Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

5.83% 143,944 Clients

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Religare Broking offers trading and investment services to NRIs. It offers NRI Trading and NRI Demat Accounts. This 2-in-1 account provides NRIs with access to BSE & NSE to trade across Equities, Equity Derivatives, IPOs, and Mutual Funds.

Religareonline.com is the flagship online investment portal of the company. The website offers online trading and many useful tools like e-contract notes, research & advisory, stock screener, stock comparison, calculators and portfolio tracking system.

Religare has a dedicated support team to assist NRIs in account opening, account updates, fund allocation, trading support and advisory. Religare also offers PAN Card services to NRIs.

The company also has a dedicated research team that regularly publishes incisive reports on stocks, markets, and economies to help customers make informed trading decisions.

To start investing in the Indian stock market, an NRI must have:

Religare Online doesn't offer banking services. NRIs have to open NRE or NRO Bank Account with a designated bank. Further, with the help of the bank, the NRIs can obtain PIS permission from RBI for investing in Indian Stock Markets.

Religare online is a clearing member registered with SEBI. It works as a custodian for the transaction placed through the Religare Online platform. If you are interested in trading in Equity Derivatives (F&O), Religare can get a CP Code for you, which is required for F&O trading.

Religare, through its membership with BSE and NSE, offers trading account to NRI investors. The trading account is required to buy and sell securities from stock exchanges.

Note:Religare offers Demat Account to NRI customers through its depository participant (membership) with central depositories i.e. NSDL and CDSL. The Demat account holds securities in electronic format and is a must for trading in Indian stock markets.

Note:NRI online trading with Religare is simple. Once you open a 2-in-1 account with Religare and link your NRI bank account, you can trade following these steps:

Transfer funds to your PIS Bank Account. The bank informs Religare on how much funds you have allocated and accordingly your trading account is updated as an available limit.

When the NRI places buy or sell order, the system will check the availability of funds for a buy order or shares in the respective accounts for the sell order. If everything is alright, the order is executed on the stock exchange.

If it's a buy order, the NRI Bank Account is debited and the NRI Demat account is credited with shares. For sell orders, the NRI Demat account is debited with shares and the NRI Bank Account is credited with the money.

The broker sends separate buy and sell contract notes to the bank at the end of the day. The bank further reports those transactions to RBI.

Religare NRI brokerage charges for trading in Equity and Equity Derivatives.

| Transaction | Fee |

|---|---|

| NRI Account Opening Charges | |

| NRI Account AMC | |

| Equity Delivery Brokerage | |

| Equity Future Brokerage | |

| Equity Options Brokerage | |

| Other Charges | ODIN Diet: ₹999 per year |

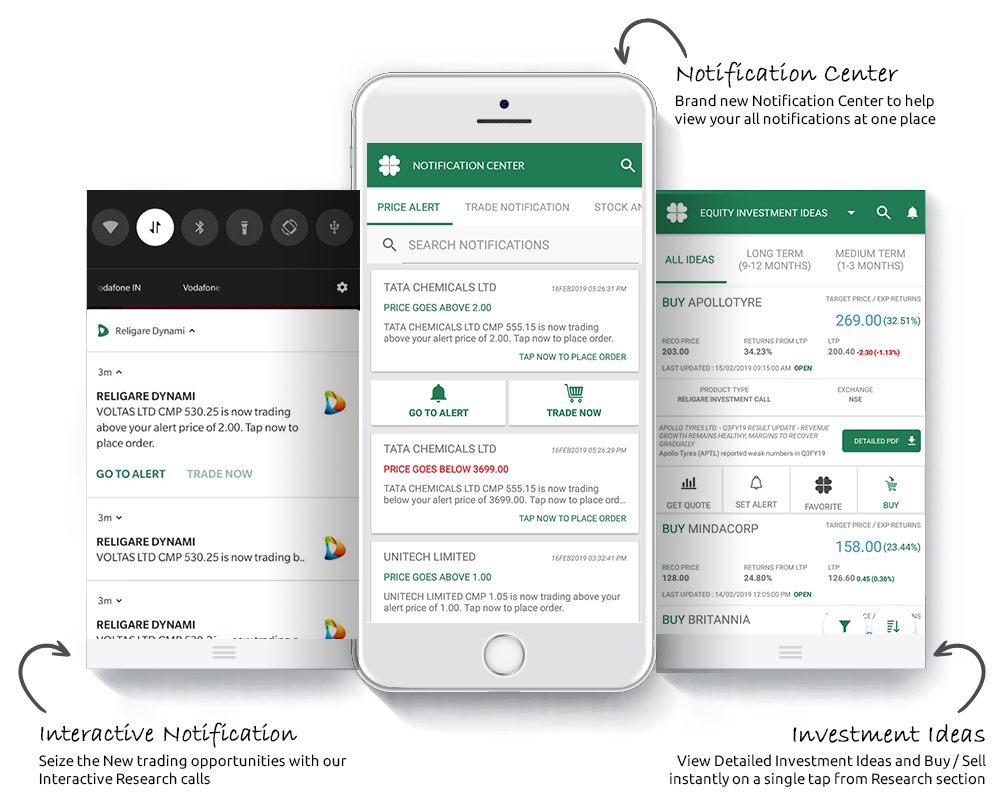

Religare offers free web and mobile-based trading software to NRIs. The platforms provide several useful trading features like advanced portfolio tracker, live market watch, stock screener, technical analysis tools etc.

The investment options available to an NRI at Religare.

| Investment Option | Status |

|---|---|

| Stocks | Yes |

| Mutual Funds | Yes |

| IPO | Yes |

| Others |

Religare is a full-service broker offering Trading and Demat Account to NRIs. Before opening the account with Religare, an NRI needs:

PAN Card can be obtained by filling up Form 49AA online through the websites of UTIITSL and NSDL. After submission, a 15 digit acknowledgment number is generated, which needs to be sent to the designated address along with the supporting documents.

Once PAN Number and PIS Bank Account are established, an NRI can open following 2 accounts with Religare:

Note:

| Feature | Status |

|---|---|

| 3-in-1 Account | No |

| Free Research and Tips | Yes |

| Automated Trading | No |

| Other Features |

Religare offers online Mutual Fund investment to NRI customers. NRIs can choose from 5000+ MFs offered by 30+ AMCs.

Religare also provides tools like Portfolio Tracker for easy tracking of investments across the segments including MFs.

Religare Mutual Fund Research & Advisory services also provide Personalized Mutual Fund Research Reports to NRIs.

Key Features:

Learn more about NRI Mutual Fund Investment.

Religare NRI Support Desk contact information. Find Religare NRI contact number.

| Religare NRI Helpline | Number |

|---|---|

| Religare NRI Customer Care Number | 0120 6130300 |

| Religare NRI Customer Care Email ID | wecare@religareonline.com |

Religare Broking Ltd is a good choice for NRIs who wants trading assistance as well as access to research reports to gain market insights. It has a dedicated research team that publishes incisive research reports to keep you updated on the latest trends in the economy and markets. It also offers good trading platforms with useful features like multiple stock tracking, instant order execution, and real-time streaming of quotes.

No, an NRI should have a PAN number to open an NRI account with Religare. The company offers PAN card services to NRIs. An NRI who doesn't have a PAN card can contact the broker and an advisor at Religare will contact you to assist you in getting a PAN card.

NRIs would need a PAN Card and NRI Bank Accounts (PIS) before opening an NRI 2-in-1 account with Religare. Religare offers assistance in getting PAN cards, bank accounts and PIS permission. Contact their customer support and the company's advisors will help you in opening the various accounts.

NRIs can invest in following products with Religare:

There are 2 types of bank accounts for NRI:

NRE/NRO Bank Account Subtypes:

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Information on this page was last updated on Tuesday, October 1, 2019

Zerodha (Flat Rs 20 Per Trade)

Special Offer - Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|