Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

-42.89% 30,881 Clients

Bajaj Financial Account Opening Enquiry

Rs 0 Account Opening Charges + Flat Rs 10 Per Trade Brokerage (with Rs 2500 yearly subscription charges) + Rs 0 Demat AMC Open Demat Account Now!.

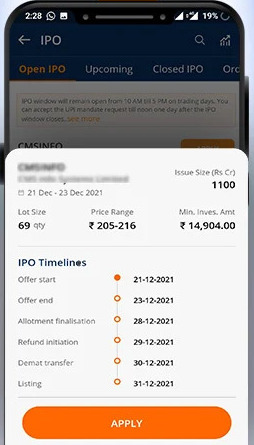

Bajaj Financial customers can apply in an IPO online using UPI as payment gateway. The process is free, quick and paperless. Both trading platforms; Bajaj Financial Trading Mobile App and Website could be used to apply in IPOs.

The Bajaj Financial IPO application process is quick, easy and convenient. For Bajaj Financial customers, most of the information is pre-filled on the IPO application form. Customer has to fill only a few fields like quantity, price and UPI ID.

Key Features of Bajaj Financial IPO App

Bajaj Financial online IPO application service is free. Bajaj Financial doesn't charge any fees from its customers to apply for an IPO.

Customer has to pay brokerage, taxes and demat charges when they sell the shares allocated in the IPO.

Visit the IPO Registrar's website or check our IPO Allotment Status page to check the IPO allotment status.

Bajaj Financial does update the IPO allotment status on its IPO Order History page. The information is updated once the shares are deposited in the demat account with Bajaj Financial.

Similar to all other online brokers, Bajaj Financial offers online UPI-based IPO application. They allow its customers as well as non-account holders to apply for an IPO from its website or mobile trading app.

This is a limited-time offer. Simply leave your contact information with us and Bajaj Financial representatives will contact you.

Yes, Bajaj Capital allows investors to invest in an IPO. You will need a bank account with one of the SCSB banks and Bajaj Capital Demat Account. If you have both the accounts, you can easily invest in an IPO and get allotted IPO shares credited in your Demat account.

Yes, Bajaj Finserv offers IPO investment services. Bajaj Finserv IPO application is safe, secure, instant and paperless, and can be applied through the website and BFSLTrade App. BFSL allows non-account holders to apply for an IPO from its website in just a few mins using UPI Payment.

Bajaj Finserv's initial public offering (IPO) application process is free. They do not charge any fees for the IPO application process.

Note that when you sell the shares allocated in an IPO, you have to pay the brokerage, demat charges and taxes to Bajaj Finserv.

You could use the net-banking facility from your existing bank to apply in an IPO if you do not want to make payment using UPI.

This facility just required 'Demat Account Number' from Bajaj Finserv. While applying in an IPO using net-banking website or app (provided by your bank like ICICI or HDFC), you will have to fill your demat account number with Bajaj Finserv. The allocated shares are automatically deposited in your Bajaj Finserv demat account and are available for sale on the listing day.

You can check IPO status through the Bajaj Finserv Website and Mobile App.

Order status information is available on the main page under the Order tab, you can check the cancelled, executed and rejected status of your order.

Visit the IPO Registrar's website or check our IPO Allotment Status page to check the IPO allotment status.

Bajaj Financial Account Opening Enquiry

Rs 0 Account Opening Charges + Flat Rs 10 Per Trade Brokerage (with Rs 2500 yearly subscription charges) + Rs 0 Demat AMC Open Demat Account Now!.

Information on this page was last updated on Thursday, November 23, 2023

Add a public comment...

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|