Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Thursday, February 11, 2016 by Chittorgarh.com Team | Modified on Sunday, August 9, 2020

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Bracket order meaning an intraday trading order placed with the opposite-side orders to limit the losses or increase the chances of profit. It's an additional risk management tool for intraday traders.

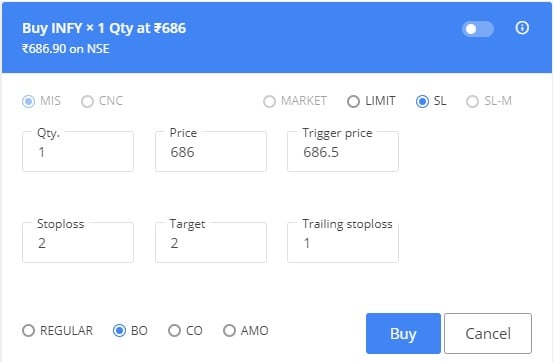

Bracket order (BO) gives an Entry, Target, and Stop-loss (SL) option, with an ability to trail SL; all in just one order window.

In a bracket order, 3 orders are placed simultaneously. i.e. a buy order is bracketed by a high side sell limit order and a low side sell stop-loss order. When any of the price is reached, one of the bracketed orders is executed and the other is canceled.

Bracket order trading is the safest way to trade in intraday as it limits the risk of losses by removing the emotions from the trade. The stop-loss (SL) orders placed using the bracket order helps to control the trades.

Bracket order provides higher leverage compared to MIS as a simultaneous stop loss is placed along with the initial buy or sell order. Since the risk is comparatively less to the bracket order broker due to the use of stop-loss the leverage provided is also higher.

The bracket order brokerage is the same as the brokerage for any intraday trade. There are no special charges to avail bracket order facility. Stock brokers give additional benefit to the traders using the bracket order in the form of higher exposure limit on the trade.

A range of stock brokers in India offers bracket order in share market.

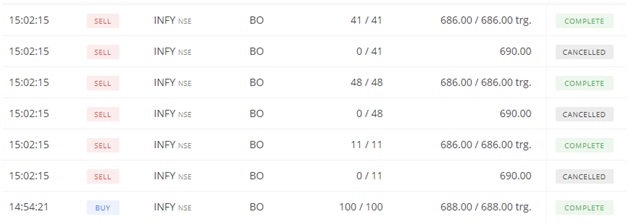

In the case of flat rate brokers like Zerodha who charge Rs 20 per trade, if the entry order gets executed in small batches, the system creates a separate target and SL order of each of these batch based on the price of entry order. The customer end-up paying 'flat Rs 20 or 0.01% whichever is lower' brokerage for each of these target/SL orders executed instead of Rs 20 as brokerage to square-off the entry trade once.

Zerodha Brokerage Rate: Flat Rs 20 per executed order or 0.01% whichever is higher

Entry Order: Infosys 100 Shares @ Rs 688, Stoploss: 2

Actual Order Execution: In chunks of 3 orders - 11, 48, 41 shares (Brokerage - Rs 6.88 (Rs 0.7568 + Rs 3.3024 + Rs 2.8208) )

Target/SL Order Created: 3 orders with respective prices

SL Order Executed: 100 Shares @ Rs 686 in 3 orders (Brokerage - Rs 6.86 (Rs 0.7546 + Rs 3.2928 + Rs 2.8126))

Total Brokerage: Rs 13.74

Note in the case of 1000 shares, the broker would be Rs 95.114 (Rs 7.568 + Rs 20 + Rs 20 for buy and Rs 7.546 + Rs 20 + Rs 20 for sell)

| Bracket Order | Cover Order |

|---|---|

|

Bracket order (BO) gives an Entry, Target and Stop-loss (SL) option, with an ability to trail SL; all in just one order window. |

Cover Order (CO) gives an Entry and SL option with the ability to modify SL. |

|

The order has a predefined target and stop-loss. |

The order has a predefined stop-loss. |

|

Zerodha offers BO only in NSE and NSE F&O intraday order. |

Zerodha offers CO in intraday market orders (NSE, NSE F&O, Currency, and MCX) |

|

The BO order allows higher leverage, usually double the MIS order. Example: In MIS the leverage provided is 3 to 12.5 times (depending on the scrip). For equity derivatives, the CO/BO margins needed is 2.45% of the contract value & for Index derivatives margins required is 1.45% of the contract value. |

Similar to BO, CO also allows higher leverage. |

|

BO positions are auto-squared off before the market close |

All CO positions are also auto-squared off before the market close. |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|