Chemical companies usually have a single or a couple of chemistry competencies for their entire product portfolio; however, this company have "EIGHT CHEMISTRY

COMPETENCIES" to use for our wide array of products, which enables them to cater to niche and advanced intermediate requirements of a wider range of end-products and applications.

They have three business models under which we operate: [Revenue break-up as on Dec'21]

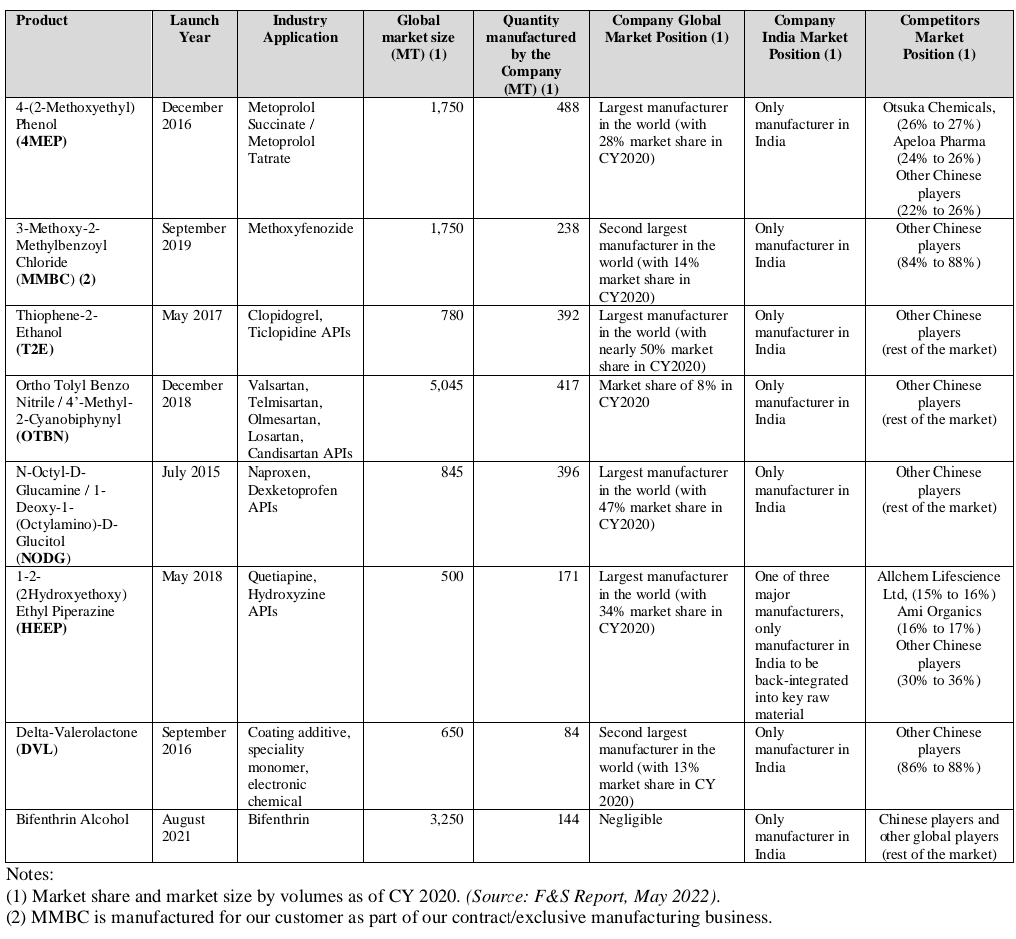

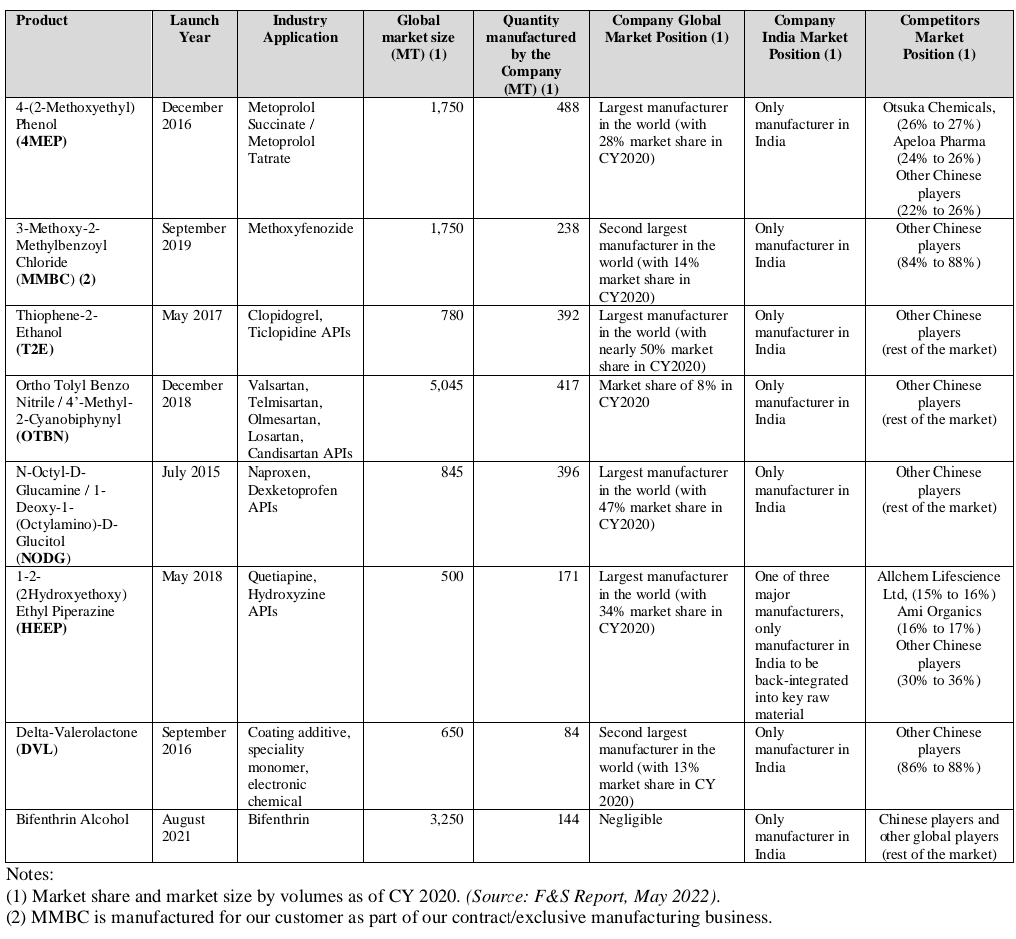

(i) large scale manufacturing of our own intermediates and speciality chemicals;[70.71% of Revenue]

(ii) contract research and manufacturing

services (“CRAMS”) : [7.44% of Revenue]

(iii) contract/exclusive manufacturing. [21.85% of Revenue]

CRAMS customers work jointly with scientists and engineers of the company, and the company execute their projects in their R&D Facilities. Molecules developed in their CRAMS business for their customers have the potential to convert into regular commercial supplies and become large scale manufacturing products for the Company. The

CRAMS business model also enables dialogue and discussions with the top technical teams and leadership (CTOs), technical directors and technical vice presidents) of their customers, opening up future contract manufacturing opportunities.

CRAMS customers: Adama Group (Israel), Altana AG (Germany), Aramco Performance Materials LLC (US/Saudi Arabia), Austin Chemical Company, Inc. (USA), Avient Corporation (UK), BYK Chemie GmbH (Germany), Connect Chemicals (Germany), Milliken & Co. (USA), Polaroid Film BV (Netherlands), and Tosoh FineChem Corporation (Japan).

CONTRACT MANUFACTURING CUSTOMER: Adama Group (Israel), Altana AG (Germany), BYK Chemie GmbH (Germany), Divis Laboratories Limited (India), Dr. Reddy’s Laboratories Limited (India), Moehs Iberica SL (Spain) and UPL Limited (India).

They are among the few Indian specialty

chemical companies to have successfully launched these three separate business models in just 5 years into commercial manufacturing.

CRAMS business segment has huge potential in future and this business segment generate 70% margin business for the company.

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)