Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

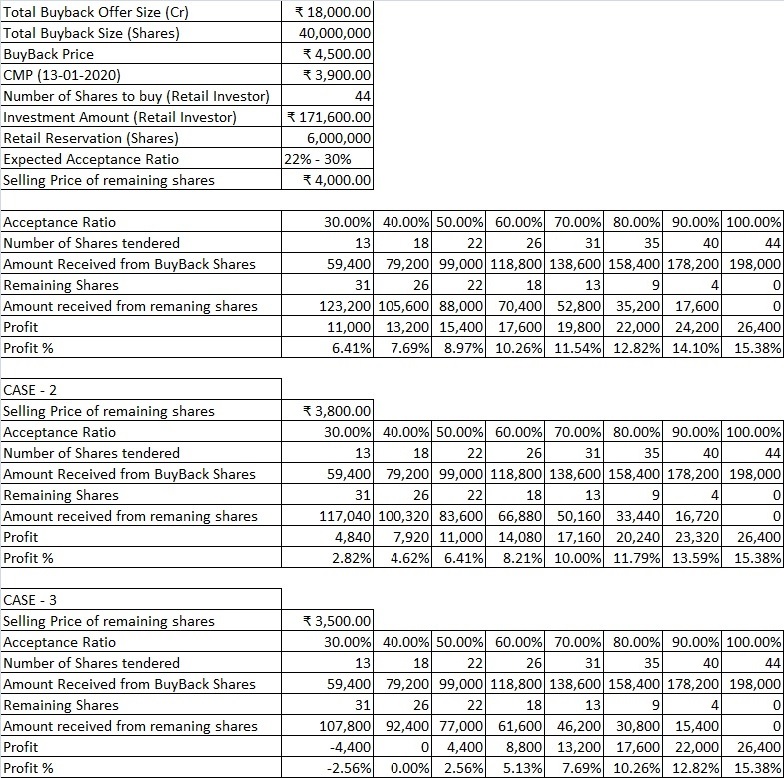

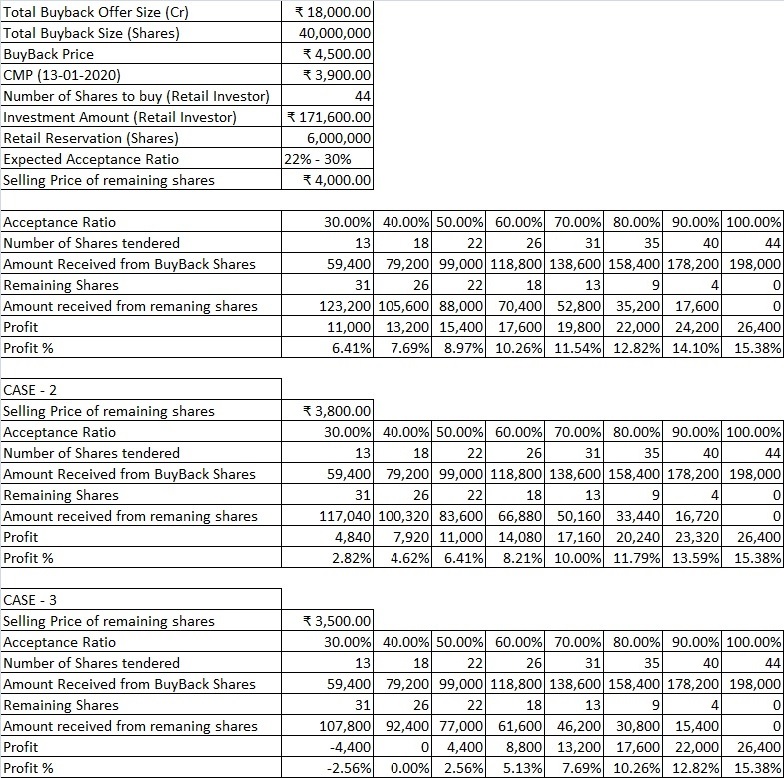

Established in 1968, Tata Consultancy Services (TCS) is an IT services, consulting, and business solutions provider. The company provides services grouped under the segments - Consulting and service integration, digital transformation services, cloud services, cognitive business operations, and products and platforms.

Key verticals the company serves are Banking, Financial Services, and Insurance (BFSI), Retail and Consumer Business, Communications, Media and Technology (CMT), Manufacturing, and Others.

TCS is a subsidiary of the Tata Group and is the largest IT services company in the world by market capitalization. TCS's geographic footprint covers North America, Latin America, the United Kingdom, Continental Europe, Asia-Pacific, India, the Middle East, and Africa. The company has over 556,986 employees around the globe and operates in 149 locations across 46 countries.

A "Small Shareholder" is a Shareholder who holds Equity Shares having market value of not more than Rs 200,000 on the Record Date.

As on the Record Date, the closing price on NSE, being the Recognized Stock Exchange having the highest trading volume, was Rs 3,571.90 per Equity Share. Accordingly, all Eligible Shareholders holding not more than 56 Equity Shares as on the Record Date are classified as 'Small Shareholders' for the buyback offer.

Buyback Price Calculation and Eligibility Criteria for Retail Small Shareholders Category

TCS shares closing price on 23 February, 2022 (record date) at NSE was Rs 3,563.80. Thus the number of Shares as on Record Date to qualify as Small Shareholder is 56 shares.

| NSE | BSE | |

|---|---|---|

|

Trading Volume (Shares) on 23rd Feb 2022 |

24,26,203 |

2,09,000 |

|

Closing Price |

3,563.80 |

3,565.30 |

Number of Shares to qualify as Small Shareholder in TCS 2022 Buyback = Rs 3,563.80 * 56 = Rs 199572.80 (which is less than Rs 2,00,000)

As per the email received from registrar on March 5th, 2022, the buyback entitlement is:

TCS accepted 26% shares in its buyback for retail category. People who applied for 50 shares got accepted 13 shares. HNI acceptance ratio is 2.45%.

| Buyback Date | Share % of paid-up capital bought back | Share Buyback price | Total Buyback Amount | Acceptance Ratio (Retail) |

|---|---|---|---|---|

| May 18, 2017 | 2.85% | Rs 2,850.00 | Rs 16,000.00 Cr | NA |

| Sep 06, 2018 | 1.99% | Rs 2,100.00 | Rs 16,000.00 Cr | NA |

| Dec 18, 2020 | 1.42% | Rs 3,000.00 | Rs 16,000.00 Cr | NA |

| Mar 09, 2022 | 1.08% | Rs 4,500.00 | Rs 18,000.00 Cr | 24.00% |

| Dec 01, 2023 | 1.12% | Rs 4,150.00 | Rs 17,000.00 Cr | 35.00% |

| Issue Period | March 9, 2022 - March 23, 2022 |

| Security Name | Tata Consultancy Services |

| Issue Type | Tender Offer |

| Issue Size (Shares) | 40,000,000 |

| Issue Size (Amount) | ₹18,000.00 Crores |

| Buyback Price | ₹4500 per share |

| Face Value | ₹1 per share |

| Listing At | BSE, NSE |

| Record Date | February 23, 2022 |

| Offer Opens On | March 9, 2022 |

| Last Date for receipt of Tender Forms | March 23, 2022 |

| Offer Closes On * | March 23, 2022 |

| Finalisation of Buyback Acceptance | March 31, 2022 |

| Last Date for settlment of bids | April 1, 2022 |

| Last Date for Extinguishment of Shares | April 8, 2022 |

| Particulars | For the year/period ended (Rs. in Millions) | |||

|---|---|---|---|---|

| 31-Dec-21 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Income | 1,233,870.00 | 1,413,630.00 | 1,393,830.00 | 1,307,970.00 |

| Profit After Tax | 283,920.00 | 309,600.00 | 332,600.00 | 300,650.00 |

| Net Worth | 923,929.10 | 747,939.10 | 743,682.40 | 788,982.40 |

| Month | High Price | Low Price | Average Price |

|---|---|---|---|

| Feb-2022 | 3,857.00 | 3,695.60 | 3,782.93 |

| Jan-2022 | 4,019.10 | 3,650.10 | 3,847.53 |

| Dec-2021 | 3,736.85 | 3,534.35 | 3,630.88 |

| Month | High Price | Low Price | Average Price |

|---|---|---|---|

| Feb-2022 | 3,856.20 | 3,694.95 | 3,782.74 |

| Jan-2022 | 4,019.15 | 3,649.25 | 3,847.37 |

| Dec-2021 | 3,738.35 | 3,536.40 | 3,631.14 |

The Buyback aims to :

i) Return excess cash to the shareholders.

ii) Increase shareholder's value in the long term; and

iii) Improve Return on Equity.

Tata Consultancy Services

9th Floor, Nirmal Building,

Nariman Point,

Mumbai - 400 021.

Phone: +91 22 6778 9696

Email: investor.relations@tcs.com

Website: https://www.tcs.com/

Link Intime India Private Ltd

Link Intime India Private Ltd

C 101, 247 Park, L.B.S.Marg,

Vikhroli (West), Mumbai - 400083

Phone: +91-22-4918 6270

Email: tcs.buyback2022@linkintime.co.in

Website: https://linkintime.co.in/initial_offer/public-issues.html

Lead Manager(s)

Registered Broker

The Buyback Offer size in terms of Equity Shares to be bought back will be 4,00,00,000 Equity Shares and in terms, the amount will be approximately Rs.18,000 Crores, which represents 1.08% of the total issued and paid-up equity share capital of the Company, as of December 31, 2021.

The Equity Shares will be bought back at a price of Rs 4,500 per Equity Share.

The income from the accepted buyback share is tax-free. There are no short-term or long-term capital gain taxes on the profits from TCS buyback accepted shares. The buyback price of Rs 4500 is the net price you will get for shares accepted.

But the gain/loss from the sell of the remaining share in the open market (not accepted in buyback offer) will be taxable as usual.

Example:

This TCS Buyback offer will be implemented through the "Tender Offer" route.

The 'Tender Offer' means an offer by a company to buy back its own shares through a letter of offer from the shareholders. The shareholders have to contact their Share Broker to submit the shares.

Yes. The Shareholders who desire to tender their Equity Shares in the electronic form or physical form under the Buyback would have to open a trading account with any BSE or NSE registered broker.

No, lock-in/ pledged and non-transferable shares cannot be tendered.

Shareholders holding Equity Shares as on the Record Date (Feb 23, 2022) would be eligible to participate in the buyback. Shareholders would either be categorized as a general category shareholder or a small shareholder based on the market value of shares held on the Record Date. The entitlement for each shareholder would then be fixed as per their holding on the Record Date. Shareholders can tender either part or entire holding as on the Record Date in the buyback. However, the acceptance would initially be the entire entitlement of the shareholder and any additional acceptance would be based on the overall additional shares tendered by all the Eligible Shareholders.

Receipt of tender/ offer form is not necessary. If you are a TCS shareholder on the Record Date, you can participate in the buyback. An Eligible Shareholder may participate in the Buyback by downloading the Tender Form from the websites of the Company and the Registrar to the Issue.

Acceptance will be decided basis the number of shares tendered in the buyback. The entire entitlement of the Eligible Shareholders would be accepted and if any additional shares are tendered by the Eligible Shareholders, the same would be accepted on a proportionate basis.

The shareholder would receive the intimation once their shares are accepted and settlement is completed post the completion of the tendering period.

The current Buyback is in line with the Company's shareholder-friendly capital allocation practices of returning excess cash to shareholders, thereby increasing shareholder value in the longer term, and improving the Return on Equity.

The TCS Buyback opens on March 9, 2022, and closes on March 23, 2022.

The TCS Buyback last day to buy is not available as of now.

The TCS Buyback is a Tender Offer.

TCS Buyback Schedule

| Buyback Opening Date | March 9, 2022 |

| Buyback Closing Date | March 23, 2022 |

| Last Date for receipt of Tender Forms | March 23, 2022 |

| Finalisation of Buyback Acceptance | March 31, 2022 |

| Last Date for settlment of bids | April 1, 2022 |

| Last Date for Extinguishment of Shares | April 8, 2022 |

The TCS Buyback is being offered at Rs ₹4500 per share per equity share.

The record date for the TCS Buyback is February 23, 2022.

The issue size of TCS Buyback is of 40,000,000 equity shares at ₹4500 per share aggregating upto ₹18,000.00 Crores.

The Buyback aims to :

i) Return excess cash to the shareholders.

ii) Increase shareholder's value in the long term; and

iii) Improve Return on Equity.

All the eligible Shareholders of the Company holding either Physical Shares or Demat Shares as on the Record Date can participate in the buyback offer through their Stock Broker.

The eligible shareholder holding the shares in Demat form needs to inform their broker the details of the Equity shares they wish to tender in the Buyback Offer. The shareholder needs to transfer the tendered shares to a Special account of the clearing corporation. The broker, in turn, would place an order on the stock exchange for the buyback.

The eligible shareholder holding the shares in physical form needs to approach their broker with original share certificates and supporting documents. Upon completion of document verification, the broker places an order on the stock exchange and submits the original share certificate and TRS to the registrar.

The tender form and TRS are optional in the case of Demat shares but mandatory in the case of physical shares.

The TCS Buyback offers an opportunity for the shareholders to exit their positions at a premium price. In case you stay invested you would have an increased percentage of shareholding in the company and improved earnings per share. Thus, one should understand the company fundamentals along with one's need, goals, and risk appetite to decide if one wants to stay invested or participate in the buyback offer.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

I am suresh Talreja my broker is Angel broking