Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Authum Investment & Infrastructure Ltd. (AILL) was originally incorporated under the name and style 'Astral Traders Ltd.' which was subsequently changed to 'Subhash Yurim Textiles Ltd.?' and then to 'Pentium Investments & Infrastructures Ltd.' and finally it was changed to the current one. It is registered with RBI as an NBFC (Non Banking Finance Company) without accepting public deposits. It mainly focuses on equities in India through investments in listed/unlisted companies, private equity investments, real estate investment and debt investment.

AIIL is also involved in activities like structured financing, fixed return portfolio, secured lending, equity investments in emerging companies. According to offer documents, the company reaped the benefits of COVID-19 crisis and has accumulated/bought great companies at cheaper valuations. It operates from rented office premises of the group company. The company has entered into a rent agreement for 33 months from October 01, 2020. As on December 31, 2020, the total numbers of shareholders of AIIL were 599.

To part finance its plans for part repayment/prepayment of certain borrowings (Rs. 30.00 cr.) and general corpus fund needs (Rs. 7.09 cr.), AILL is coming out with a rights issue in the ratio of 2 shares for every 5 shares held at a fixed price of Rs. 81 per share of Rs.10 each. The company is issuing 4611236 equity shares to mobilize Rs. 37.35 cr. to the shareholders whose names were registered on the books of the company on the record date of February 19, 2021. The issue opens for subscription on March 01, 2021 and will close on March 15, 2021.

The is solely lead managed by Shreni Shares Pvt. Ltd. and Bigshare Services Pvt. Ltd. is the registrar for the issue. Post allotment, shares will be listed on BSE. The company is spending Rs. 0.26 cr. for the entire rights issue process.

Post issue, AILL's current paid up equity capital of Rs. 11.53 cr. will stand enhanced to Rs. 16.14 cr.

On financial performance front, AILL has posted total income/net profits (loss) of Rs. 8.42 cr. / Rs.2.53 cr. (FY18), Rs. - (35.77) cr. cr. / Rs. - (37.43) cr. (IFY19) and Rs. - (10.52) cr. / Rs. - (15.29) cr. (FY20). Thus for last two fiscals, it has shown negative top line. It has accounted for its investments in subsidiaries and associates at cost. As on March 31, 2020 the company had a loan of Rs. 169.85 cr. and a total MF investment of Rs.330.48 cr. (see page 89 and 91 of offer documents). As of December 31, 2020, its total borrowings were Rs. 266.06 cr. (Page 25 of offer document)

Surprisingly, it has posted total income of Rs.194.68 cr. with a net profit of Rs. 90.14 cr. for the first nine months of the current fiscal ended on December 31, 2020. On the said date, its NAV stood at Rs. 969.45.

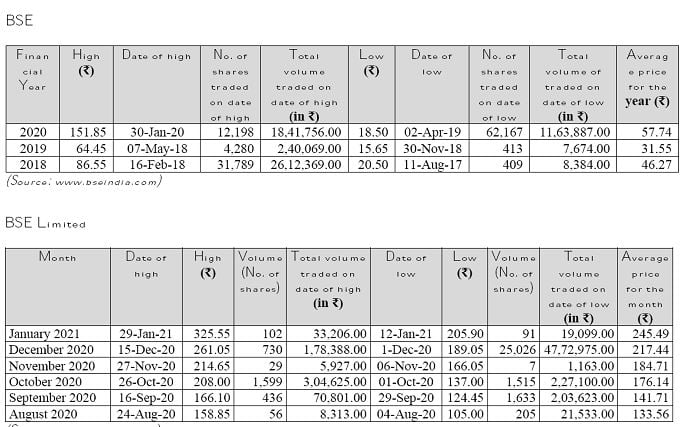

AIIL's counter is witnessing very thin trades with high volatility as shares are in very few hands.

The company has not declared any dividend for the past three fiscals and the current financial year.

Based on rights offer price, the company is looking for a market cap of Rs. 130.73 cr. whereas on the basis of its last traded price, its market cap stands at Rs. 600.47 cr. Isn't it surprising. AIIL's capital also has CCD (0.01% Compulsorily Convertible Debentures) worth Rs. 630 cr. and preference shares of Rs. 41.90 cr. as on filing of the offer documents.

The scrip (BSE Code 539177) marked cum-right closing of Rs. 421.40 on February 16, 2021 and turned ex-right at Rs. 330.50 for opening as well as closing. Since then, it has shown surge in market price which closed at Rs. 372.10 on February 26, 2021. Thus the scrip is quoting at a good premium to the offer price of the rights issue. The scrip has marked 52 week high/low of Rs. 379.45/Rs. 38.33. (On ex-right basis).

Review By Dilip Davda on February 26, 2021

The Authum Investment & Infrastructure Rights Issue Analysis helps you to understand about the company, offer detail, valuation, capital structure and financial performance. Our SEBI registered Rights Issue Analysts tells you if Authum Investment & Infrastructure Rights Issue worth investing. The Authum Investment & Infrastructure Rights Issue Note sets the Rights Issue expectations in systematic way which tells you if Authum Investment & Infrastructure Rights Issue good to buy (good or bad / yes or no). The Rights Issue Forecast tells you weather to invest in Authum Investment & Infrastructure Rights Issue by providing Rights Issue recommendations i.e. subscribe, avoid and neutral.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|