Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

asked

An options trade means buying or selling a Call or Put option. You can trade in equity, commodity and currency options. You pay a premium for buying an Option while receiving a premium for selling an Option. Options can be traded in exchanges as well as in OTC markets.

Example of Option Trade:

Suppose you want to buy a Call Option of TCS currently trading at 3495. Options have 3 contract cycles: 1, 2 and 3 months. So you have to choose which contract cycle you want to buy. Contract cycles expire on the last Thursday of their month. Then there are various strike prices of the contract to choose. The strike prices are like goals which you expect an Option to reach on expiry. It can be higher or lower than the current price of the contract. The next step is to choose the lot size. A lot size is the number of shares of the underlying, in this case, TCS, you want to buy. The lot size is decided by the exchange. For TCS, it is 250.

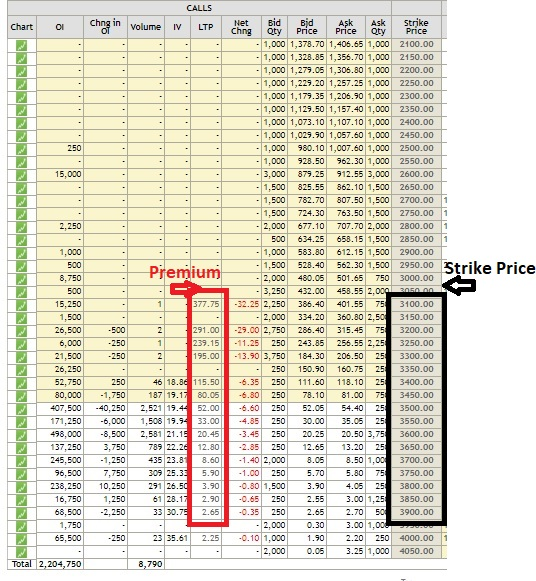

You have to pay a premium for buying an Option. The premium is decided by the exchange and is expressed per share. The boxed column in the below image shows the premium prices for various strike prices, as on May 18, 2018, for Call options expiring on May 31st.

So if you want to buy a Call option with strike price of 3600 then your premium would be Rs 20.45 per share. As the lot size for TCS is 250 shares, you have to pay Rs 20.45 X 250= Rs 5112.50.

If the TCS goes above 3600 you will make a net profit. In case the TCS stays at or falls below 3100, you will make a loss of the premium paid. In between, you can settle the Option by squaring off by selling a Call Option of 3600 strike price for the same month and depending on the situation earn a profit or limit your loss.

List of all questions Ask your question

List of all questions Ask your question

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|

If you're interested in option trades, Hedged is an InvesTech platform that provides its members with free and paid research advisory on both long and short-term option trades through its trained algorithms : hedged.in