Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

asked

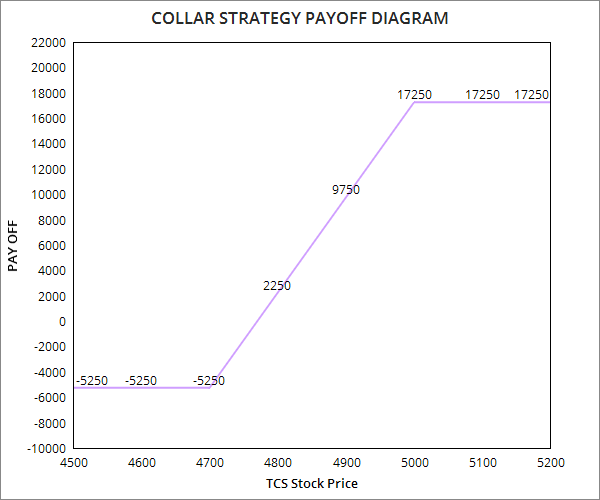

A collar is an options trading strategy used when you hold shares in a company and want to hedge them against a sharp fall in the share price. This involves buying a put option and selling a call option.

Max Loss = Purchase Price of Underlying - Strike Price of Long Put - Net Premium Received

Max Profit = Strike Price of Short Call - Purchase Price of Underlying + Net Premium Received

Suppose you hold 250 shares of TCS, currently trading at Rs 3495. So your collar option strategy would involve buying 1 TCS 3450 Put and selling 1 TCS 3550 Call.

If the price rises to Rs 3550, the value of your shares will increase and you will lose net premiums. However, if the price falls to Rs 3450, you lose the value of your shares but benefit from exercising the Put option.

The synthetic collar option strategy involves the simultaneous purchase of a long call option and the sale of a short put option at the same strike price, creating a synthetic long position in the underlying.

This strategy can provide downside protection at a lower cost than the collar strategy but forgoes some potential gains. The synthetic collar can be useful for investors who want to limit their downside risk while retaining potential gains.

The reverse collar is a hedging strategy used to protect a position from falling prices. As with most collars, both calls and puts are bought at the same time. In the case of the reverse collar, they have the same expiry date but different strike prices.

In a reverse collar, a trader buys calls and sells puts. In many cases, the cost of using this type of collar is very low. It essentially serves as protection against a sudden drop in the price of the asset and can be successfully used to protect an open position around earnings releases or other major events that are likely to cause price fluctuations.

Add a public comment...

List of all questions Ask your question

List of all questions Ask your question

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|