Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Monday, June 17, 2019 by Chittorgarh.com Team

Zerodha (Flat Rs 20 Per Trade)

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

With stocks trading going completely online, it is a must for a trader to open a demat account along with trading account to trade in stock exchanges. Contrary to popular belief, a demat account is not opened by a stockbroker. Then who opens and manages a demat account? Read this article to know what is a demat account, its types and where to open a demat account.

A demat account stands for a dematerialized account. It works as a personal locker for individual investors to store securities or shares in an electronic format.

The demat account system was introduced in 1996 to take away the physical handling of shares related documents and certificates. If you want to invest or trade across securities in India, you are required to have the demat account first.

Demat account have mainly 4 types; which are:

A regular demat account is for investors residing in India. The shares purchased by investors are held in digital format in the account. In a regular demat account, there are no restrictions on the maximum value of securities held.

BSDA is a demat account for small investors in the stock market. Unlike a regular demat account, the BSDA demat account has no demat account maintenance charges (AMC) for investment up to Rs 50,000. For investment between Rs 50,001 and Rs 2,00,000, the AMC is charged at Rs 100 per year. In any case, the maximum value of securities should not be greater than Rs 2 lakh to utilize the benefits of the BSDA account.

The Repatriable Demat Account is for Non-Resident Indians (NRIs) to hold securities in a dematerialized form. Although, NRI also requires a Non-Resident External (NRE) bank account along with Repatriable Demat Account. In a calendar year, NRI can transfer a maximum of USD 1 million of wealth abroad.

This account is also for Non- Resident Indians (NRIs), but fund transfer to abroad is not allowed. NRI investors also require an NRO bank account linked with Non-Repatriable Demat Account to buy or sell securities.

Before the introduction of the Depository Act, 1966, the purchase and transfer of securities were done in physical form which was prone to losses due to theft, damage etc. Then online demat accounts were introduced to make trading online. Currently, there are two central depositories, which are NSDL and CDSL, in India, who open and manage demat accounts.

The central depositories provide the services through their registered members called depository participants (DP). Every stock brokers need to be registered with NSDL or CDSL to provide depository or demat services.

Any investor who wants to open a demat account needs to first approach a depository participant.

As per SEBI guidelines, you cannot buy shares in physical forms at the exchanges. That means to buy or sell shares; you will need the dematerialized forms of the shares.

A Demat account process takes place in the following manner:

You can access the demat account online and check whether the securities are accurately credited and debited.

To open your Demat Account, you first need to select a Depository Participant(DP). Most stock brokers in India are also DP with either CDSL or NSDL.

With most brokers going online, it has become easy and quick to open a demat account. Depending on the services provided by a stockbroker, a demat account can be opened in many ways:

Many brokers like 5paisa and Zerodha these days offer instant online demat account facility wherein the account can be opened in 15 to 30 minutes. This service is available for customers who have Aadhar card with their current mobile number linked to it. Customers need to submit required documents in digital form, pay the fees online, the verification is done through a webcam and if all goes well, the account is opened instantly.

Some brokers have an online contact form on their websites. People who want to open a demat account need to fill in the form entering their name, email and mobile number etc. A company representative will then contact them to take forward the account opening process.

Many brokers, especially full-service brokers have branch offices across their area of operations. These offices serve as customer service hubs wherein people can open demat accounts.

A demat account is an online account holding equity shares, ETFs, mutual funds, etc in electronic format.

An individual can open a demat account with any Depository Participant (DP) who is a member of either CDSL or NSDL depository participants. Usually, all stockbrokers are DP's. They offer demat account along with the trading account.

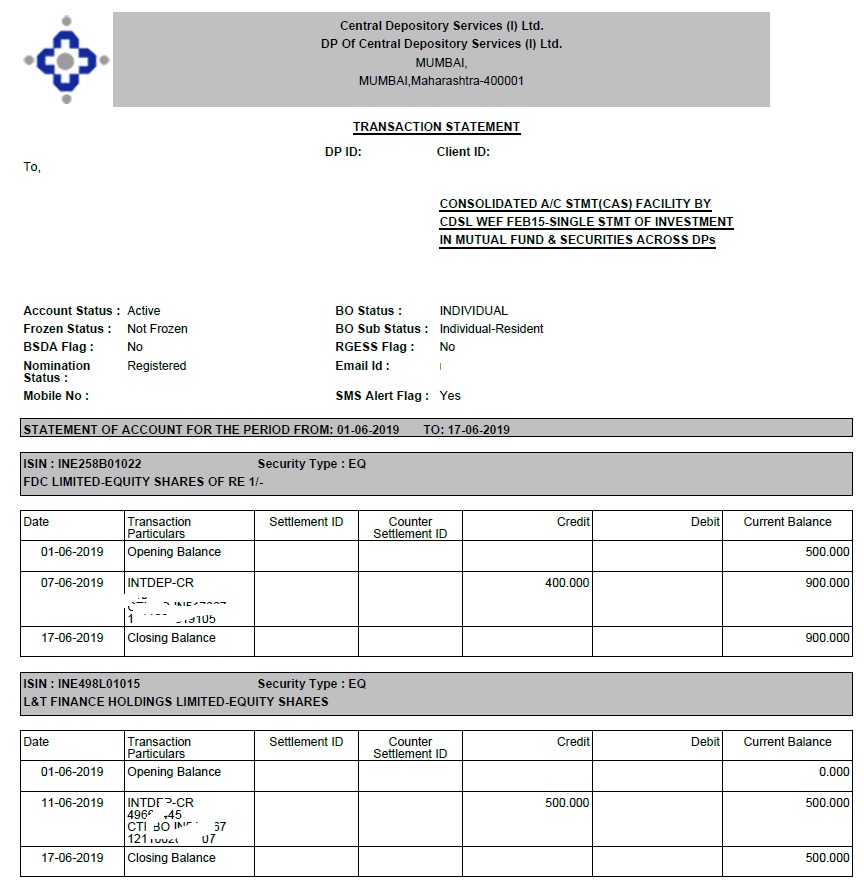

The sample statement of a customer Demat Account at CDSL looks like as below. It shows a customer has shares of 2 companies in his demat account; FDC Limited (900 shares) and L&T Finance Holdings limited (500 shares).

Demat account is an online account for holding shares and mutual funds. The demat account is opened with a depository participant DP (usually the stockbroker). DP is a member of CDSL or NSDL, the central depositories who actually hold the demat accounts.

For every transaction at Demat Account, the customer has to pay a fee to the DP. These fees vary by a broker to broker.

Demat account allows an investor to trade online and hold shares, mutual funds, etc. in electronic format.

An individual or any other entity can open as many as demat accounts they want on their name. There is no limit on the number of accounts held by an individual or an entity like HUF, LLP, Pvt Ltd Company and trust.

But one broker (depository participant) usually allows only 1 demat account per person.

Thus, an individual can open 2 demat accounts with 2 different brokers.

Note that multiple demat accounts should be only opened in case it is really required.

Each demat account has an annual maintenance cost (AMC) which ranges between Rs 600 to Rs 1200 per year.

More demat accounts are difficult to handle and monitor. As a limited power of attorney of demat account is given to the stockbroker for online trading, it raises the risk of misuse (intentional or accidental) of your demat account.

Yes, you can open two demat and trading accounts with two different brokers using one mobile number, email, or PAN number. Most traders have multiple accounts with different stockbrokers. For example, Mr. Rakesh can have the demat/trading account with both ICICI Direct and Zerodha at the same time using the same PAN, Phone, and Email address.

Note:

Yes, you could open a demat and trading account in the name of a Partnership Firm, Private Limited Company, HUF, Trust or any other organization.

Here are a few facts:

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|