Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, September 13, 2018 by Chittorgarh.com Team | Modified on Monday, July 18, 2022

|

Pros |

Cons |

|---|---|

|

One of the lowest, flat brokerage on Options of Rs 20 per executed order |

Demat account charges are higher as Fyers don't have its own depository services. The demat account is offered by IL&FS |

|

In-house developed free Options Trading Platform 'Fyers One' offers a range of features to traders. |

Fyers doesn't offer trading in commodities. |

|

Transparent brokerage fee/charges |

Exchange transaction rates are higher. |

|

30-day challenge wherein the winner gets the brokerage refunded. |

Incorporated in 2015, Fyers Securities is discount stockbroking company. It is headquartered in Bengaluru. Fyers offers online trading services across many segments like equity, equity derivatives, currency and currency derivatives etc., across NSE and BSE.

Fyers has gained a lot of popularity and customers due to its low brokerage rates. The company is one of the low rate broking company in India.

The company has a monthly trading turnover of Rs 10,000 crores with a MoM growth of around 15%.

Fyers Securities offers 3 trading platforms to suit the varied trading needs of the traders. As a Fyer customer, you can trade using your personal computer as well as a mobile app.

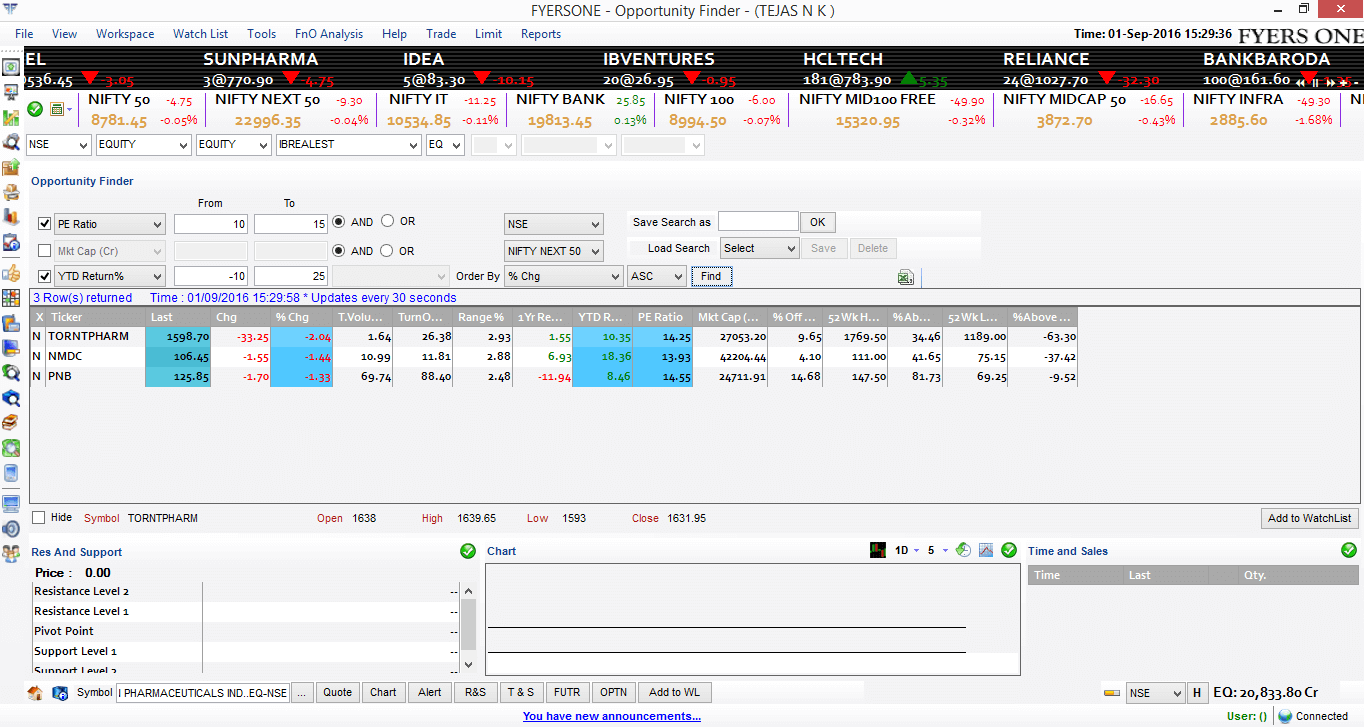

Fyers One- Fyers One is an installable trading platform that can be downloaded on your personal computers. The platform offers a range of features for technical and fundamental traders-

Source: Fyers One

Fyers Web- It is a trading platform that can be accessed via any browser on computers, Tablets, and mobile phones. The platform offers a range of important features such as-

Source: Fyers One

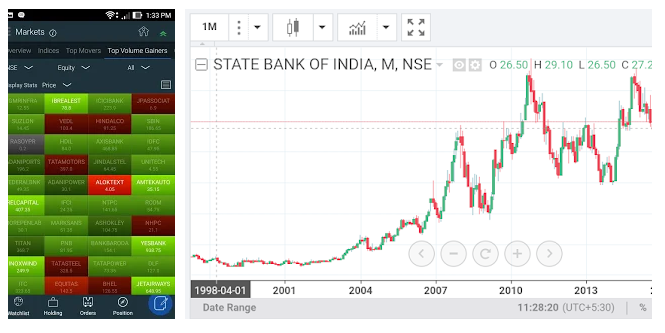

Fyers Markets- It is an in-house developed trading which makes a trader 100% location independent and offers many advanced features like-

Source: Fyers One

Traders need advanced tools to help them make profitable decisions. Fyers offers two useful calculators-

Margin Calculator- While you don't need to maintain margin when you buy Call and Put contracts, you need to maintain margin when you sell contracts. The margin calculator from Fyers makes it easy for you to calculate margins required for your trade.

Brokerage Calculator- Brokerage charges have an impact on your profitability. The brokerage calculate from Fyers helps you calculate taxes and brokerage costs of your trades beforehand and help you make informed decisions.

Fyers Securities Options Brokerage Charges

Fyers Securities is popular among traders for its low broking charge in options trading. It is known as a discount or flat fee Options broker.

|

Account Opening Charges |

Nil |

|

Account Maintenance Charges |

Nil |

|

Demat Opening Charges |

Rs 400 + Tax |

|

Demat Debit Transaction charges |

Rs 20+ Depository charges at actual |

|

Equity Options |

Currency Options |

|

|---|---|---|

|

Brokerage |

Rs 20 per executed order |

Rs 20 per executed order |

|

Security Transaction Tax (STT) |

0.01% on Sell |

0.01% on Sell |

|

Turnover Charges |

NSE-0.0021% |

NSE-0.053% |

|

GST |

18% (Brokerage + Transaction) |

18% (Brokerage + Transaction) |

|

SEBI Charges |

Rs 5 per crore |

Rs 5 per crore |

|

0.003% (Rs 300 per crore) on buy-side |

0.0001% (Rs 10 per crore) on buy-side |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|