Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, December 6, 2019 by Chittorgarh.com Team

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Are you considering changing your share broker? It could be due to high brokerage, frequent downtime, poor customer services or for any other reason, changing the stock broker is easy. Traders who are considering changing share brokers, generally have questions like how to close the existing account, how to change demat account from one broker to another, how to transfer shares from one broker to another broker, etc. This article discusses the process, rules, and tips for changing share brokers.

There can be many reasons for changing stock broker like-

These are personal reasons for moving from one broker to another. Then there can be other reasons like your share broker shutting down due to default, non-profitability in business, etc.

Share brokers are regulated by SEBI as well as exchanges like BSE, NSE & MCX, etc. Those offering depository services are members of NSDL and CDSL.

As per SEBI guidelines, a share broker who wishes to wind up its business, need to take the following steps-

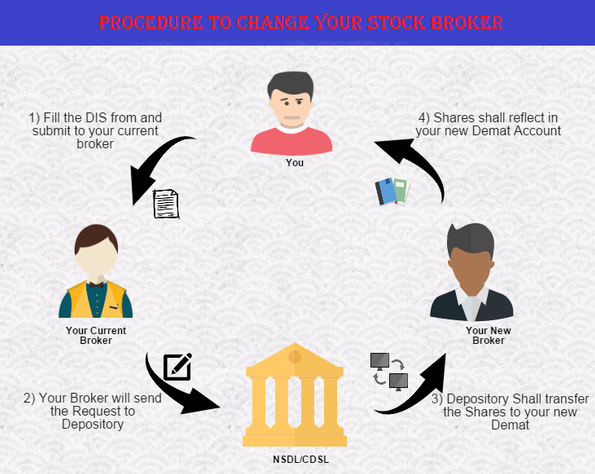

Once you have decided to move to another broker for whatever reason then you need to take the following steps-

5 Factors in choosing the best brokerage company in India

Top 10 share brokers in India (Best stock brokers in India)

Best stock broker for small investors in India (Low-cost trading)

Good Stock Broker - Qualities, Importance, and Tips

Best Online Brokers in India (Find Low Brokerage Trading Company)

Best Stock Broker for Day Trading

Discount Broker vs Full-Service Broker in India

Once you find the share broker of your choice, open a trading and demat account.

To close your trading and demat account, you need to-

The full and final settlement of the funds and securities due to you will be credited to the bank account number provided by you in the form.

It is advisable to follow up on the account closure process with the customer support team. You can call/email the customer support and inquire about the account closure after 15 days of sending the form.

You cannot change the demat account from one broker to another. However, you have the option to open a new demat account with another broker while keeping the existing demat active or close the existing demat and open a new account with another. The law permits the opening of multiple demat accounts. However, you will be paying AMC fees and other charges for keeping multiple accounts. So, if you really don't need multiple demat accounts then it is better to close the existing one and open a new demat with a different broker. Before initiating an account closure process, you need to-

To close your trading and demat account, you need to-

The process to transfer shares or any other holdings from other brokers to Zerodha depends on the central depository with which you have your current demat account. Zerodha is a depository participant (DP) with Central Depository Services Limited (CDSL) depository. If your current stock broker is a member of CDSL then you can transfer the shares online on your own. If the demat account is with NSDL then you have to fill a form and submit it to your first broker.

Both Sharekhan and Zerodha are members of CDSL. So you can use the CDSL's internet-based facility EASIEST (electronic access to securities information and execution of secured transactions), to transfer shares from one DEMAT account to another online. To transfer shares online, you need to-

Once you will receive the password at your email-Id, you can transfer shares online.

However, Zerodha recommends using DIS (Delivery Instruction Slips) for share transfers. It is because once you register for EASIEST, Zerodha loses the PoA (Power of Attorney) over the Demat account. This means that you cannot sell shares using Zerodha's trading platform as the broker will not be able to debit your shares from the Demat.

Kotak is a depository participant (DP) with both NSDL and CDSL while Zerodha is a DP of CDSL. So, if your Kotak demat account is opened with CDSL then you can use the CDSL's internet-based facility EASIEST (electronic access to securities information and execution of secured transactions), to transfer shares from Kotak To Zerodha. The steps to transfer shares online is discussed above.

If your Kotak demat is with NSDL then you have to fill DIS (Delivery Instruction Slips) provided by Kotak for share transfers and submit it to Zerodha.

However, Zerodha recommends using DIS (delivery instruction slips) for share transfers even if it is inter-depository. It is because once you register for EASIEST, Zerodha loses the PoA (Power of Attorney) over the Demat account. This means that you cannot sell shares using Zerodha's trading platform as the broker will not be able to debit your shares from the Demat.

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|