Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Review By Dilip Davda on September 25, 2019

Indian Railway Catering & Tourism Corporation Ltd. (IRCTC) is an only Public Sector Undertaking authorized to by Indian Railways to provide catering services, online railway tickets and packaged drinking water at railway stations and trains in India. It has been conferred upon Mini-Ratna status as well. IRCTC is wholly owned by Government of India (GoI) and has administrative control of the Ministry of Railways. It is also promoting international and domestic tourism through public-private partnership

IRCTC operates one of the most transacted websites, www.irctc.co.in, in the Asia-Pacific region with transaction volume averaging 25 to 28 million transactions per month during the five months ended August 31, 2019. It has also diversified into other businesses, including non-railway catering and services such as e-catering, executive lounges and budget hotels, which are in line with its objective to build a 'one stop solution' for its customers. Currently, it operates in four business segments, namely, internet ticketing, catering, packaged drinking water under the 'Rail Neer' brand, and travel and tourism. Currently IRCTC has nearly 72.60% online railway ticket booking business volume with login of over 25 million per month and 7.2 million per day. The company expects average 8% growth in catering segment for the coming five years. New catering policy of 2017 augurs well for the future prospects of IRCTC. It currently has 10 manufacturing facilities and six are under commissioning for Rail Neer.

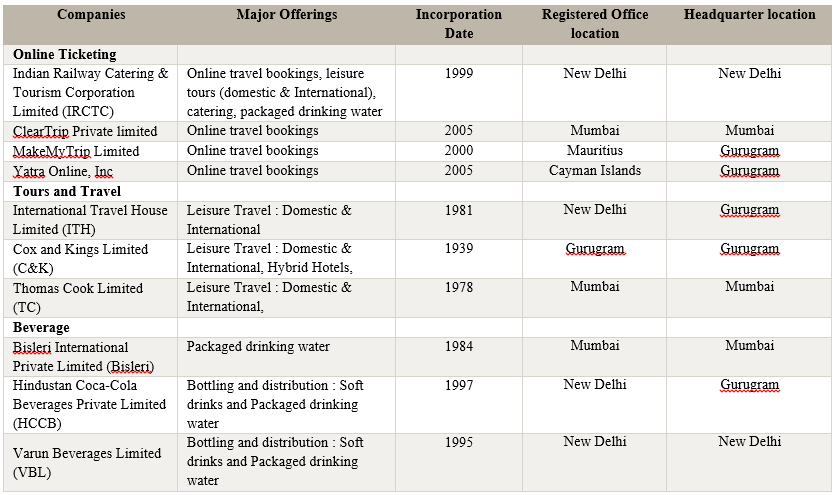

CRISIL Research has evaluated the key players across online ticketing, tours and travels and beverage segments in the section below.

The company has implemented its own payment gateway platform named IRCTC e-Wallet and is also developing additional payment tools such as IRCTC iMudra and i-Pay. IRCTC mandated with two trains under the haulage concept, with ticketing and on board services. It enjoys full freedom to determine the trains' fares. Currently it is in process of finalizing the modalities of this concept.

The company is enjoying virtual monopoly with its business model offering major tourism related services on all aspects under one roof.

For listing gains through dis-investment, IRCTC is coming out with its maiden IPO with an offer for sale of 20160000 equity shares of Rs. 10 each with a price band of Rs 315 - Rs 320 to mobilize Rs 635.04 cr to Rs 645.12 cr. on the basis of lower and upper price bands. The company is diluting 12.6% of GoI holding with this issue. Issue opens for subscription on 30.09.19 and will close on 03.10.19. Minimum application is to be made for 40 shares and in multiples thereon, thereafter. It has reserved 160000 shares for eligible employees. From the balance shares on offer, it has allocated 50% for QIB, 15% for HNIs 15% and 35%for the retail investors. As the issue is purely an offer for sale, its post issue paid up equity will remain at Rs 160 cr. Post allotment shares will be listed on BSE and NSE. IRCTC is offering a discount of Rs 10 per share to eligible employees and retail investors.

It has issued entire equity at par so far and has also given bonus shares in the ratio of 1 for 1 in March 2017 and 3 for 1 in March 2019. The average cost of acquisition of shares by the selling shareholders is Rs 1.25 per share. Issue is jointly lead managed by IDBI Capital Markets & Securities Ltd., SBI Capital Markets Ltd. and Yes Securities (India) Ltd. Alankit Assignments Ltd. is the registrar to the issue.

On financial performance front for the last three fiscals, IRCTC has posted total revenue/net profits of Rs 1602.85 cr. / Rs 229.08 cr. (FY17), Rs 1569.56 cr. / Rs 220.62 cr. (FY18) and Rs 1956.66 cr. / Rs 272.60 cr. (FY19). The company has posted CAGR of 10.49% in revenue and 14% in net profits. It follows liberal dividend policy with lat three year's average dividend payouts of 40%. As on 31.03.19, it's paid up equity capital of Rs 160 cr. is supported by free reserves of Rs 882 cr. plus. For the last three fiscals it has posted an average EPS of Rs 15.50 and an average RoNW of 25.63%. Issue is priced at a P/BV of 4.91 (on upper price band) on the basis of its NAV of Rs 65.18 as on 31.03.19. If we consider FY19 earnings and attribute it on its current paid up equity, then asking price is at a P/E of 18.8. Thus issue appears fully priced, but considering its virtual monopolistic business model, it is sure to generate fancy post listing.

As per offer documents, IRCTC has not listed peers to compare with.

On BRML's front, three merchant bankers associated with the offer have handled 25 public issues in the past three years out of which 11 closed below the issue price on listing date.

Review By Dilip Davda on September 25, 2019

DISCLAIMER: No financial information whatsoever published anywhere here should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for educational and information purposes only and under no circumstances should be used for making investment decisions. Readers must consult a qualified financial advisor before making any actual investment decisions, based on the information published here. My reviews do not cover GMP market and operators game plans. Any reader taking decisions based on any information published here does so entirely at their own risk. Investors should bear in mind that any investment in stock markets is subject to unpredictable market-related risks. The above information is based on RHP and other documents available as of date coupled with market perception. The author has no plans to invest in this offer.

About Dilip Davda

Dilip Davda is veteran journalist associated with stock market since 1978. He is contributing to print and electronic media on stock markets/insurance/finance since 1985.

Dilip Davda is a leading reviewer of public issues and NCDs in the primary stock market in India. The knowledge he gained over 3 decades while working in the stock market and a strong relationship with popular lead managers makes his reviews unique. His detail fundamental and financial analysis of companies coming up with IPO helps investors in the primary stock market. Dilip Davda has a special interest in analyzing the SME companies and writing reviews about their public issues. His reviews are regularly published online and in news papers.

(Dilip Davda -SEBI registered Research Analyst-Mumbai,

Registration no. INH000003127 (Perpetual)

Email id: dilip_davda@rediffmail.com ).

The initial public offer (IPO) of IRCTC Limited offers an early investment opportunity in IRCTC Limited. A stock market investor can buy IRCTC IPO shares by applying in IPO before IRCTC Limited shares get listed at the stock exchanges. An investor could invest in IRCTC IPO for short term listing gain or a long term.

Read the IRCTC IPO recommendations by the leading analyst and leading stock brokers.

IRCTC IPO offers an opportunity to buy IPO shares before they get listed at the stock exchanges. Read the IRCTC IPO Notes, Analysis and Recommendations by leading stock brokerage firms and experts in the above answer.

Our recommendation for IRCTC IPO is to subscribe.

As per the analysis by our lead analyst Mr. Dilip Davda, we suggest you to subscribe to the IRCTC IPO.

The IRCTC IPO allotment status will be available on or around October 9, 2019. The allotted shares will be credited in demat account by October 11, 2019. Visit IRCTC IPO allotment status to check.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|