Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

The IPO prospectus is an offering document that provides potential investors with details about the company and helps them decide whether or not to invest in the company.

hide

Content:

An IPO prospectus is a legal document that introduces the company to the public. The prospectus contains a lot of decision-making information that an investor can use to decide whether or not to invest in the company.

In Indian IPOs, the issuers have to file the DRHP (Draft Red Herring Prospectus) when they apply for the IPO. Once the company receives SEBI/Exchange approval, the issuer files the prospectus or RHP (Red Herring Prospectus). All prospectuses should be drafted or prepared based on SEBI guidelines.

The IPO prospectus is an offering document that provides potential investors with details about the company and helps them decide whether or not to invest in the company.

The IPO prospectus is not an agreement for an initial public offering. It is an invitation to the public to buy the shares. Investors may or may not invest in an IPO based on their analysis. The IPO prospectus is prepared by the lead manager and the issuer which helps investors make an informed decision. It contains all the necessary information about the company including the financials.

There are different types of offer documents based on the stage of the IPO.

DRHP stands for Draft Red Herring Prospectus. The DRHP is also known as a draft offer document.

The DRHP document is the preliminary prospectus that the issuer submits to initiate the IPO process. The DRHP is required to be approved by SEBI/stock exchanges based on where it is a mainboard IPO or SME IPO.

The DRHP contains information on the company overview, IPO structure, details of the offering (new issue or offer for sale), management and promoters, shareholder structure, related risks, use of proceeds, financial statements of the company and other information.

It does not contain detailed information about the size of the offering, the price or the number of shares offered.

The DRHP will be posted on the websites of the issuing company, SEBI, the stock exchanges and merchant bankers for the public to review and provide feedback or comments.

After evaluating the DRHP, the Merchant Banker makes the necessary adjustments and submits the final offer to SEBI, the Registrar of Companies (ROC) and the Stock Exchanges.

For mainboard IPOs, SEBI provides an observation report on the draft offer documents within 30 days from the date of receipt of the draft offer documents. The observation letter issued by SEBI is valid for 12 months. The issuing company has to clear the comments, make clarifications and initiate the IPO within 12 months from the date of the SEBI observation letter.

SEBI requires 15 days to issue an observation report on the clarifications/responses received from the commercial banks on the original observation letter.

The DRHP application process is conducted by the issuer and a merchant banker. Below are some guidelines and standards for filing the offering document:

RHP stands for Red Herring Prospectus and is an improved/altered version of DRHP issued in case of book-building issues.

An RHP is filed with SEBI, exchanges and RoC once the IPO application has been approved. The RHP contains all the latest and updated financial statements. All changes to the offering structure and corporate information and all other updates and modifications to the DRHP are included in the RHP. The RHP contains all details except the price or number of shares of the issue.

The IPO prospectus is the final and definitive offering document that contains all relevant information. This includes the offering price, the number of shares offered and the size of the net offering.

In the case of a fixed-price issue, this document is registered with the Company Register prior to the opening of the issue. In the case of a book building issue (price discovery), it shall be registered with the Registrar of Companies after the closing of the issue.

Information contained in a final prospectus together with all other information:

An abridged prospectus is a mini/summary version of the offering document issued together with the application form. An abridged prospectus contains a summary of the offer document with all relevant information. Under the Companies Act, an abridged prospectus must accompany each application form.

An abridged prospectus saves investors time and ensures they do not miss important details by providing them with the key information and features of the full prospectus at a glance.

An abridged prospectus contains information such as promoter details, price range, minimum bid lot and provisional deadlines, BRLM details, names of intermediaries, business overview and strategy, board details, the object of the issue, financial statements, a summary of claims and regulatory actions, etc.

For investors looking to understand the IPO quickly, the following sections are pertinent:

An IPO prospectus is a legal document that must contain all the information as per the guidelines laid down by SEBI.

The DRHP format, the RHP format and the prospectus format all remain the same. The RHP is an updated version of the DRHP and the final prospectus is an updated version of the RHP with all the latest changes and pricing information.

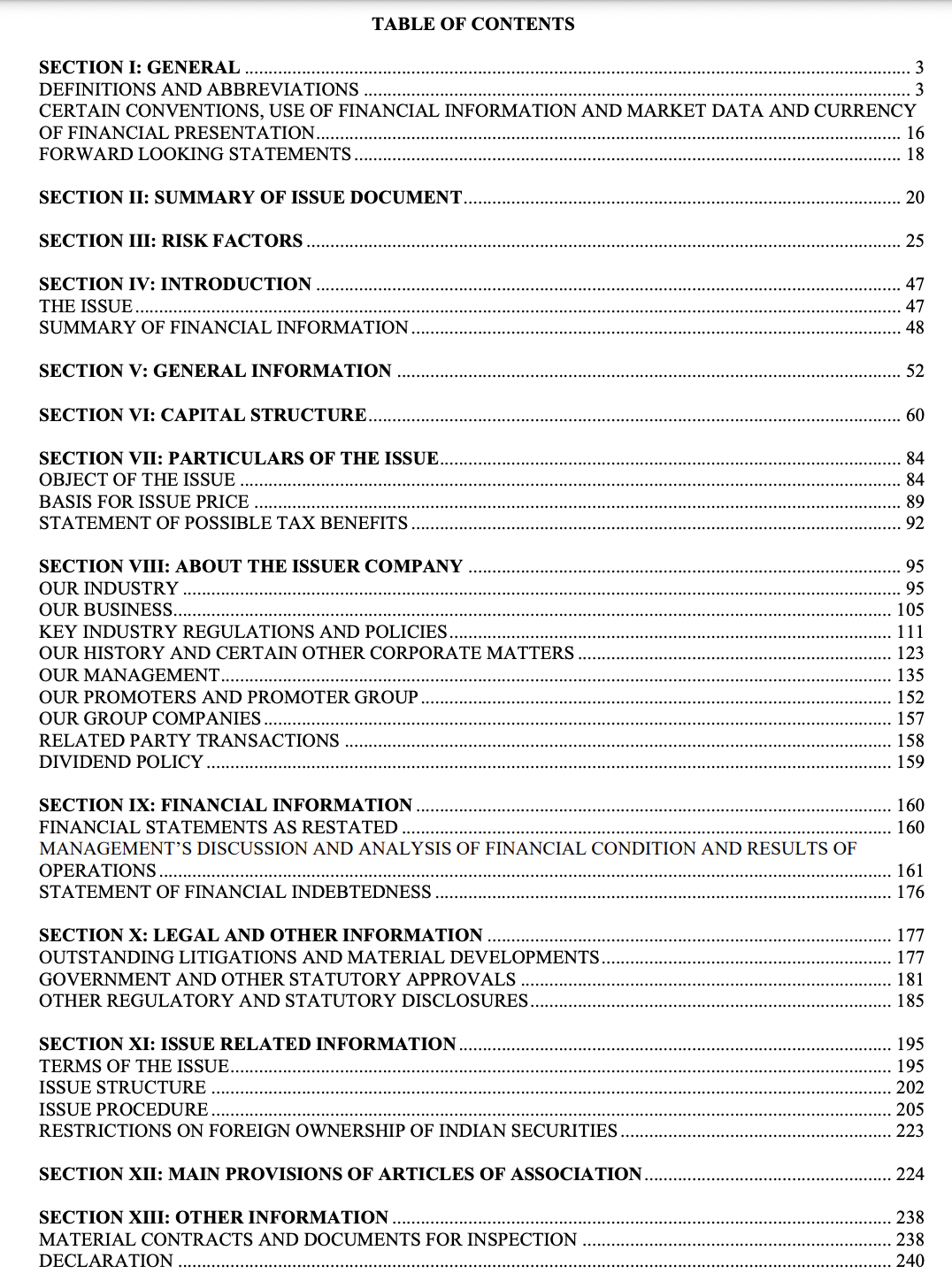

Refer to the below-extracted IPO Prospectus sample that gives an idea of the information an offer document needs to include.

In this section, let us take a detailed look at the contents of an IPO prospectus:

This section contains a complete list of definitions and abbreviations used in the offer Document with their meanings/full forms.

This section contains a general summary of the terms of the offer, including information about the company's primary business, the industry in which it operates, the names of the Promoters, the size of the Offering, the objectives of the Offering, the shareholdings of the Promoters, the Promoter Group and the Selling Shareholders, and risk factors and financing arrangements.

IPO prospectus risk factors section includes all risks that could potentially impact the Company. These include business risks, information about lawsuits filed against the company, product information, development-related costs and expenses, and positive and negative facts about the company's sales performance.

The introduction section is divided into different parts that include a summary of information about the offering, a summary of financial information, and the capital structure of the company.

This section contains information about the offer structure, including issue size, fresh issue size, offer for sale, face value, IPO price, investor allocation portion or percentage, net issue, employee reservation, market maker portion, and employee discount information.

This section contains details on the consolidated or standalone balance sheet, profit and loss, cash flow statements and financial ratios like the PE Ratio, debt-to-equity ratio, and return on equity ratio, among others.

The capital structure includes details on the authorized share capital, issued/subscribed/paid-up capital before and after the issue, and details of the share premium account.

This section provides details on how the Company intends to use the net proceeds and the basis of the Offer Price.

The company specifies the purpose of the offer in this section and how the company intends to utilise the funds raised. An investor should analyse this section to understand whether the funds raised are used to repay the debt or for expansion purposes.

This section includes the qualitative factors, quantitative factors and comparison of accounting ratios with listed industry peers that form the basis for deriving the offer price.

This section provides an overview of the industry, operations, management and promoter details.

The Industry Overview section contains information on the Indian economy, including India's Gross Domestic Product (GDP), per capita income, a macroeconomic overview of India, and market information related to the industry to which the issuing company belongs.

The business overview section includes information on the core business, competitive strengths, opportunities, subsidiaries, business models, expansion plans, and detailed information on the company's products and services.

This section contains information about the Board of Directors, the relationships between the directors, the biographies of the directors, the terms of appointment of the directors, their compensation, their ownership stakes in the Company, changes in the Board of Directors, and other management-related data.

This section contains information about individual promoters and promoter groups, including their names, shareholdings, personal details, information about the promoters' trust company, promoters' experience with the Company's business, changes in control of the Company.

This section contains information about the issuer's affiliates, including regulatory violations, business interests, related business transactions, financial information and other relevant data.

This section contains information on the company's restated standalone and consolidated financial statements, including balance sheets, income statements and cash flows, as well as any financial-related information.

This section contains information about legal actions taken against the Company, its directors, its promoters and its subsidiaries, including any criminal proceedings, legal or regulatory actions and tax claims.

The offering-related information includes the terms of the offer such as market lots, trading lots, ranking of shares, offering structures, allocation tables for investors, payment terms, bidding information, and details of the IPO process (fixed or book-build).

The provisions of the Articles of Association contain information on the provisions of the Company's Articles of Association, the calling of shares, the transfer of shares, information on the issuance of bonds, the transfer of shares, repurchases, general meetings and the forfeiture of shares.

This section includes all other matters such as material contracts and documents relating to the Offer. This is followed by a statement from the management confirming that all the information contained in the Offer Document is true and correct and complies with the SEBI Guidelines and the provisions of the Companies Act 2013.

The DRHP and RHP are the offering documents that must be issued in the event of an IPO. They both contain the same content, but the information differs because one document is a draft and the other is an updated version of the draft.

| Criteria | DRHP | RHP |

|---|---|---|

|

Meaning |

DRHP is the primary offering document, also known as the draft offering document. |

RHP is the updated version of the Draft Prospectus includes all the latest changes made after the publication of the Draft Document and the changes proposed by SEBI. |

|

Information |

DRHP includes Business details, offer structure, investor allocation, management details, shareholding structure, risk factors, and legal information, financial information, terms of issue, offer of issue etc. |

RHP contains all information included in the DRHP with updated financials, issue dates, and changes to previously mentioned information. |

|

Purpose |

Preliminary document to

|

Updated document with all changes incorporated to announce IPO dates. |

|

Issue Type |

Book-Building Issue: This does not contain the issue price, number of shares, and total issue shares. Fixed Price Issue: It contains the issue size, price, and total number of offered shares. |

Book-Building Issue: It includes issue dates and updated financials. Fixed Price Issue: There is no RHP in case of fixed price issue. Its DRHP and Final Prospectus. |

|

Filing |

Filed and submitted at the time of application submission. |

Filed and drafted after the DRHP approval. |

|

Approval |

Mainboard IPO: SEBI approval SME IPO: Exchange approval |

SEBI approval is required. |

|

Mandatory |

DRHP is mandatory for every IPO. |

RHP is required in case of book-built issues. Once the price is determined after the closing of the offering, the company will file a final prospectus updating the pricing information. In the case of a fixed-price issue, the final prospectus is issued directly because the price is fixed in advance. No RHP is required for a fixed-price offering. |

RHP applies to IPOs and FPOs, while shelf prospectus applies to public offerings of bonds (NCDs).

| Criteria | RHP | Shelf Prospectus |

|---|---|---|

|

Meaning |

Red Herring Prospectus is issued in case of an IPO or FPO. |

Shelf prospectus is issued when a company wants to issue bonds (e.g. NCDs). |

|

Mandatory |

Every time a company wants to issue shares in the form of IPO or Follow-on public offering (FPO), the issuer company has to file RHP with SEBI. RHP is required in case of book-built issues. |

With a shelf prospectus, a company can issue the bonds up to four times. |

The prospectus is one of the most important factors in applying for an IPO. It introduces the issuer to investors and allows them to learn about the company's operations, related risk factors, capital structure, offering details, management details, share ownership, financial statements, and intermediary information. Investors can evaluate all aspects before deciding whether or not to invest in the company. DRHP and RHP contain all the information about the company and the offering structure, while the final prospectus contains the IPO price, total number of shares and net proceeds.

An IPO Prospectus is the final offer document issued in case of an IPO that contains all the information about a company in a particular format as prescribed by SEBI.

An IPO Prospectus helps an investor to make an informed decision on whether or not to invest in the IPO based on the facts and figures mentioned in the prospectus.

An IPO prospectus provides investors with comprehensive information about a company. It is an offer document that is made available to the public so that they can learn more about the following:

DRHP and RHP PDF file are public documents available on Chittorgarh.com at

DRHP and RHP are also available on the public domain including the website of issuer, lead manager, SEBI and stock exchanges, BSE SME, NSE SME, BSE and NSE. A prospectus is generally accessible through the investor relations or offer document/IPO section of a company's website.

SEBI is required to submit observations on a draft offer document within 30 days from the date of receipt of the draft offer document or 15 days from the date of receipt of a satisfactory reply to the additional clarifications sought by SEBI from the merchant banker.

The Company should open its issue within the twelve-month window commencing from the date of the SEBI Letter of Notice as this is the only time frame for which it is valid.

An IPO prospectus is a comprehensive document that contains all the information about the company. In order to read an IPO prospectus, it is important to understand the content and purpose of each component of the prospectus.

This page contains the contact details, address and email address of the issuing company, the registrar and the merchant bank. One should check the lead manager of the issue and analyse their history and performance, because in many cases the performance of the IPO depends on the skills of the lead manager.

The cover sheet also includes information about the issue, size of the issue, price (in the case of a fixed-price issue), shares offered, type of offering, type of issue, IPO rating, risk of the initial offering, date of opening and closing of the issue.

The prospectus contains details about the company's operations, issuer's competitive strengths, industry overview and regulations, history, information about group companies, corporate structure, information about the management and board of directors, corporate governance, etc. This gives an investor a fair idea of the company vision.

A prospectus contains all the details of financial information such as total assets, total liabilities, total revenue, profit after tax, net worth, PE Ratio, debt-to-equity ratio, earnings per share, consolidated or restated balance sheet, cash flow, and profit and loss. The financial statements give an idea on the track record of the company.

This section of the Prospectus includes all internal and external risks relating to the Company and its management. Investors are generally advised to review all risk factors associated with a company before making an investment decision.

Offer structure includes information like face value, issue price, number of fresh shares, offer for sale shares, net issue shares, employee reservation, market maker portion, QIB, NII, RII portion and Post and pre-paid up capital details. This section gives an idea of the extent of equity dilution.

The purpose of the offering includes details of the issuer's plans for using the proceeds or funds from the offering. The issuer may use the proceeds for a variety of purposes, such as business needs, including product development, general corporate purposes, equipment purchases, acquisitions, capital expenditures and debt repayment.

Investors should note the use of the proceeds of the offering and whether the proceeds are used only for corporate purposes or also to meet business expenses.

The prospectus includes information on ongoing legal disputes, significant developments, and lawsuits involving the company, its promoters, its management, its subsidiaries, and group companies. It also includes any prohibitions or restrictions from SEBI.

Every company is involved in some or the other dispute. It is important to see whether the survival of the company is not impacted due any of the ongoing disputes.

This section is mainly for reference purposes and contains information about the description of the shares and the provisions of the Articles of Incorporation, as well as explanations, definitions, abbreviations and important contracts and documents for reference.

The merchant banker (lead manager) prepares and drafts the IPO prospectus with the help of the issuing company. The Merchant Banker's team gathers all the required information and documents from the issuing company, hires intermediaries, determines the capital/issue structure and fills all the required disclosures as per SEBI guidelines.

A DRHP for an IPO is a legal document prepared by the issuer and the merchant banker to request an IPO. It is the most important document submitted by a merchant banker at the time of filing the IPO application. It contains information about the issuer's operations, management, financial statements, offering details, capital structure and other details. DRHP is a draft document

The RHP is prepared once the application is approved, which is after the DRHP is submitted. The Red Herring Prospectus includes updated financial information, changes to the offering structure, and updates to the DRHP.

The DRHP and the RHP are 2 different documents. While the DRHP is filed earlier, the RHP is filed by incorporating additional information and comments received from regulators. The table below makes the difference easy to understand:

| DRHP | RHP |

|---|---|

|

Primary Document and filed at the time of Application submission. |

Filed after the DRHP |

|

Contains information related to company business, offer structure, management information, shareholding information, financial statements and other details related to IPO. |

RHP is an updated version of DRHP. Latest financial statements and updated offer details and dates are mentioned in RHP |

|

Mandatory to file DRHP for every IPO issue |

RHP is mandatory in case of book built issues. |

A prospectus is an offer document issued for launching an IPO. The prospectus is the final document containing all details, including the issue price and issue size, as well as all information from a draft document with updated and recent amendments.

An offer document is a document issued in case of an IPO. There are various types of offer documents. The names of the offering documents depend on what stage of the IPO they are in.

DRHP is the first document, also known as a draft offer document, issued to seek feedback from the public and SEBI/Exchange approval for the IPO. RHP is an updated offering document issued in case of book-built issues with updated financial information, issue dates and proposed amendments as directed by SEBI. A Prospectus is a final document containing pricing details, issue dates and all updated information from the RHP/DRHP. In case of a fixed price issue, a company directly issues a final prospectus.

All the offer documents including the prospectus contains a wealth of information about the company to help investors make their IPO investment decision.

You can download the IPO Prospectus from:

You can also find it on the website of:

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|