Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Compare Trading Platform Kotak KEAT Pro X and Fyers One. Find similarities and differences between Kotak KEAT Pro X and Fyers One Trading Softwares. Find the most powerful trading platform. Find which trading software is better among Kotak KEAT Pro X and Fyers One.

| Kotak KEAT Pro X | Fyers One | |

|---|---|---|

|

|

|

| About Trading Platform | Kotak KEAT Pro X is free desktop trading software (installable trading terminal) to trade across NSE, BSE and NSE currency markets. It provides a range of features to traders that gives you complete control over your investment portfolio, provides live streaming market data, access to research calls and charting tools to analyze your trades. |

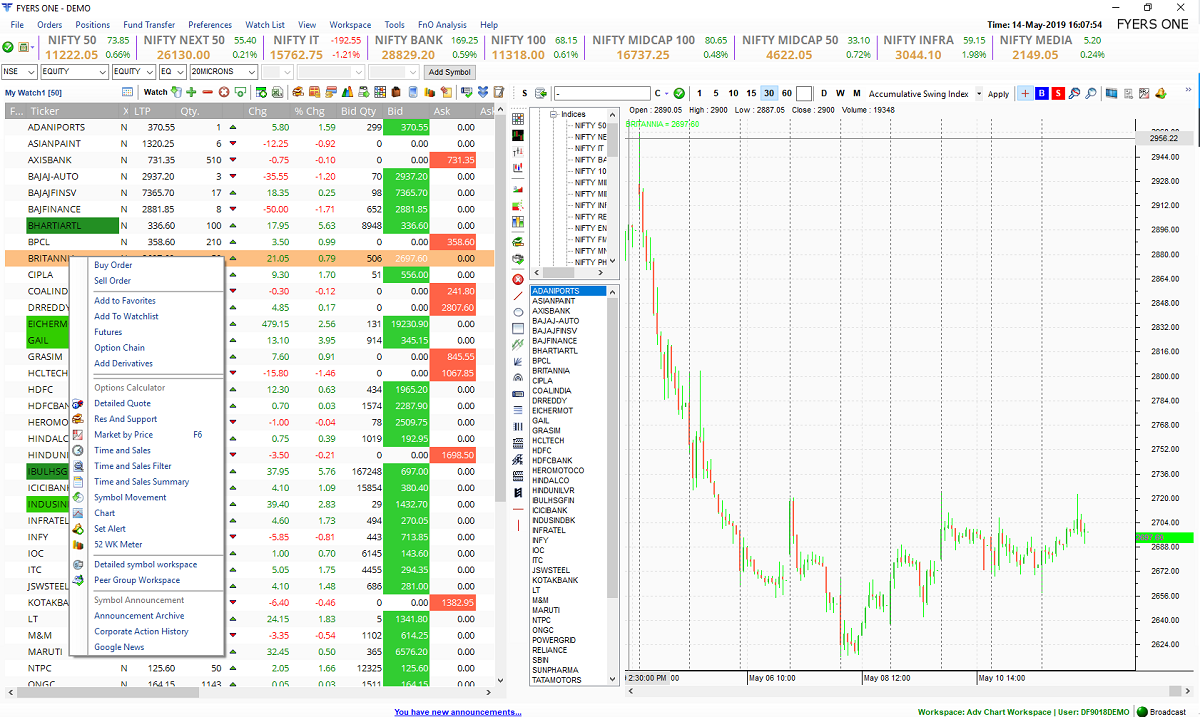

Launched in May 2016, Fyers One is an installable trading terminal for online trading. It offers trading across multiple segments including commodity, equity cash, F&O, and currency derivatives. With advanced charting features, market scanners, technical indicators, and customizable workspace, it is a platform designed for professional traders. |

| Platform Owner | Kotak Securities Limited | Fyers securities |

| Trading Segments Offered | Equity, Derivatives, Currency, Mutual Fund, IPO, Corporate Bond, NCD |

Equities, Currency, Commodities and Derivatives |

| Products Offered | NRML, CNC, MIS |

Regular, Cover Order, Bracket Order, AMO, Intraday, CNC, Margin |

| Order Type Offered | Market Order, AMO, SL, GTC |

Limit, Market, Stop Loss, Stop Loss Limit |

| Supported Exchanges | NSE, BSE |

NSE, BSE, MCX |

| Brokers using this platform | ||

| Order Management System (OMS) | Omnesys OMS | |

| Risk Management System (RMA) | Omnesys RMS | |

| Trading Platform Enquiry | Open Instant Account with Kotak KEAT Pro X | Open Instant Account with Fyers One |

| Kotak KEAT Pro X | Fyers One | |

|---|---|---|

| Highlights | Key Features of Kotak KEAT Pro X are:

|

Highlights of the Fyers One Trading Terminal are mentioned below:

|

| Features | Kotak KEAT ProX key features:

|

|

| Advantages |

|

|

| Disadvantages |

|

|

| Broker Account Enquiry | Open Instant Account with Kotak KEAT Pro X | Open Instant Account with Fyers One |

| Kotak KEAT Pro X | Fyers One | |

|---|---|---|

| Installable Trading Terminal | ||

| Trading Website | ||

| Mobile Trading App | ||

| API Access | ||

| Offered by Multiple Brokers | ||

| Equity Trading | ||

| Currency F&O Trading | ||

| Commodity Trading | ||

| Online IPO Application | ||

| Online Mutual Funds | ||

| Integrated Backoffice | ||

| Open an Account | Open Instant Account with Kotak KEAT Pro X | Open Instant Account with Fyers One |

| Kotak KEAT Pro X | Fyers One | |

|---|---|---|

| Chart Types Supported | 5 | 4 |

| Chart Indicator | 30 | 65 |

| Place Orders from Chart | ||

| Online Account Opening | Open Instant Account with Kotak KEAT Pro X | Open Instant Account with Fyers One |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|