Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, August 24, 2018 by Chittorgarh.com Team | Modified on Sunday, August 9, 2020

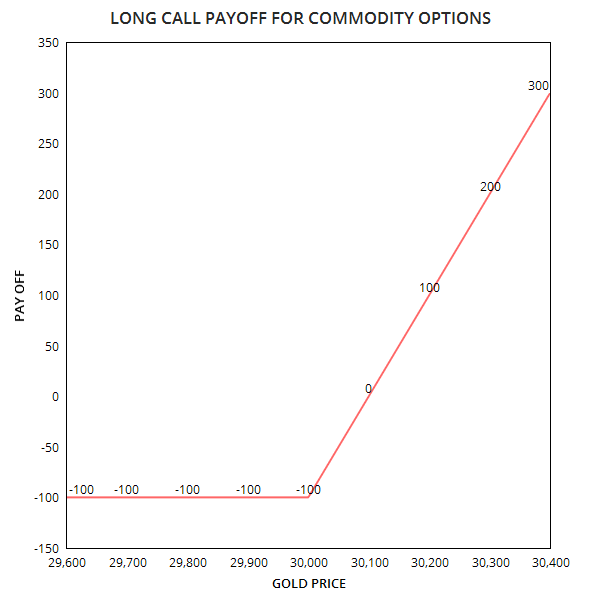

Suppose you want to invest in Gold Option and your view is that its price will increase in next 2 to 3 months. You buy a Call Option at a strike price of Rs 30,000 by paying a premium of Rs 100.

The profit is unlimited in a Long Call Commodity Option while the risk is limited to the premium paid i.e. Rs 100.

Scenarios-

When the strike price of the Call option at expiry is less than Rs 30,000. You will allow the option to expire worthless and lose the premium of Rs 100 paid.

When the strike price of the Call option at expiry is above Rs 30,000. Your trade will break even at Rs Rs 30,000 + Rs 100= Rs 30,100. Anything above the break-even is your profit.

|

Strike Price on Expiry |

Pay Off= Strike Price- Break Even= (Max loss cannot be more than Rs 100) |

|---|---|

|

29,600 |

-100 |

|

29,700 |

-100 |

|

29,800 |

-100 |

|

29,900 |

-100 |

|

30,000 |

-100 |

|

30,100 |

0 |

|

30,200 |

100 |

|

30,300 |

200 |

|

30,400 |

300 |

PAYOFF CHART LONG (BUY) CALL COMMODITY POSITION

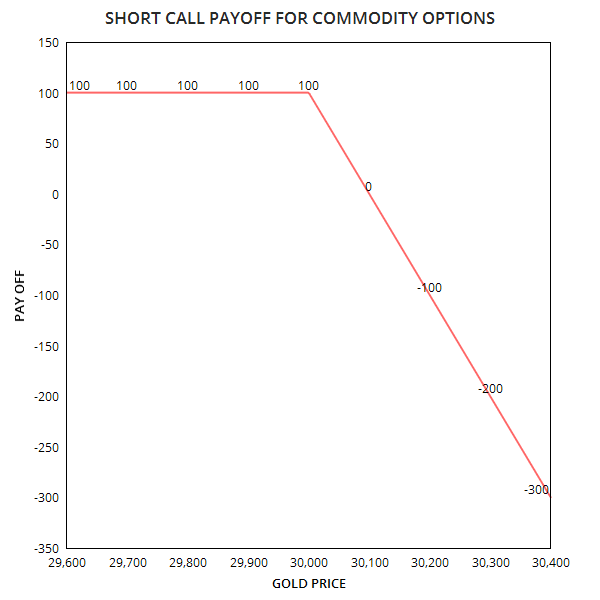

Suppose you want to invest in Gold Option and your view is that its price will decrease in the coming days. You sell a Call Option at a strike price of Rs 30,000. You receive a premium of Rs 100 for selling the option.

The profit is limited to the premium received in a Short Call Commodity Option while the risk is unlimited.

When the strike price of Call option at expiry is less than Rs 30,000. You will allow the option to expire worthless and retain the premium of Rs 100 paid.

When the strike price of Call option at expiry is above Rs 30,000. Your contract will be exercised by the buyer. The trade's break-even at Rs Rs 30,000 + Rs 100= Rs 30,100. Anything above the break-even is your loss and depends on the extent in the rise of the price.

|

Strike Price on Expiry |

Pay Off= Break Even-Strike Price= (Max profit cannot be more than Rs 100) |

|---|---|

|

29,600 |

100 |

|

29,700 |

100 |

|

29,800 |

100 |

|

29,900 |

100 |

|

30,000 |

100 |

|

30,100 |

0 |

|

30,200 |

-100 |

|

30,300 |

-200 |

|

30,400 |

-300 |

PAYOFF CHART SHORT (SELL) CALL COMMODITY POSITION

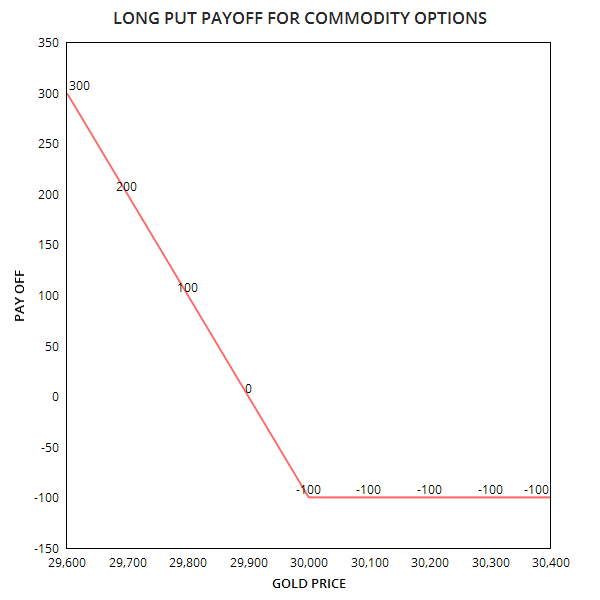

Suppose you want to invest in Gold Option and your view is that its price will decrease in the coming days. You buy a Put Option at a strike price of Rs 30,000. You pay a premium of Rs 100 for buying the contract.

The profit is unlimited in a Long Put Commodity Option while the risk is limited to premium paid.

When the price of Call option at expiry is above Rs 30,000. You will allow the option to expire worthless and you will lose the premium of Rs 100 paid.

When the strike price of Call option is below Rs 30,000. The trade's break even is at Rs 30,000 - Rs 100= Rs 29,900. Anything below the break even is your loss and depends on the extent in the rise of the price.

|

Strike Price on Expiry |

Pay Off= Break Even-Strike Price= (Max loss cannot be more than Rs 100) |

|---|---|

|

29,600 |

300 |

|

29,700 |

200 |

|

29,800 |

100 |

|

29,900 |

0 |

|

30,000 |

-100 |

|

30,100 |

-100 |

|

30,200 |

-100 |

|

30,300 |

-100 |

|

30,400 |

-100 |

PAYOFF CHART LONG (BUY) PUT COMMODITY POSITION

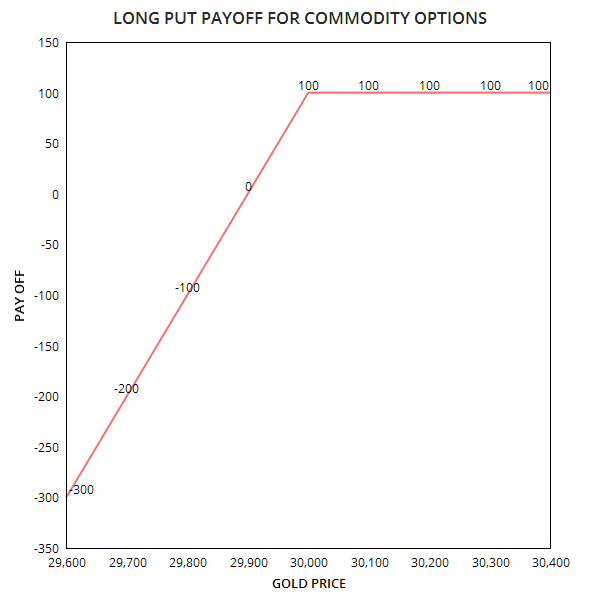

Suppose you want to invest in Gold Option and your view is that its price will increase in next couple of weeks. You sell a Put Option at a strike price of Rs 30,000 and you receive a premium of Rs 100.

The profit is is limited to premium paid i.e. Rs 100 in a Short Put Commodity Option while the risk is unlimited.

Scenarios-

When the strike price of Put option at expiry is less than Rs 30,000. You will allow the option to expire worthless and retain the premium of Rs 100 paid.

When the strike price of Call option at expiry is above Rs 30,000. Your trade will break even at Rs Rs 30,000 - Rs 100= Rs 29,900. Anything above the break even is your profit.

|

Strike Price on Expiry |

Pay Off= Strike Price- Break Even= (Max profit cannot be more than Rs 100) |

|---|---|

|

29,600 |

-300 |

|

29,700 |

-200 |

|

29,800 |

-100 |

|

29,900 |

0 |

|

30,000 |

100 |

|

30,100 |

100 |

|

30,200 |

100 |

|

30,300 |

100 |

|

30,400 |

100 |

PAYOFF CHART SHORT(SELL) PUT COMMODITY POSITION

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|