Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Friday, September 14, 2018 by Chittorgarh.com Team | Modified on Monday, July 18, 2022

|

Pros |

Cons |

|---|---|

|

Lifetime free AMC on demat accounts. |

An accesss fee of Rs 3500 for Ventura Pointer trading platform. The fee is refunded if the brokerage generated is over Rs 3500. |

|

Facilitates trading in equity, equity derivatives, currency futures, commodities, mutual funds and fixed income products. |

3-in-1 accounts not available. |

|

Good inhouse developed trading platform |

|

|

Brokerage charges are reasonable. |

|

|

Strong presence acrthe oss country with a large network of sub brokers. |

Incorporated in 1994, Ventura Securities Ltd. is a popular broking company in India. The company is headquartered in Mumbai with presence in over 300 locations across India. It has 25 branches and a large network of over 500 sub-brokers.

Ventura Securities offers a range of trading and investment services including equity, equity derivatives, currency futures, commodities, mutual, funds and fixed income products to its customers.

The company has developed a good trading platform called 'Ventura Pointer' which offers a range of features to meet the Options trading needs of the traders. Besides, it is also known for its high-quality research.

Ventura is a corporate member of NSE and BSE. The company is a depository participant with NSDL which allows it to offer demat account opening services to its customers.

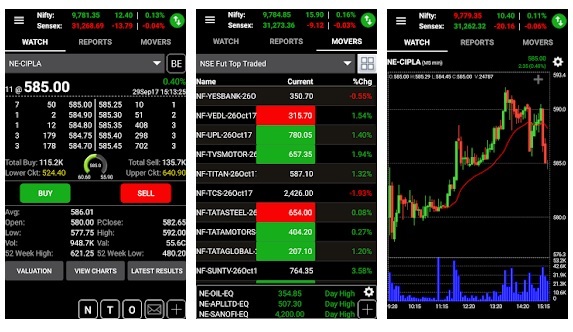

Ventura Web- A web-based platform that can accessed from your Computer, tablet, and mobile on any browser. It offers many good features like-

Venture Pointer- It is an installable or downloadable trading platform for your personal computers. The platform gives traders access to features like-

Ventura Wealth- It is a mobile app available that makes it easy for traders to trade from anywhere. Some of the key features of the app are-

Ventura Commodities- Ventura Commodities app is designed for commodity traders. The trading app allows you to-

Ventura Options Brokerage 2019

|

Trading Account Opening Charges |

Rs 150 |

|---|---|

|

Trading Account Maintenance Charges |

Nil |

|

Demat Opening Charges |

Rs 300 |

|

Demat Account Maintenance Charges |

Rs 400 (free for 1st year) |

|

Ventura Platform Trading Fee |

Based on chosen plan. Refundable if brokerage generated is more than access fee. |

Ventura Options Trading Plans

Ventura securities offers multiple trading plans to traders. Each plan has different brokerage charges. The plans with high fee have low brokerage rate. The fee is charged as access fee for Ventura Pointer trading platform. If you generate more brokerage than the plan fee during the plan validity period then your brokerage is refunded by the company.

|

Access Fees For POINTER Platform |

Plan Validity |

Brokerage |

|

|---|---|---|---|

|

Intraday |

Delivery |

||

|

Rs 1000 |

1 Year |

0.05% |

Rs 50 per lot |

|

Rs 2000 |

1 Year |

0.04% |

Rs 50 per lot |

|

Rs 3500 |

1 Year |

0.03% |

Rs 50 per lot |

|

Rs 5000 |

1 Year |

0.025% |

Rs 35 per lot |

|

Rs 7500 |

1 Year |

0.02% |

Rs 35 per lot |

|

Rs 9999 |

1 Year |

0.02% |

Rs 35 per lot |

|

Rs 10000 |

6 Months |

0.015% |

Rs 35 per lot |

|

Rs 18000 |

1 Year |

0.015% |

Rs 35 per lot |

|

Rs 15000 |

6 Months |

0.0125% |

Rs 35 per lot |

|

Rs 25000 |

1 Year |

0.0125% |

Rs 35 per lot |

|

Rs 30000 |

1 Year |

0.01% |

Rs 35 per lot |

|

Rs 40000 |

1 Year |

0.01% |

Rs 25 per lot |

|

Rs 50000 |

1 Year |

0.01% |

Rs 21 per lot |

|

Rs 72000 |

1 Year |

0.01% |

Rs 18 per lot |

|

Equity Options |

Currency Options |

|

|---|---|---|

|

Security Transaction Tax (STT) |

0.01% on Sell |

0.01% on Sell |

|

GST |

18% (Brokerage + Transaction) |

18% (Brokerage + Transaction) |

|

SEBI Charges |

Rs 5 per crore |

Rs 5 per crore |

|

0.003% (Rs 300 per crore) on buy-side |

0.0001% (Rs 10 per crore) on buy-side |

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|