Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, September 18, 2018 by Chittorgarh.com Team | Modified on Monday, July 18, 2022

Incorporated in March 2015, SAMCO Securities Limited is a leading online discount broker. Previously the company was known as Samruddhi Stock Brokers Limited which was later rebranded into SAMCO Securities.

The company offers online trading services in Stocks, Futures, Options, and Commodities across multiple exchanges including NSE, BSE, and MCX-SX etc. In addition, SAMCO customers can invest in IPOs and mutual funds from the platform. It is a depository participant of CDSL for demat accounts.

SAMCO Launched Indian Trading League, a stock and commodity trading competition for investors.

| Pros | Cons |

|---|---|

|

Charges one of the lowest brokerage fees. |

3-in-1 account not available. |

|

Free, good trading platforms |

No local branches for support. It is a complete online discount broker. |

|

Free Trading and Demat Account opening |

|

|

Good training resources for new traders |

|

|

Instant Account opening with digital KYC |

|

|

100% Brokerage as cash back for the 1st month on trading from StockNote platform. |

SAMCO Securities offers multiple online trading platforms to its customers to suit their individual trading needs. All trading platforms are available free to the customer. Trading platforms offered by SAMCO are:

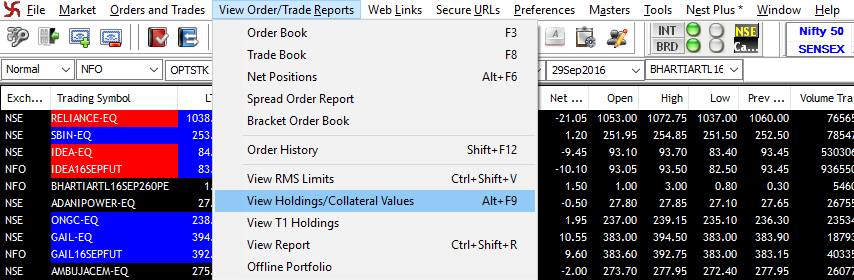

It is an installable trading platform available for Windows computers. The SAMCO trader is built on NEST trading platform of Thomson Reuters. The platform offers good speed and reliability. Customers can download the platform on their personal computers and trade on it.

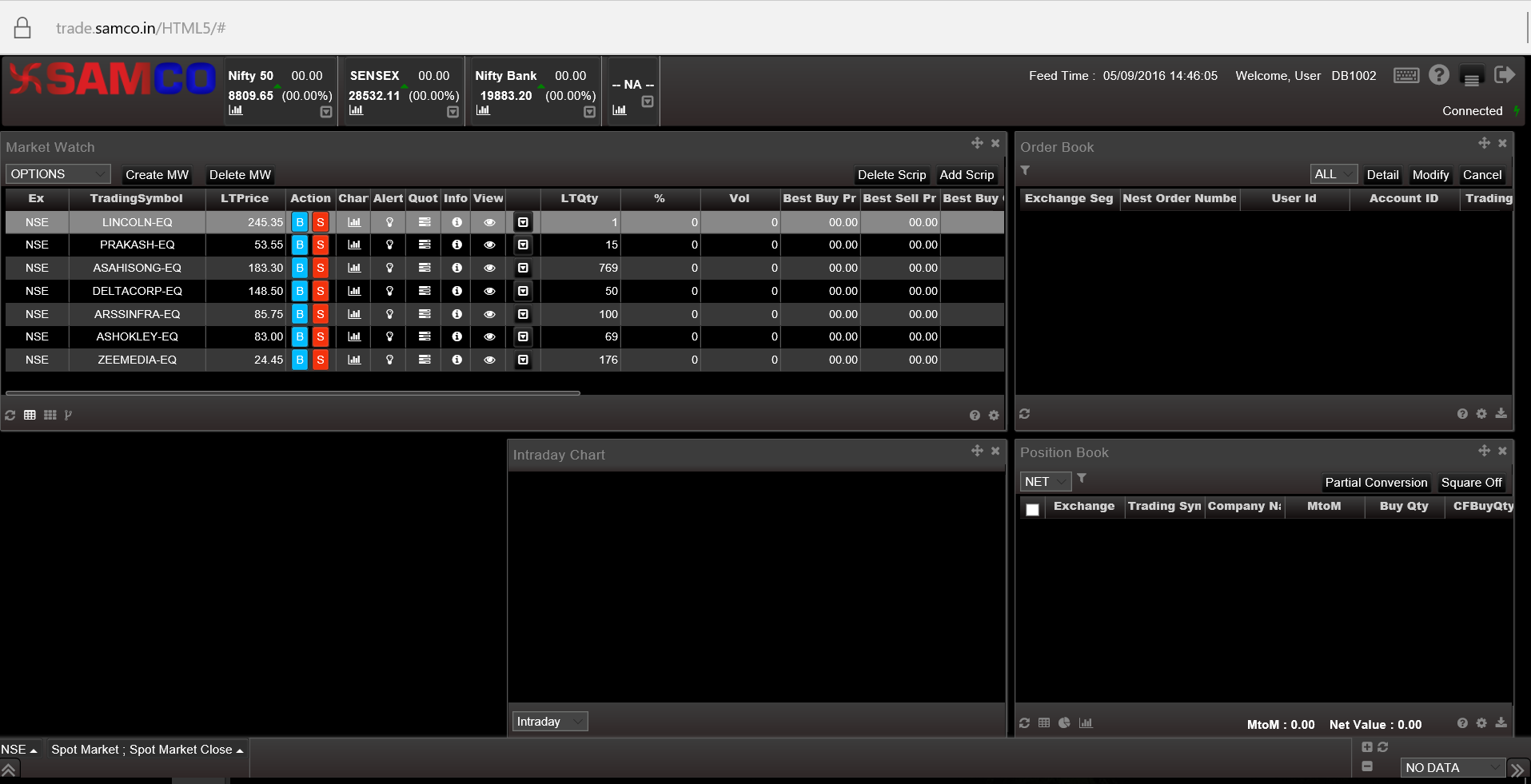

It is a web-based trading application which can be accessed using any browser.

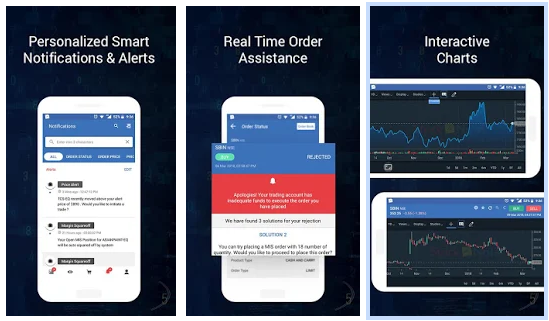

It is a Mobile Trading App that allows SAMCO customers to trade from anywhere.

It is the back office that helps traders to analyze their trades, check account statements, manage funds, monitor holdings and pledge / unpledge their holdings.

SAMCO also offers call and trade facility wherein its customers can trade on the phone. This service is available at an additional cost of Rs 20 per executed order.

SAMCO also offers a range of useful tools and calculators to its customers like:

The Option Value calculator helps traders calculate Fair Values of Call and Put options for Stock, Nifty and other Index Options listed on the NSE. The tool can also be used to simulate the outcomes of different positions in the options due to change in factors like volatility or interest rates.

It provides traders with an honest picture of risk and its degrees of concentration or dispersion so as to help them balance their portfolio and keep it profitable. The tool will scan all the securities available in a customer's trading portfolio, and present a graphical picture of asset and sectoral allocation as well as percentage components of each instrument in the portfolio.

SAMCO's Risk Monitor tool warns traders against high exposure in a single sector to protect their portfolio against one adverse regulation. It also cautions traders against overexposure in a single stock, over-diversification and unrated stocks. The tool rates stocks against various parameters and rates them.

It is a proprietary stock rating tool that helps customers pick good stocks. The tool rates stocks on over 20+ important business parameters and grades them from 'AAA' to 'Penny' based on the results.

SAMCO Caution Stock Watchlist- The tool helps SAMCO customers prevent themselves from fraudulent SMS Tips by operators and manipulators. The caution stock watchlist is built using a robust surveillance mechanism that tracks tips from unscrupulous market elements and adds the stock to the list.

In addition to the above tools, SAMCO also offers good calculators like-

Margin Calculator & SPAN Calculator- It is helpful in calculating the margin requirements for selling options or for multi-leg F&O strategies before taking a trade.

This tool is helpful in calculating total brokerage costs and other transaction charges.

SAMCO offers 3 trading plans or as they call it 'leverage products' for their customers to choose from-

|

Trading Account Opening Charges |

Nil |

|

Trading Account Maintenance Charges |

Nil |

|

Demat Opening Charges |

Nil |

|

Demat Account Maintenance Charges |

Rs 400 per year |

| SAMCO Options Charges | Equity Options | Currency Options |

|---|---|---|

|

Brokerage |

Rs 20 per executed order |

Rs 20 per executed order |

|

Call and Trade Charge |

Additional Rs 20 per executed order |

Additional Rs 20 per executed order |

|

Securities Transaction Tax (STT) |

0.05% on Sell Side on premium amount |

No STT |

|

Transaction / Turnover Charges |

NSE Rs 7500 per crore BSE Rs 1 per trade on premium |

NSE Rs 4000 per crore or 0.04% on premium |

|

Goods and Services Tax (GST) |

18% on (Brokerage + Transaction Charge) |

18% on (Brokerage + Transaction Charge) |

|

SEBI Charges |

Rs 5/Crore |

Rs 5/Crore |

|

Stamp Charges |

As per rates in the residential state of the investor |

As per rates in the residential state of the investor |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|