net banking or BHIM app. |

|

Need Smartphone |

No |

Yes, you should have BHIM or net-banking app installed and setup on your Smartphone. |

UPI IPO facility is offered by the brokers who don't have a banking license. In this case, the IPO applications are made using UPI id. The customer has to follow a few additional steps to accept the UPI mandate using the net banking app or BHIM app.

Steps to apply in IPO using UPI

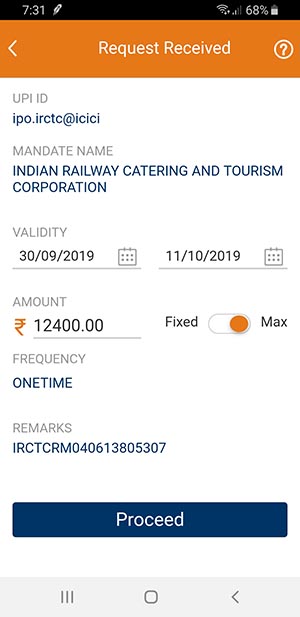

UPI IPO Mandate is a request on a smart phone app to block the fund for an IPO application.

When you apply for an IPO using UPI ID as payment option, you receive a fund block mandate request on the app where he has setup his UPI ID i.e. net-banking or BHIM app.

Steps to accept UPI IPO Mandate

An investor can apply in an IPO using UPI as a payment gateway at any time while the public issue is open for bidding.

|

UPI IPO Application |

Timings |

|---|---|

|

Start Time |

10 AM on Issue Open Date |

|

End Time |

5 PM on Issue Closing Date |

|

Accept the UPI Mandate |

5 PM on Issue Closing Date |

|

Bid Update/Cancel Time |

Upto 5 PM on Issue Closing Date |

The funds blocked for UPI based IPO application is released on the day of IPO allotment, if none or partial allotment is received.

What if funds are blocked even after allotment?

Your funds get automatically unblocked and credited to your account with the expiry of the mandate request period if the bank failed to unblock them on the allotment date.

At the time of accepting the fund block mandate request, you also specify the validity of the request as per the below screenshot. If for any reasons, the funds are not unblocked on the allotment date, the fund will surely released when the fund block request expires.

You could also reach out to the bank to unlock the funds.

Almost all large national level banks offer UPI based IPO Applications. This includes both private and public sector banks.

You can check list of permitted apps & banks for UPI IPO Application.

Answered on

No, only one IPO application in an IPO is permitted per UPI ID. In case if UPI as a payment option for IPO, the primary account holder's name in IPO application, Demat Account and Bank account should be same.

You cannot modify the IPO bid details (shares, price etc.) in the application once you accept the UPI mandate.

If the IPO is still open for bidding, you could cancel the IPO application and create new one.

You could accept or revoke the UPI IPO mandate for blocking the funds till 5 PM of the issue closing date.

You should reach out to your bank with the Unique Mandate Number (UMN) for any problem related to the IPO UPI Mandate block or unblock request.

If you didn't receive the allotment and the funds remain blocked, you may reach out to the bank of the UPI app you use.

Note that every UPI IPO mandate request has validity date which you choose at the time of accepting the request. In case the funds are not unblocked after allotment, the funds get unblocked automatically when the validity expires. Usually banks keep 12 days validity.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|