Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha (Trading & Demat Account)

Zerodha (Trading & Demat Account)

FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

|

|

Published on Tuesday, November 14, 2017 by Dilip Davda | Modified on Monday, July 22, 2019

We have seen Government PSU ETFs CPSE coming to market in two tranches and getting overwhelming response in the past. Now we have yet another ETF called Bharat 22 that also includes some private sector companies that are having major investments from SUUTI. The Bharat 22 is the result of promise in Budget 2016-17 given by the Finance Minister It is the second ETF to be launched after CPSE ETF (launched in 2014).

The ETF mirrors the BSE Bharat 22 Index which comprises select companies from the CPSE universe, stakes held under the Specified Undertaking of the Unit Trust of India (Suuti) and public sector banks, from the underlying universe consisting CPSE companies, Suuti A group companies, and PSU banks.

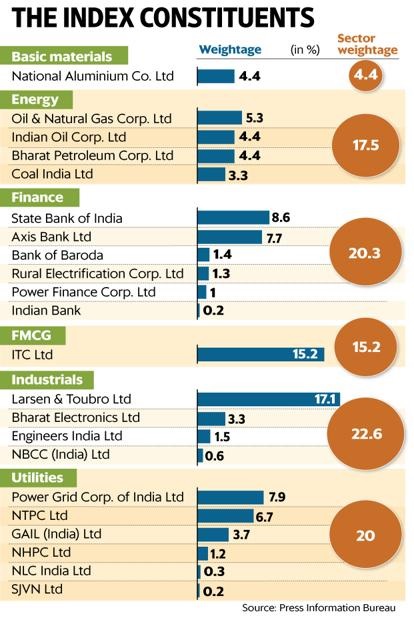

The Bharat 22 ETF has a well diversified portfolio that includes six core sectors, including industrials, finance, utilities, energy, FMCG and basic materials, and offers good investment opportunity. This ETF is being managed by ICICI Prudential AMC, comprises select companies from the private sector having an exposure to the extent of 39 per cent while the rest are public sector firms.

The Bharat-22 exchange traded fund (ETF) that aims to raise an initial amount of Rs 8,000 crore for government, is opening for subscription on 15.11.17 and will close on 17.11.17. This ETF is a part of government's overall disinvestment programme, which has set a target of realizing Rs 72500 crore this fiscal. Bharat 22 ETF has reserved 25% each for Retail Investors (up to Rs. 2 lakh limit), QIBs, HNIs and Retirement Funds. Retail investors can make an application for a minimum amount of Rs. 5000 and in multiple of Re. 1 thereon, thereafter. For this offer, one has to apply online that provides various mode of payment of application money. There is 3% upfront cash discount to all categories on investors. Allotment will be made only in demat form and trading too will take place in demat form on BSE and NSE post allotment.

As per test reports, Bharat 22 ETF has offered superior risk adjusted returns. The historical data reveals that ETF has outperformed the S&P BSE Sensex and Nifty 50 on risk adjusted basis over 10-year horizon.The average annualised returns delivered by Bharat 22 ETF across all 3-year holding periods since March 2006 stood at 14.86 percent, higher than the S&P BSE Sensex's 10.96 percent and Nifty 50's 11.03 percent, a similar outperformance was also observed in the 5-year holding period. An investment of Rs 10,000 in Bharat 22 ETF on March 17, 2006 would have grown to Rs 44,475, compared to S&P BSE Sensex's Rs 34,084 and Nifty 50's Rs 34,879. The Bharat 22 ETF has also delivered a higher dividend yield of 2 percent during the financial year of 2016 – 17, compared to 1.3 percent of the S&P BSE Sensex. The ETF has also recorded lower price-to-earnings ratio for majority of time compared to the S&P BSE Sensex, hence delivering better returns with lower volatility in earnings.

The Bharat 22 ETF is expected to invest a majority of its capital in equities of listed companies thus from the taxation point of view, it would be considered as an equity investment. ETF investments are not subject to wealth tax however, profits from the fund are subject to short term capital gains and long term capital gains. In case profits are obtained by an investor through sale of the Bharat 22 ETF units within 1 year from the date of unit allocation, short term capital gains (STCG) rules are applicable. If ETF units have been held for over a year from the date of allocation before being traded for a profit, long term capital gains (LTCG) taxation rule is applicable. At present, the applicable tax rate in case of STCG is 15% of profits earned, while the LTCG rate in case of equity investments is currently nil.

Bharat 22 ETF portfolio includes following scrip with their weightings and sector weightage.

Anchor investors have submitted bids for Rs. 12000 crore on 14.11.17 and thus it is oversubscribed by 6 times against offer size of Rs 2000 showing interest of institutional investors.

Conclusion: Investors looking for safe medium to long term investment for better returns may consider this ETF opportunity.

DISCLAIMER: No financial information whatsoever published anywhere here should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for educational and information purposes only and under no circumstances should be used for making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at own risk. Investors should bear in mind that any investment in stock markets are subject to unpredictable market related risks. Above information is based on RHP and other documents available as of date coupled with market perception. Author has no plans to invest in this offer.

(SEBI registered Research Analyst-Mumbai).

About Dilip Davda

Dilip Davda is veteran journalist associated with stock market since 1978. He is contributing to print and electronic media on stock markets/insurance/finance since 1985.

Dilip Davda is a leading reviewer of public issues and NCDs in the primary stock market in India. The knowledge he gained over 3 decades while working in the stock market and a strong relationship with popular lead managers makes his reviews unique. His detail fundamental and financial analysis of companies coming up with IPO helps investors in the primary stock market. Dilip Davda has a special interest in analyzing the SME companies and writing reviews about their public issues. His reviews are regularly published online and in news papers.

Email: dilip_davda@rediffmail.com

FREE Intraday Trading (Eq, F&O)

Flat ₹20 Per Trade in F&O

|

|