Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, September 10, 2021 by Chittorgarh.com Team | Modified on Sunday, July 10, 2022

Zerodha Account Opening

Invest without brokerage fees in Equity Delivery and Direct Mutual Funds. Pay a flat Rs 20 per trade for Intra-day and F&O. Open an instant account with Zerodha and start trading today.

There are numerous reasons why people may look to switch their trading accounts from one broker to another. Some may want to shift due to better brokerage plans or value-added services, while others may look for advanced trading platforms.

You can open multiple trading and Demat accounts with different brokers. However, managing these accounts comes with a cost of annual maintenance charges and also needs tracking. Thus, it is always advisable to maintain only one trading and Demat account.

Topics

The trading account transfer process depends on two factors:

Note:

To shift your brokerage account from one broker to another, you need to open a new Trading and Demat account. Most brokers have made it mandatory to open both Demat and Trading accounts.

Once the new Demat account gets opened, you can transfer the stocks in your existing Demat account to the new Demat account. You can also sell off the shares if you get a better price and do not wish to transfer them to your new account.

To transfer the stocks to the new Demat account; contact the existing broker and submit the Delivery Instruction Slip (DIS). The DIS should contain all the stocks details, new DP ID, and new Demat account number. This process is offline and takes a few days.

Alternatively, if both of your Demat accounts are with CDSL, you can transfer the securities online on your own by registering with CDSL Easiest.

Points to Note:

Once you close your F&O positions (if applicable) and your demat holdings (stocks and Mutual Funds) get transferred, you are good to proceed with the account closure of your old trading account.

Before initiating the closure of the account, you also need to ensure there are no outstanding dues to the broker. You can either withdraw the amount if there is a credit balance in your trading account or receive the funds in your bank account as part of the full and final settlement.

The trading account closure is a manual process. It requires sending the paper form to the broker. A trading account cannot be closed via email, phone or chat. A broker generally takes about 7-15 days to close the account.

A trading account transfer involves the below charges:

Let us have a look at two examples to understand the process better.

Following are the steps for trading account transfer Sharekhan to Zerodha.

Open an online account with Zerodha. The process is simple, 100% online and just takes a few minutes. Both trading and demat accounts are opened.

Get the DIS slips from Sharekhan, fill them and submit them to the Sharekhan office. Sharekhan processes your offline transfer request within a day. Sharekhan charges an 'offline share transfer fee'.

You also have an option to transfer your holdings using CDSL Easiest if your Sharekhan account is CDSL.

Close all your open F&O positions in equity, commodity and currency segments. The open positions in Sharekhan need to be squared off, as these cannot be transferred to Zerodha. You can square off the existing month position in Sharekhan and take the new month's position in Zerodha.

To close the Sharekhan account, you need to submit a physical copy of the account closure form.

Steps to close the Sharekhan account:

Sharekhan takes about 7-15 days to process the closure application.

Following are the steps for the account closure-cum-transfer process from ICICI Bank to Upstox.

Open an online account with Upstox. The process is simple and paperless.

Steps to open Upstox trading and demat account online:

To transfer the securities from ICICI to Upstox, fill the DP slip for offline transfer of shares and submit it to your nearest ICICIdirect branch or send them to the address given. Note, you got the DP slip (look like a cheque book) when you opened the demat account with ICICI. If you don't have DP Slips, request them from ICICI.

ICICI Demat account closing form also has an option to transfer the demat holding to another demat account. Check with the bank before submitting the DP slips.

If you have open positions in the derivatives segment, you need to close them before initiating the closure of the ICICI account. To close the open positions, you need to square off the trades in ICICI.

To close the ICICI Direct account, you need to fill and submit two separate closure forms for the Trading and Demat accounts. This is a manual paper-based process. You cannot close accounts online, via email or on phone.

Steps to close ICICI Direct trading account

Steps to close ICICI Demat account:

ICICI may take up to 7-10 working days to close the account. Once the account is closed, you will get a confirmation SMS.

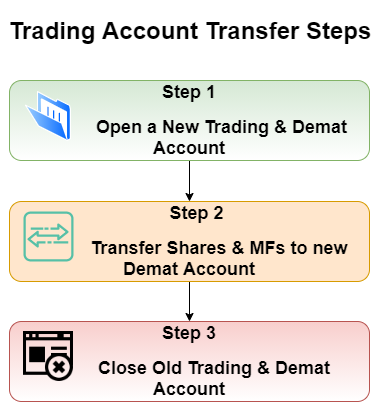

Shifting from one broker to another broker is simple, convenient and safe. It's a 3-step process; open a new account, transfer holdings / close positions and close the account (manual process). You will have to print, sign and submit the paper form to the broker. Moving to another broker can save brokerage and let you experience the next level of the trading platform.

This is a limited time offer. Open an instant Zerodha account online and start trading today.

Transferring trading account to Zerodha is a 3 step process:

Note:

Yes, you can transfer brokerage accounts by opening a new account, transferring demat account holdings and closing the old one. It's easy, hassle-free and safe to move to another broker.

Transferring a brokerage account is a simple 3 step process:

Note:

The brokerage account transfer in India requires opening an account with a new broker, transferring shares and closure the existing account.

Moving account from one broker to another is easy, convenient and safe. Millions of investors do it every year. It takes a couple of week's time.

Before closing the old brokerage account, you need to ensure to:

The transfer process is simple but may take up to 20-25 days to complete the closure-cum- transfer. It includes the timelines at each step - new account opening (2-5 days), transfer of holdings (2-3days), the closing of open positions (may vary based on the price movements), and account closure (7-15 days).

Changing is trading account can be achieved easily by following simple steps. With paperless instant account opening and online share transfer through CDSL Easiest, changing the trading account becomes fast, convenient and safe.

Note:

CDSL provides an online facility to transfer the shares from one Demat account to another using CDSL Easiest. To use this facility, both the Demat account should be with CDSL.

Once the DP confirms the request, the shares get transferred.

You can transfer shares between brokerage accounts in two ways:

The online route is convenient. However, certain brokers will lose the authority to debit the shares from your account to meet the sell obligation. This may create difficulty in selling your holdings. Hence, ensure to check with your new broker before you opt for the online route.

You can transfer the shares from NSDL to CDSL by submitting the physical Delivery Instructions slip (DIS) or using the online Speed-e facility. You need to ensure to submit an Inter-depository transfer request as the transfer involves two different depositories.

If the transfer of securities is a one-time process, it is recommended to use the manual route to transfer the securities for simplicity.

You need to register for Smart card-based access to Speed-e to procure a digital signature certificate (DSC) to submit an on-market or off-market inter-depository transaction of your choice.

Note: The Speed-e facility is available to users only when their DP has subscribed to the Speed-e facility.

You can transfer the shares from CDSL to NSDL using the CDSL Easiest facility or through manual submission of physical Delivery Instruction Slip (DIS).

The inter-depository transfer using CDSL Easiest requires a digital signature certificate that costs Rs. 2,250 + taxes. CDSL's Easiest facility is convenient for intra-depository transfers. Thus, when it is a one-time transfer from CDSL to NSDL, it is advisable to transfer the shares using the offline route.

The DP/broker will complete the transfer within 2-5 working days.

You cannot directly convert your NSDL account to CDSL. You need to open another Demat account with ICICI with CDSL and transfer your holdings to the newly opened CDSL account as per below:

You can then close your NSDL account or keep it as desired.

Alternatively, you can also visit your nearest ICICI branch. The company representatives can assist you with the end-to-end process of account opening and transfer.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|