Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

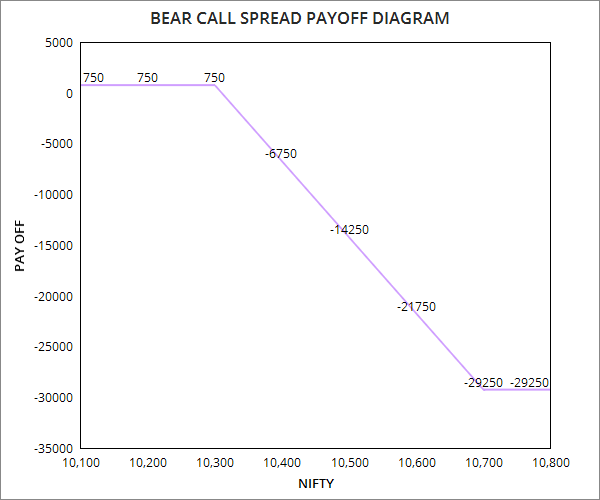

asked

A Bear Call Spread strategy is a two-leg strategy involving buying a Call Option while simultaneously selling a Call Option. The strategy is also called as the bear call credit spread. To execute this strategy, you can Buy 1 OTM Call and Sell 1 ITM Call of the same expiration date.

When to use Bear Call Spread strategy?

The Bear Call spread strategy is used by traders when they expect the price of the underlying to moderately fall. The maximum profit and loss in this strategy are limited.

Maximum Loss = Long Call Strike Price - Short Call Strike Price - Net Premium Received

Max Profit = Net Premium Received

Bear Call Option Strategy Payoff Graph

Add a public comment...

List of all questions Ask your question

List of all questions Ask your question

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|