Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Wednesday, June 6, 2018 by Chittorgarh.com Team | Modified on Wednesday, November 13, 2019

Options are fast becoming the favorite investment instrument for retail traders. High leverage and returns potential are attracting retail traders towards the Options market. However, most traders end up losing money. One of the reasons for losing trades is lack of a strategy or using the same strategy in all market scenarios.

Most traders, especially beginners, adopt two strategies. One, when the market is bullish, they buy a Call Option. Two, when the market is bearish, they buy a Put Option. These strategies are useful in only some market scenarios. It is because most of the times market move in a narrow range or sideways. Buying a Call or a Put works only when there is a sharp movement in the market which doesn't happen most often. In most of the times, markets move up by 2 points, come down by 1 point, move up by 1 point and so on.

One of the beauties of Options trading is that you can make money in every market scenario- bullish, bearish or neutral. But to do that you need to adopt the right strategy. There are over 20 Option strategies that are popular and described in various websites. But not all strategies are meant for retail traders who trade with limited money and have a low-risk appetite. But there are some strategies which can help you make money in different market scenarios-

When the market is moderately bullish or bearish:

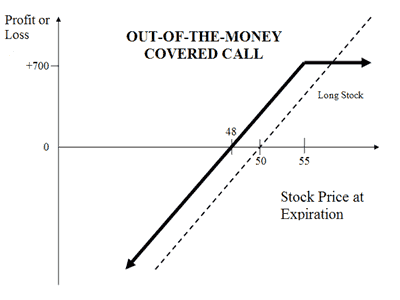

This a common day's market. You are holding a stock and you expect a moderate change in its price. What to do in such a market scenario? You can adopt 'Covered Call' or a ' Covered Put' strategy depending on whether the market is expected to be mildly bullish or bearish. In case you are not holding any stocks, this strategy can also be implemented by buying the stocks of a company and selling the Options simultaneously.

A Covered Call is an Options strategy in which you Sell OTM Call Option of the company, you own shares of, and in similar proportion. So, if you are owning 200 shares of a company then you buy Options of 200 shares in equivalent lot sizes. Selling the Call Option will earn you premium which will be your maximum profit.

Suppose you are holding 200 shares of an XYZ company currently trading at Rs 100. You can implement a Covered Call Option strategy by selling a Call Option at strike price 105 at Over The Money (OTM) available at a premium of Rs 10. Since you are selling an Option, you will receive Rs 10 X 200= Rs 2000.

Your total investments in the trade are-

Cost of holdings (Rs 100 X 200= Rs 20000) - Premium Received (Rs 2000)= Rs 18000

Now let's discuss about the possible scenarios:

Scenario 1: Price of XYZ rises to Rs 108.

Here the price of XYZ on expiry (Rs 108) is greater than the strike price of sold Call Option (Rs 105). The Call Option would be assigned and you will sell the holding shares and make a profit of (Rs 108- Rs 105) X 200= Rs 600. Your total profit, after adding Rs 2000 from the premium received on selling the Call Option, would be Rs 2600.

Scenario 2: Stock price of ABC falls to Rs 95

Your holding will lose (Rs 100-Rs 95= Rs 5) X 200= Rs 1000 in value. Since you would not be selling the shares, this loss would only be in the paper. Moreover, the loss will not be a loss if you factor in Rs 2000 premium received on selling the Call Option.

So until and unless there is a sharp decline in the price of the stocks you are holding, you are good and will make good money.

When the market is lackluster:

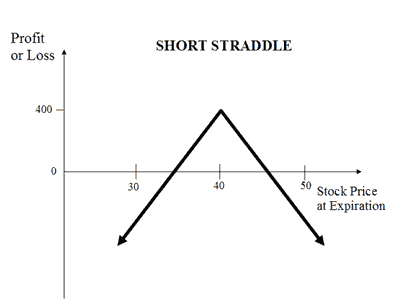

There are times when the market or a stock is pretty stagnant. There is barely any movement. In such a scenario, you can implement short straddle strategy. This strategy involves simultaneously selling a Call and a Put Option of the same underlying, strike price and expiry.

Suppose Nifty is currently moving in a range of 10500 and you expect it to hover around the same range in the near future. In such a scenario, you can implement Short Straddle strategy by selling a Nifty Call at a strike price of 10500 for a premium Rs 20 a Nifty Put of 10500 at a premium of Rs 30. The lot size is 75 shares. You will get a net premium of Rs 50 X 75= Rs 3750 for both the Options. The net premium received by selling Put and Call Options will be your maximum profit while the losses can be unlimited if the price moves sharply in either direction. Here's what your profit/loss would be for various closing prices-

|

NIFTY Closing Price |

Put Option Payoff Max Profit= Rs 1500 |

Call Option Payoff Max Profit= Rs 2250 |

Net Payoff |

|

10400 |

-6000 |

2250 |

-3750 |

|

10500 |

1500 |

2250 |

3750 |

|

10600 |

1500 |

-5250 |

-3750 |

So, here you will earn a profit if as expected the Nifty remain at 10,500. However, if increases or decreases significantly then you would make losses.

Awaiting A Major Event:

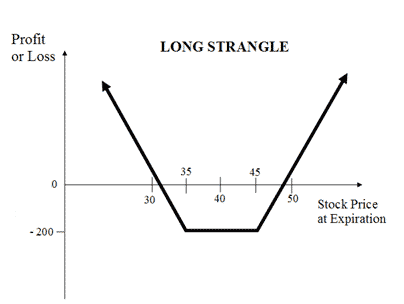

Events like election results, budgets, credit policy or company results can make stock prices to move sharply in one direction. However, we are not sure which direction will it take. In such a situation, you can use a long strangle strategy. The Long Strangle is a neutral strategy wherein OTM Call and OTM Put Options are bought simultaneously. It is a limited risk and unlimited reward strategy. The maximum loss is net premium paid while maximum profit is achieved when the underlying moves either significantly upwards or downwards at expiration.

Suppose Nifty is trading at 10,500 and you are expecting markets to be volatile in the coming days. You can execute a Long Strangle strategy by buying a Rs 10,300 Put for a premium of Rs 20 while simultaneously buying a Nifty Rs 10, 700 Call for Rs 40. The net premium paid of Rs 4500 will be your maximum loss while the profit will depend on how high or low the index moves. Here's how your profit/loss would be for various prices-

|

Nifty Closing Price (CP) |

Call Option Payoff MAX LOSS= Rs 3000 |

Put Option Payoff MAX LOSS = Rs 1500 |

Net Payoff |

|

10100 |

-3000 |

13500 |

10500 |

|

10200 |

-3000 |

6000 |

3000 |

|

10400 |

-3000 |

-1500 |

-4500 |

|

10500 |

-3000 |

-1500 |

-4500 |

|

10600 |

-3000 |

-1500 |

-4500 |

|

10700 |

-3000 |

-1500 |

-4500 |

|

10900 |

12000 |

-1500 |

10500 |

|

11000 |

19500 |

-1500 |

18000 |

The secret of making money in Options Trading is in predicting the direction of market movement and adopting the right strategy on it. Also, playing in spreads rather than taking single positions will help you minimize your risks. Once you do that, you can make money in all market scenarios.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|