Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

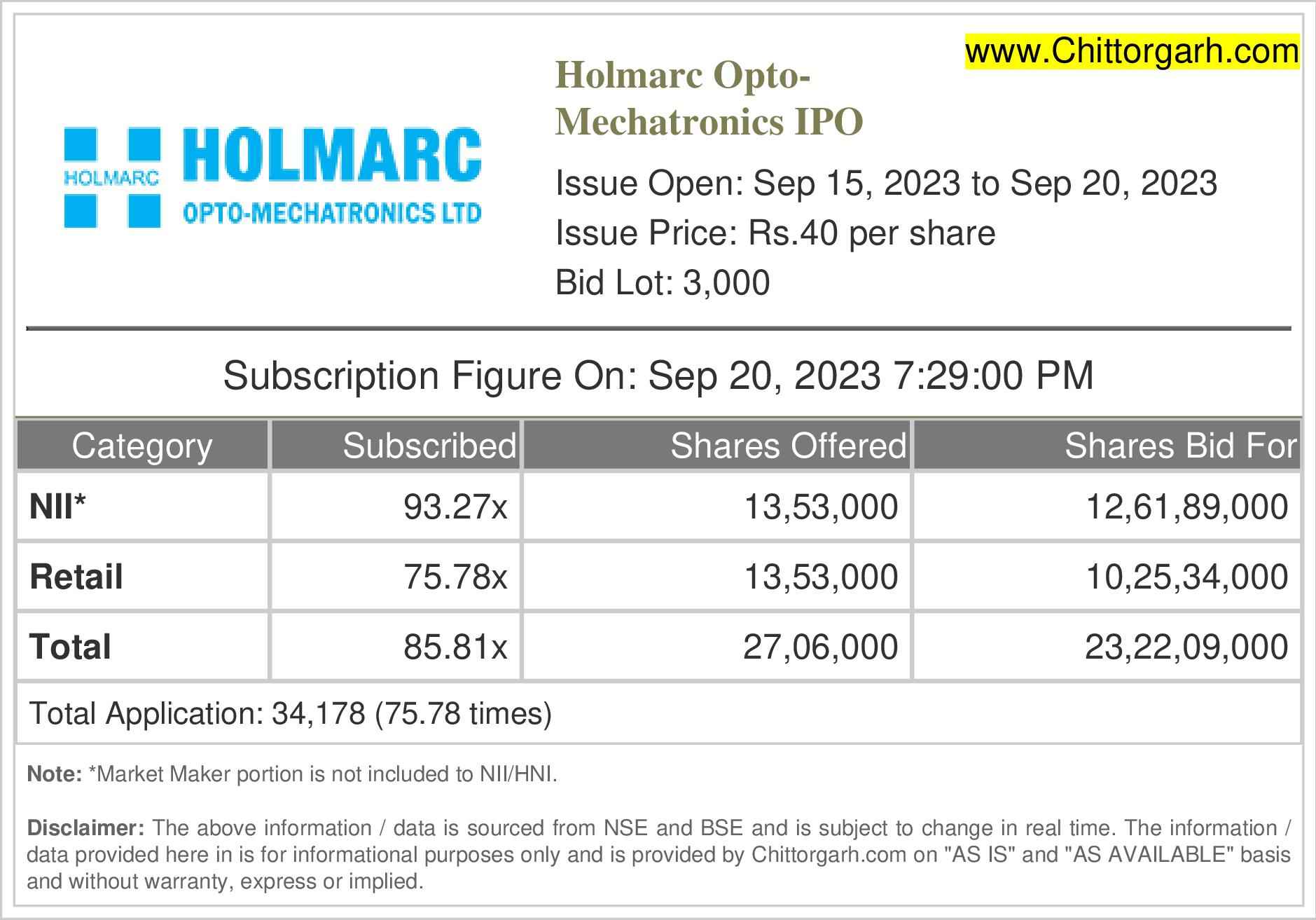

Holmarc Opto-Mechatronics IPO subscribed 85.81 times. The public issue subscribed 75.78 times in the retail category, 93.27 times in Other category by September 20, 2023.

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Others | 93.27 | 1,353,000 | 12,61,89,000 | 504.76 |

| Retail Investors | 75.78 | 1,353,000 | 10,25,34,000 | 410.14 |

| Total * | 85.81 | 2,706,000 | 23,22,09,000 | 928.84 |

Total Application : 34,178 (75.78 times)

Disclaimer: *The total amount is calculated based on the final issue price or the price in the upper price range.

* Market Maker portion of 144,000 equity shares not included.

| Date | Other | Retail | Total |

|---|---|---|---|

| Day 1 September 15, 2023 | 0.36 | 2.51 | 1.44 |

| Day 2 September 18, 2023 | 2.72 | 14.06 | 8.40 |

| Day 3 September 20, 2023 | 93.27 | 75.78 | 85.81 |

Holmarc Opto-Mechatronics IPO is a public issue of 2,850,000 equity shares. The issue offers 1,353,000 shares to retail investors, 1,353,000 shares to other investors. The other investors include applicants other than retail i.e. HNI, corporates, institutions, (NII and QIB).

| Category | Shares Offered | Amount (Rs Cr) | Size (%) |

|---|---|---|---|

| Market Maker | 144,000 | 0.58 | 5.05% |

| Other | 1,353,000 | 5.41 | 47.47% |

| Retail | 1,353,000 | 5.41 | 47.47% |

| Total | 2,850,000 | 11.40 | 100% |

Financial Institutions, Banks, FIIs, and Mutual Funds registered with SEBI are called QIBs. In most cases, QIBs represent small investors who invest through mutual funds, ULIP schemes of insurance companies, and pension schemes.

Retail Individual Investors (HNI), NRIs, Companies, Trusts, etc who bid for shares worth more than Rs 2 lakhs are known as Non-institutional bidders (NII). Unlike QIB bidders, they do not need SEBI registration.

NII category has two subcategories:

The Small NII category is for NII investors who bid for shares between Rs 2 lakhs to Rs 10 lakhs. The 1/3 of NII category shares are reserved for the Small NII sub-category. This subcategory is also known as Small HNI (sHNI).

The Big NII category is for NII investors who bid for shares worth more than Rs 10 Lakhs. The 2/3 of NII category shares are reserved for the Big NII subcategory. This subcategory is also known as Big HNI (bHNI).

The retail individual investor or NRIs who apply up to Rs 2 lakhs in an IPO are considered as RII reserved category.

A category of eligible employees who have a reserved quota in the IPO.

A category of eligible shareholders or other investors who have a reserved quota in the IPO.

What is the difference between RII, NII, QIB and Anchor Investor?

Disclaimer: The above information / data is sourced from National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) websites and is subject to change in real time. For latest information / data, please refer to the respective websites. The information / data provided here in is for informational purposes only and is provided by Chittorgarh.com on "AS IS" and "AS AVAILABLE" basis and without warranty, express or implied. Chittorgarh.com does not warrant the accuracy, adequacy or completeness of the information you obtain through the above websites. Chittorgarh.com shall not be liable in any way for any discrepancies, errors, omissions, losses or damage. Chittorgarh.com, including its affiliates and its directors, staff and employees, shall not be liable for any loss, damage of any kind, including but not limited to direct, indirect, punitive, exemplary, consequential damages and lost profits arising in any way out of the use of information / data obtained through the said websites. The recipient alone is fully responsible / liable for any decision made based on this information / data. All recipients, before relying on the said information, should do their own research and seek appropriate professional advice.

The Holmarc Opto-Mechatronics IPO is subscribed 85.81 by September 20, 2023.

| Investor Category | Subscription (times) |

|---|---|

| Qualified Institutional | [.] |

| Non Institutional | 93.27 |

| Retail Individual | 75.78 |

| Employee Reservations | [.] |

| Others | [.] |

| Total Subscription | 85.81 |

An investor can apply in Holmarc Opto-Mechatronics IPO online via bank (using ASBA) or the broker (using UPI). The Holmarc Opto-Mechatronics IPO shares are offered online only.

The Holmarc Opto-Mechatronics IPO is subscribed 85.81 by September 20, 2023.

The Holmarc Opto-Mechatronics IPO allotment status is expected on or around September 25, 2023. Visit Holmarc Opto-Mechatronics IPO allotment status to check.

Visit Holmarc Opto-Mechatronics IPO subscription status page for real-time bidding information about Holmarc Opto-Mechatronics IPO.

| IPO Opens On | September 15, 2023 |

| IPO Closes On | September 20, 2023 |

| Finalisation of Basis of Allotment | September 25, 2023 |

| Initiation of Refunds | September 26, 2023 |

| Credit of Shares to Demat Account | September 27, 2023 |

| IPO Listing Date | September 25, 2023 |

Useful Articles

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|