Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Urja Global Ltd. (UGL) is a developers and operators of Non Renewable and Renewable Energy. It is engaged in design, consultancy, integration, supply, installation, commissioning & maintenance of off-grid and grid connected Solar Power Plants and decentralized Solar Applications. The company is operating in highly competitive field with many local and international players.

To meet its plans for augmenting the existing and incremental Working Capital requirement of the Company (Rs. 20 cr.), adjustment of unsecured loans against the entitlement of promoter (Rs. 2.59 cr.), and General corporate purposes (Rs. 1.91 cr.), UGL is coming out with a rights issue in the ratio of 7 shares against 71 shares held as on record date of January 15, 2021. The company is issuing 50000000 equity shares having face value of Re. 1 at a premium of Rs.4 per share thus making the offer price at Rs. 5 per share. With this issue, company hopes to mobilize Rs. 25 cr. UGL is spending Rs. 0.50 cr. for this issue. Surprisingly, this issue has no merchant banker for the issue process. The issue opens for subscription on January 25, 2021 and will close on February 10, 2021. Investors have to pay Rs. 1.25 per share (Rs. 0.25 FV and Re. 1 premium) on application and the rest in one or more calls post allotment. Alankit Assignments Ltd. is the registrar for the issue. Post allotment, shares will be listed on BSE and NSE.

Promoter of the Company through their letter dated August 10, 2020 (the 'Subscription Letter') have confirmed that it intends to subscribe to the full extent of its Rights Entitlement in the Issue and to the extent of unsubscribed portion (if any) of the Issue. Further, the Promoter may also apply for additional shares along with its Rights Entitlement and/or renunciation. Such subscriptions of Equity Shares over and above its Rights Entitlement, if allotted, may result in an increase in its percentage shareholding above their current percentage shareholding.

For the last three fiscals, on a consolidated basis UGL has posted revenue from operations/net profits (loss) of Rs. 133.28 cr. / Rs. - (0.86) cr. (FAY18), Rs. 136.38 cr. / Rs. 0.004 cr. (FY19) and Rs. 163.56 cr. / Rs. 1.12 cr. (FY20). For the first half ended on September 30, 2020, it has earned net profit of Rs. 0.65 cr. on a turnover of Rs. 57.06 cr. The in pre-rights issue periods, it has posted higher profits. As on September 30, 2020 its current paid up equity capital of Rs. 50.72 cr. is supported by Rs. 114.08 cr. and promoters holding on the said date are 31.55%. Post issue it's paid up capital will stand enhanced to Rs. 55.72 cr.

If we annualize FY21 H1 performance and attribute it on fully diluted equity post rights issue, then asking price is at a P/E of 217.3, thus rights issue is priced exorbitantly. With the rights issue pricing, the company is looking for a market cap of Rs. 278.60 cr.

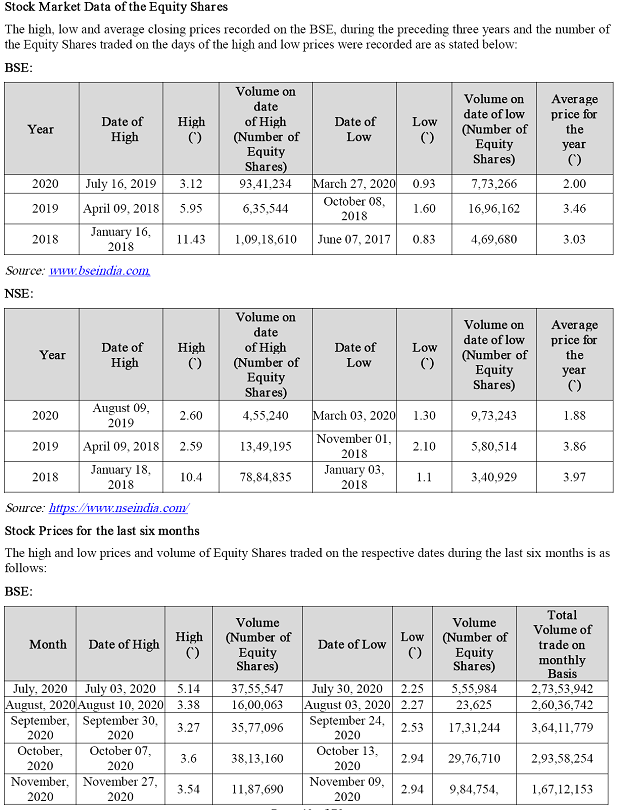

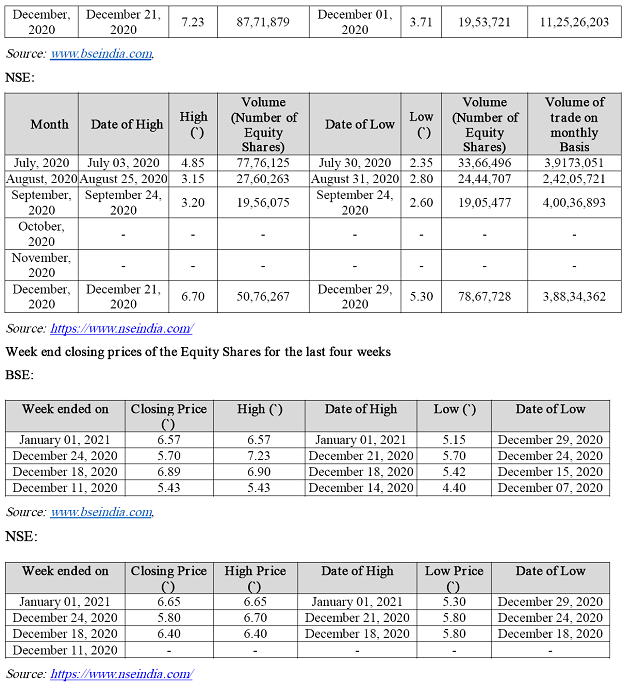

The company has no dividend track records so far. It has been trading miraculously. One can track the trading patter from the following tables:

The scrip closed at Rs. 9.56 on cum-right basis on January 13, 2021 and closed at Rs. 8.70 on ex-right basis on January 14, 2021. The scrip last closed on ex-right basis at Rs. 7.71 on January 22, 2021.

If market circles are to be believed, the scrip was hovering around Rs. 3 /Rs. 3.5 in October and November 2020 and then it marked northward move in December 20 and January 21 with hand in gloves operations between wasted interest parties after announcements of the rights issue proposal.

As per offer documents, the company has made a statement 'In case the rights issue remains unsubscribed, the Board of Directors may dispose of such unsubscribed portion in the best interest of the Company and in compliance with the applicable laws.' (Page 29). The issue is priced at a P/BV of 1.64 based on its consolidated NAV of Rs. 3.05 as on March 31, 2020.

Review By Dilip Davda on January 23, 2021

The Urja Global Rights Issue Analysis helps you to understand about the company, offer detail, valuation, capital structure and financial performance. Our SEBI registered Rights Issue Analysts tells you if Urja Global Rights Issue worth investing. The Urja Global Rights Issue Note sets the Rights Issue expectations in systematic way which tells you if Urja Global Rights Issue good to buy (good or bad / yes or no). The Rights Issue Forecast tells you weather to invest in Urja Global Rights Issue by providing Rights Issue recommendations i.e. subscribe, avoid and neutral.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|