Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

When you place a trade using Zerodha's Kite or Pi trading platform, you are required to enter a product code from the available three choices- MIS, CNC, and NRML. MIS stands for Margin Intraday Square Off and is useful for traders who are doing intraday trading in Options. Intraday trading means to buy and sell of the order on the same day. The trade is completed on that day. Nothing is carried off to the next day.

Zerodha offers margin leverage for intraday traders. There is no margin provided for traders buying options as there is no margin requirement for such a trade. However, the seller of options is required to maintain a margin. When you use an MIS code, you only need to maintain 50% of the margin. So, entering this code gives 50% margin leverage to Option sellers and allows them to do more trade with the same amount of money.

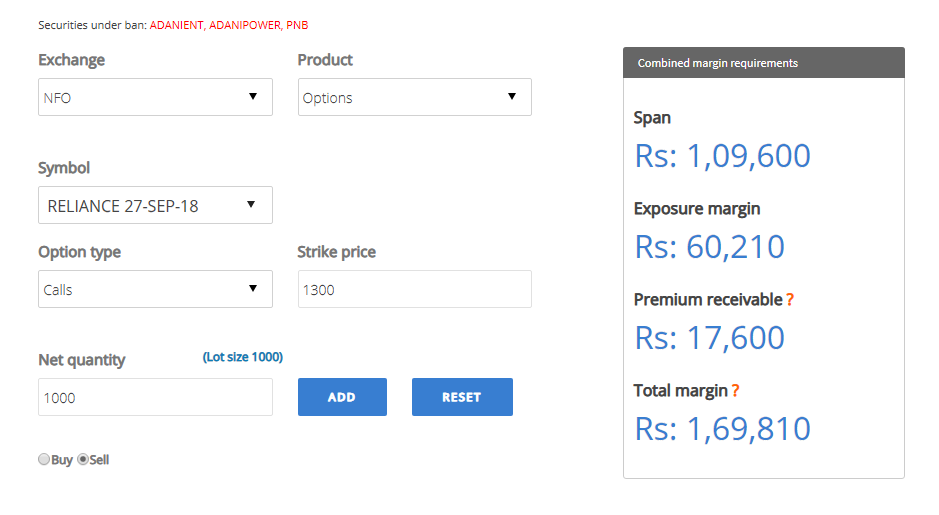

Example: Say, you want to sell Reliance Call Option for expiry date 27-Sep-18 for strike price 1300. Under the normal order, you need to maintain a margin of Rs 1,69,810. However, if you are doing intraday trading and use 'MIS' code while placing the order, you need to maintain 50% of the Rs 1,69,810 i.e. Rs 84,905.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|